The world of finance is rapidly evolving, driven by advancements in technology and changing consumer behaviors. As humanity moves further into the digital age, several emerging trends are reshaping the financial services landscape. This article will explore five key digital finance trends that readers should be aware of.

Open banking

The delivery of financial services is being revolutionized by the disruptive movement known as “open banking,” which involves securely transferring consumer financial data between financial organizations with customers’ permission.

Open banking makes it possible for outside developers to create cutting-edge programs and services that use this information to offer specialized financial services. It gives customers more control over their financial data and greater access to a broader choice of services from various suppliers, promoting competition and accelerating industry innovation.

If it’s true that Open Banking will evolve toward Open Finance, then we will no longer have limits for wanting the Open Economy. The world of finance could be the forerunner of silo destroyers. RT @antgrasso #finserv #fintech #inclusion pic.twitter.com/iWTPcYlX8m

— Data Society TW (@DataSocietyTW) July 21, 2023

Digital wallets and contactless payments

Digital wallets and contactless payments are quickly gaining acceptance as quick, safe, convenient alternatives to conventional payment methods. Thanks to the proliferation of mobile payment apps like Apple Pay, Google Pay and Samsung Pay, consumers can safely save their payment card information on their smartphones and make purchases by simply tapping their phones on contactless payment terminals.

These digital wallets reduce the risk of fraud while increase ease and enhancing security by substituting sensitive card data with encrypted tokens.

Related: How can AI be used to improve credit scoring

Blockchain technology and cryptocurrencies

In recent years, cryptocurrencies such as Bitcoin (BTC) and Ether (ETH) have drawn a lot of attention. Blockchains — decentralized networks that offer transparency, security and immutability — power these digital assets. While the use of cryptocurrencies for regular transactions is still in its infancy, they have the ability to upend established financial systems by allowing peer-to-peer trades that are quicker, less expensive and borderless.

Aside from cryptocurrencies, blockchain technology is also being investigated for use in fields like supply chain management, identity verification and smart contracts. These applications promise to boost the efficiency and transparency of many financial operations.

Robo-advisers and AI-powered financial services

Robo-advisers are automated investment platforms that offer individualized financial planning and asset management services using algorithms and artificial intelligence (AI). These platforms build individualized investment portfolios for clients by analyzing a tremendous quantity of data, including risk tolerance, financial objectives and market patterns.

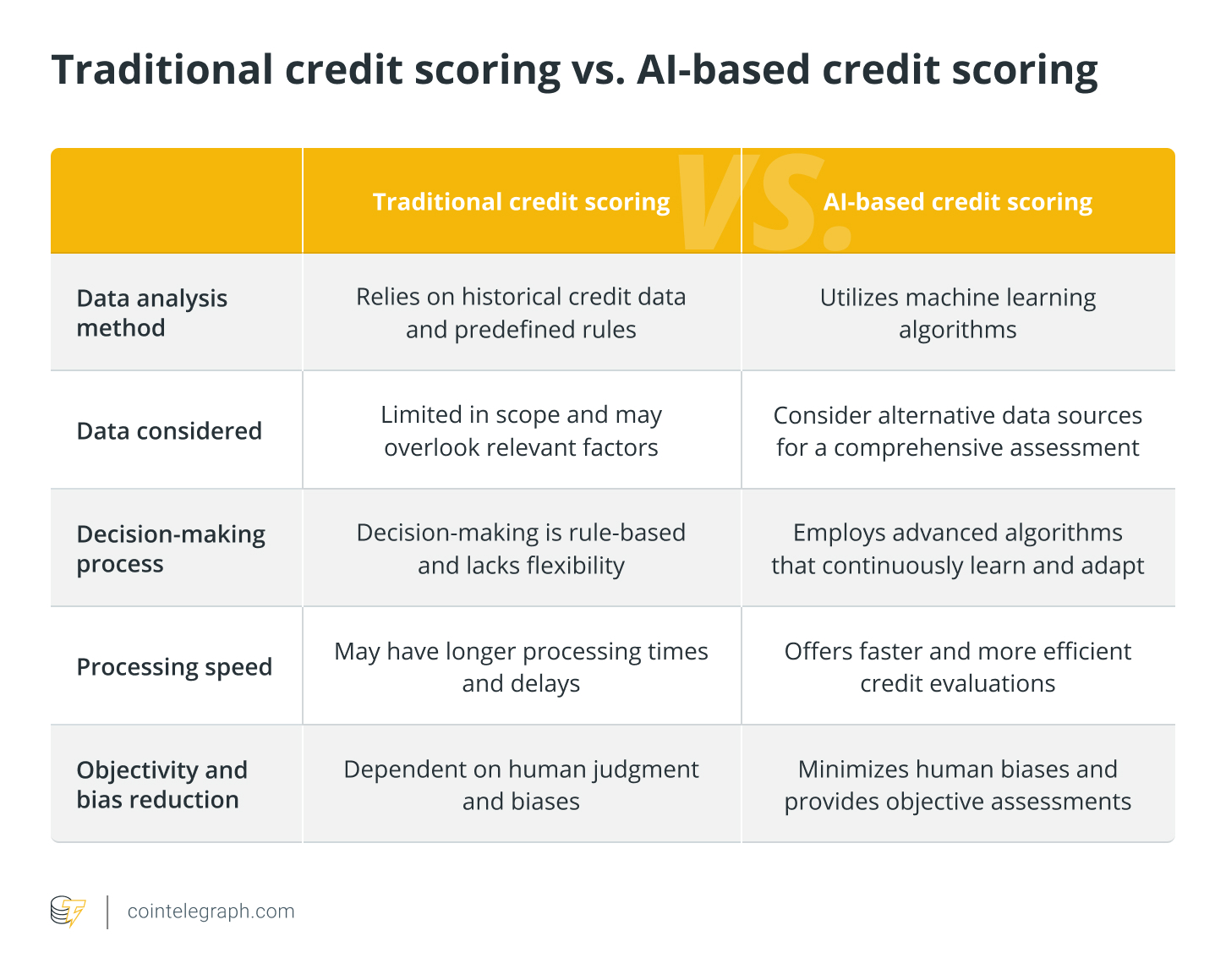

Robo-advisers appeal to tech-savvy investors who favor a digital-first strategy, and they charge lower fees than conventional human advisers. Other financial services such as fraud detection, credit scoring and chatbot-based customer care are now using AI-powered solutions to streamline operations and enhance consumer experiences.

Related: 9 essential finance terms you must know

Related: 9 essential finance terms you must know

Embedded finance

Embedded finance is the integration of financial services into software and systems that are not financial in nature. This development makes it possible for companies in a variety of sectors — including e-commerce, ride-sharing and retail — to provide their clients with financial goods and services.

For instance, a ride-sharing service might give users access to insurance or microloans directly within the app, while an e-commerce platform might provide choices for installment payments. By utilizing their current user populations and data, embedded finance enables businesses to strengthen their value offerings, increase consumer engagement and develop new revenue sources. It dissolves the distinctions between conventional financial institutions and other industries, spurring more innovation and competition.

Leave A Comment