On March 25, concerns surrounding the record-breaking $6.1 billion (BTC) options expiry this Friday sparked an overnight sell-off that dropped Bitcoin price to $50,400.

The downturn was not a surprise for many traders and some called for a possible test of the $47,000 support level. Despite Bitcoin’s loss of bullish momentum, several derivatives indicators, including a bullish futures premium and a neutral skew, suggest that the price may not drop below $50,000.

Analysts suggest the market is oversold

Glassnode co-founder and CTO Rafael Schultze-Kraft recently highlighted a possible dip lower based on low realized price distribution between $51,100 and $54,000.

Not much #Bitcoin realized between here and $51k. Would not be surprised if we dipped a bit more.

Strongest on-chain support currently at $47,400.https://t.co/3GFPTQPp6F pic.twitter.com/NLBQvEIGfB

— Rafael Schultze-Kraft (@n3ocortex) March 22, 2021

In a follow-up tweet after Thursday’s drop, Schultze-Kraft reaffirmed that the dip was “not unexpected” and in his view, the overall outlook remains bullish.

Schultze-Kraft said:

“Structurally, nothing has changed. I have yet to see a data point that points long-term bearish.”

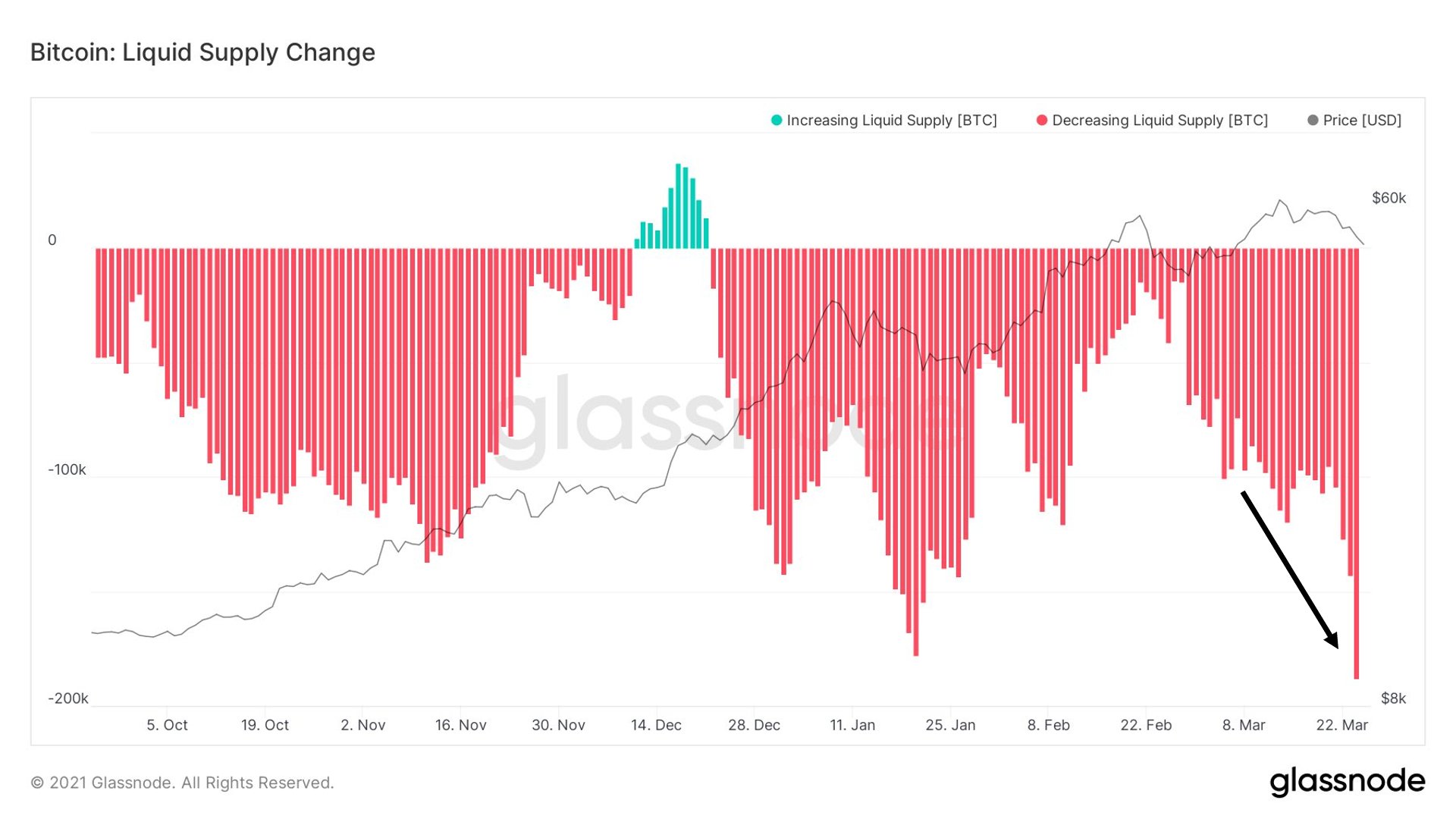

Further evidence of a possible turnaround in the near-term can be found when looking at Bitcoin’s liquid supply change, which decreased by the largest amount in more than 6 months.

Altcoins sink lower

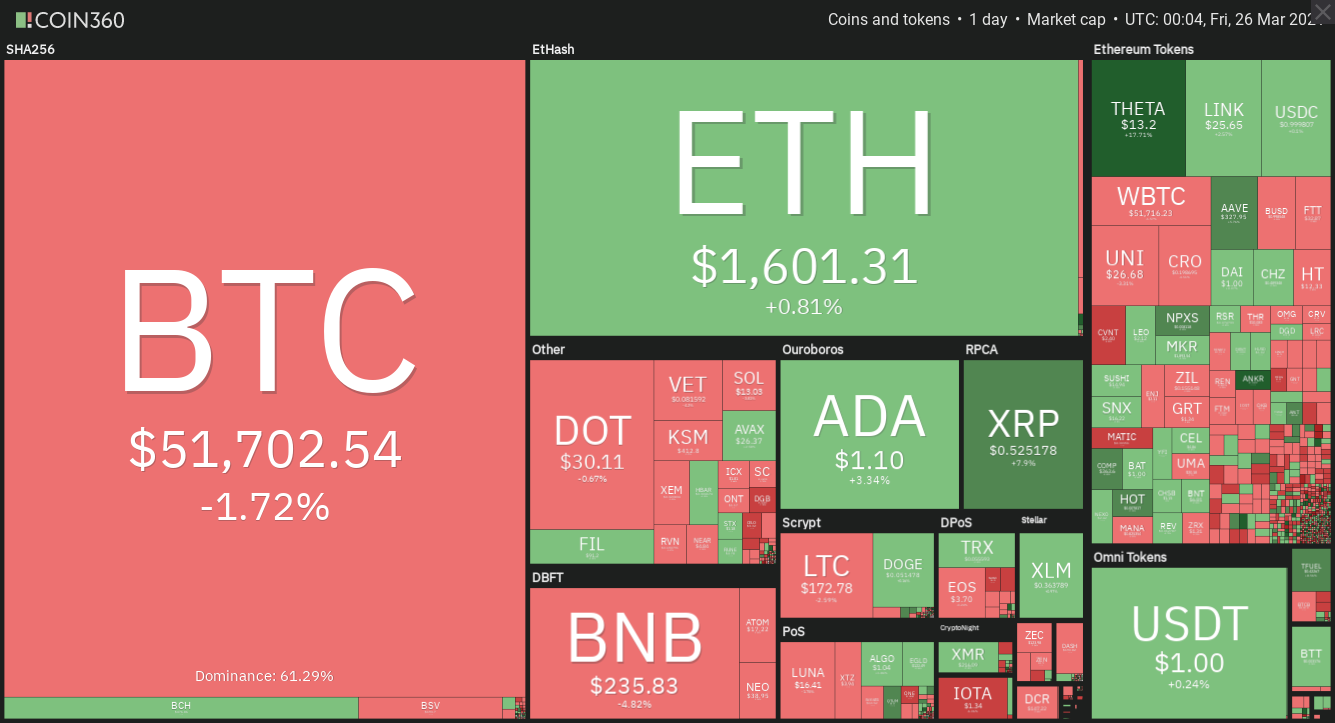

A majority of the altcoins were hit hard by the Bitcoin sell-off as traders across the market exited positions in an attempt to hold on to their recent gains.

Holochain (HOT) and Balancer (BAL) have also managed to put up a positive gain of 5.2% and 6.4% respectively.

The overall cryptocurrency market cap now stands at $1.62 trillion and Bitcoin’s dominance rate is 59.4%.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

![Dow[n] Behind Enemy Lines](https://www.riceoweek.com/wp-content/uploads/2018/04/orig_cd766-1-150x150.png)

Leave A Comment