The gold bull is back. After trending downward for more than four years, gold prices have broken out to the upside with a gain of more than 20% off their December lows.

Gold’s crossing of the 20% threshold even caused the financial media to take notice. “Gold is now in a bull market,” reported CNNMoney (March 7, 2016).

Is the path now clear for the price of gold to march on toward new all-time highs? Perhaps.

But gold bulls can be temperamental and unpredictable. Sometimes they disappoint, as was the case with multiple short-lived bull markets in the 1980s and 1990s. Sometimes they keep running and running until they go parabolic.

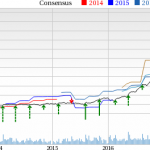

So far all we’ve seen is a gold rally turn into an “official” bull market by virtue of prices advancing 20%. It’s an encouraging sign of strength; but it’s not in itself confirmation of a larger trend in force. A major bull market is characterized by a series of higher highs and higher lows over a period of months to years.

So far, gold has rallied around 22% from a low over a period of a few weeks. This rate of ascent isn’t sustainable in perpetuity. A healthy bull market ebbs and flows – it takes two steps forward and one step back, as It were.

That’s why a price correction after a 20%+ advance would be normal and healthy. If it’s a major bull market, then prices will go on to make a higher high, followed by a higher low.

Recall that the last big mania in gold took place from mid 1976 to January 1980. Prices surged more than 700% over that time period. Yet there were still corrections along the way – until the final, parabolic blow-off move. Another major gold bull market didn’t return until 2001-2011.

Yet from 1980 to 2001, there were multiple rallies of greater than 20%. For example, from April to September 1980, gold prices rallied more than 40%. But from there, they turned around to make lower lows.

In the summer of 1982, gold prices spiked 65% – from $300 to $500 an ounce. But by 1985 prices had fallen back below $300. The gold market hit rock bottom in 1999 at just above $250. Prices rallied 30% in the second half of 1999 before sliding back down to test those ultimate lows one last time in 2001.

Leave A Comment