Whoever coined the phrase “sell in May and go away” had brilliant insight and the performance of crypto and stock markets over the past three weeks has shown that the expression still rings true.

May 20 has seen a pan selloff across all asset classes, leaving traders with few options to escape the carnage as inflation concerns and rising interest rates continue to dominate the headlines.

Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin (BTC) taking on water below $29,000 and traders worry that losing this level will ensure a visit to the low $20,000s over the coming week.

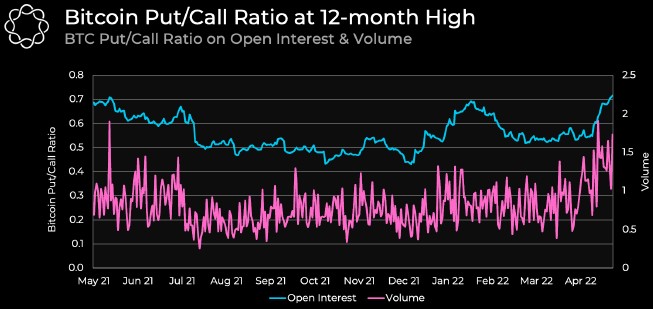

Further evidence of muted expectations from traders can be found in the put/call ratio for BTC open interest, which hit a 12-month high of 0.72 on May 18 according to the cryptocurrency research firm Delphi Digital.

“A high put/call ratio indicates that investors are speculating whether Bitcoin will continue to sell off, or it could mean investors are hedging their portfolios against a downward move.”

Stocks enter bear market territory

May 20 brought more pain to the traditional markets as the S&P 500 fell another 1.62%, marking a more than 20% decline from its January 2022 all-time high and further stoking recession fears. If the index manages to close the day down 20% from the all-time-high, that would officially put the benchmark index in bear market territory.

Related: Crypto veterans extend a helping hand to bear market newbies

What’s bad for BTC is even worse for altcoins

The few bright spots were Ellipsis (EPS), Persistence (XPRT) and 0x (ZRX), which gained 30%, 13.92% and 12.34% respectively.

The overall cryptocurrency market cap now stands at $1.234 trillion and Bitcoin’s dominance rate is 44.6%.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Leave A Comment