Over the past week, astute crypto market analysts noticed some interesting developments related to the supply of Ether (ETH) as the network’s August 4 London hard fork approaches.

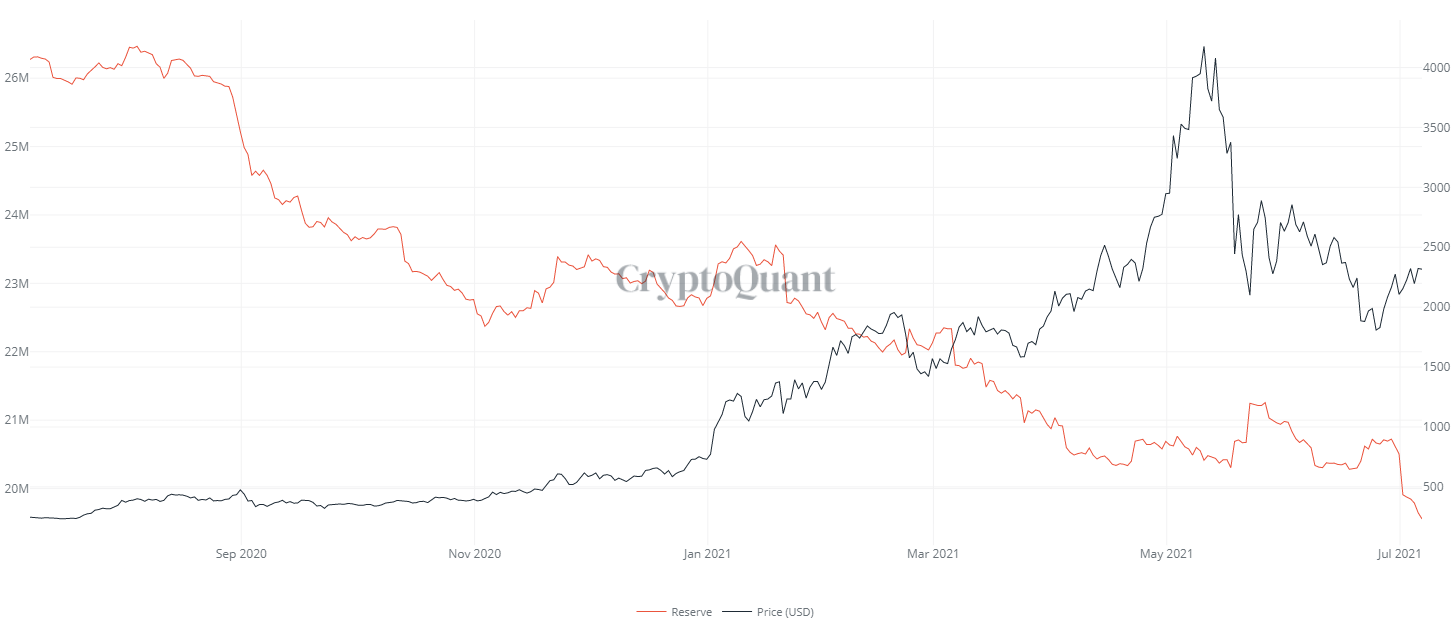

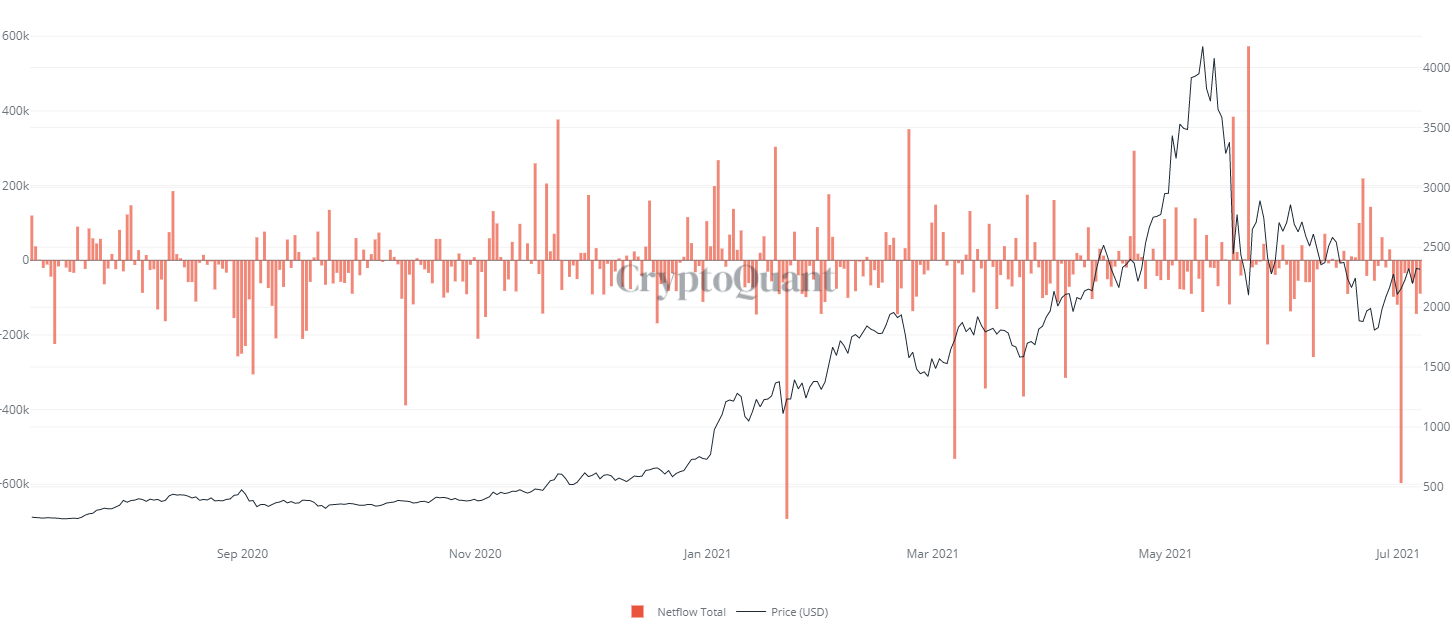

Recent data from CryptoQuant, an on-chain analytics firm, indicates that the amount of Ether held in cryptocurrency exchanges’ reserves has hit new daily lows since the start of July.

Eth2 staking surpasses 6 million Ether

One source for the increased demand for Ether is the Eth2 staking contract which surpassed the 6 million Ether mark on June 30.

There is now 6 million ETH in the eth2 deposit contract.

— Anthony Sassano ? (@sassal0x) July 1, 2021

Data from CryptoQuant shows that July 1 saw the largest single-day outflow of Ether from exchanges since January 21 with more than 596,000 Ether pulled off exchanges.

DeFi values rise

Another possible destination for the Ether being taken off exchanges is the decentralized finance ecosystem which has seen increases in token values as well as the total value locked in DeFi protocols.

Traders’ excitement grows ahead of the London hard fork

A third potential contributor to the recent flows seen in Ether is the upcoming London Hard Fork and the EIP-1559 proposal.

Several analysts expect the upgrade to positively impact Ether’s price due to the transition to a more eco-friendly proof-of-stake consensus mechanism as well as a new “scarcity” feature that will reduce the number of tokens in circulation.

Related: Ethereum price can gain 40% on Bitcoin, argues analyst as London fork nears

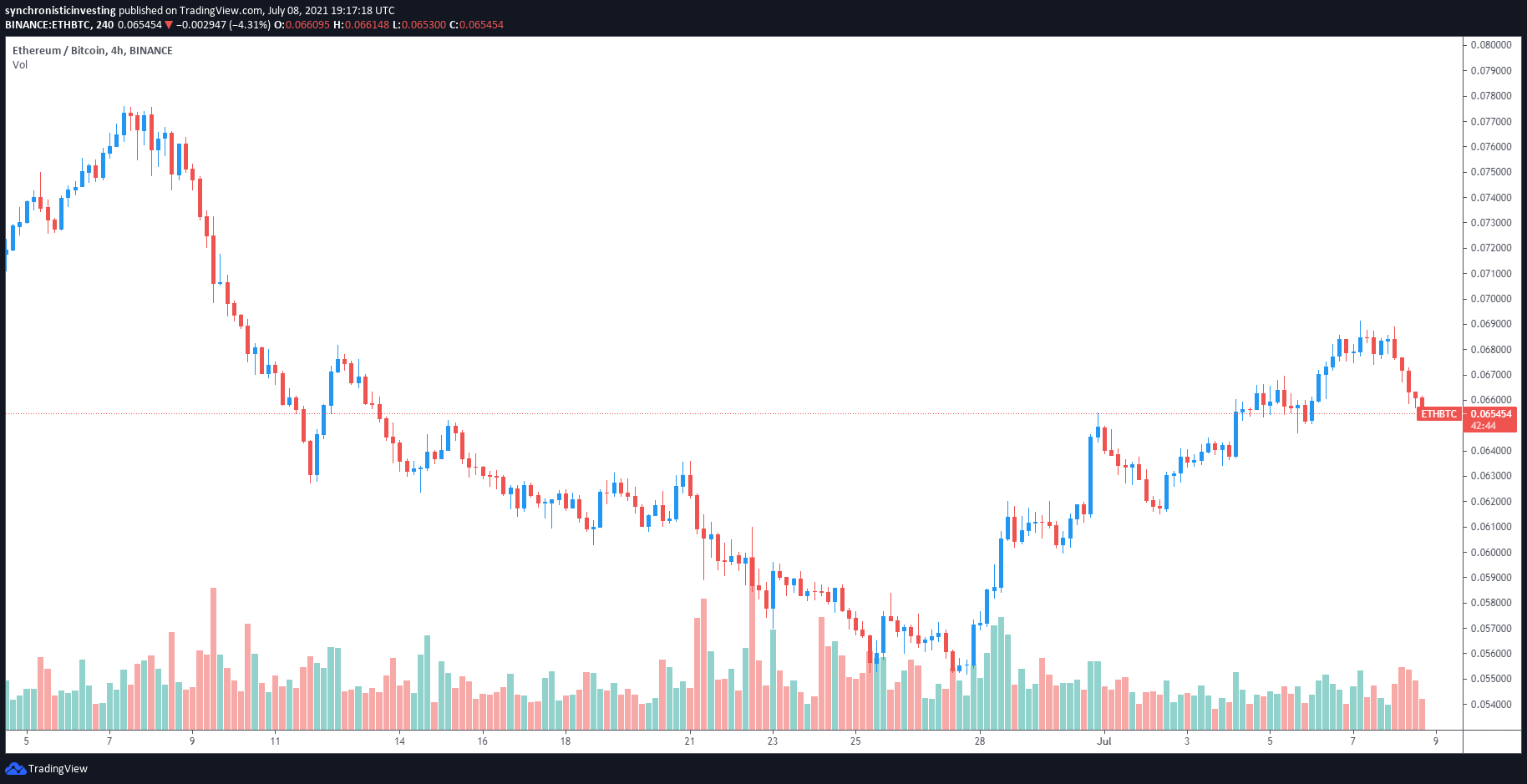

Excitement about the upcoming hard fork is a possible source in the rise of ETH/BTC pair seen since June 27 as the price of Ether also rose in its USD pair.

From a long term perspective, however, the value proposition of Ether can’t be ignored and the battle between Ether and BTC is far from settled as recently discussed in a report from Goldman Sachs, which suggests that Ether will possibly surpass the total market capitalization of Bitcoin in the coming years.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Leave A Comment