On May 18, Bitcoin (BTC) and the overall cryptocurrency market faced another round of selling as fear, uncertainty and doubt (FUD) impacted investor sentiment after Reuters and various social media outlets reported that China would ban financial institutions and payment companies from providing services related to cryptocurrency transactions.

According to these reports, China also issued a warning to several Chinese trade associations about the dangers of cryptocurrency investing.

Data from Cointelegraph Markets and TradingView shows that bulls attempted to push the price of Bitcoin back above the $45,000 resistance level in the early hours on Tuesday only to have the price battered back below $43,000.

The precarious nature of the current market conditions for Bitcoin are perhaps summed up best in the following tweet from cryptocurrency analyst and Twitter personality Rekt Capital, which highlights the importance of the upcoming daily close for BTC.

Every time #BTC Daily Closed inside green support or above it – a bullish reversal would take place#Bitcoin is back at green support again but instead is hovering below it now

Green may flip to new resistance if BTC can’t Daily Close inside/above greenhttps://t.co/2p4FgWWEIi pic.twitter.com/2iGcjLkAgU

— Rekt Capital (@rektcapital) May 18, 2021

Altcoins shake off the downturn

Despite the full-frontal FUD assault that the crypto market has been under in recent weeks, many altcoins have seen their prices breakout over the past couple of days as traders rotate out of underperforming tokens and into tokens that have turned bullish.

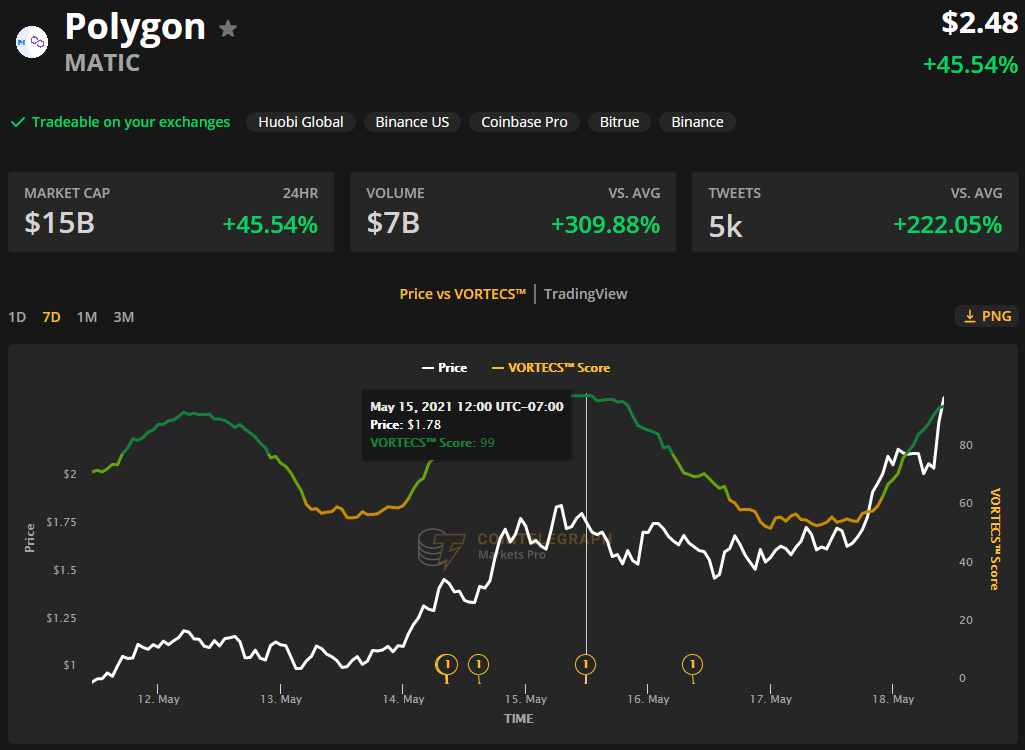

The standout performance of the week goes to Polygon (MATIC), the rapidly rising Ethereum (ETH) layer-two solution that has morphed into an oasis for traders looking for lower fees.

Synthetix (SNX) has also received a boost in trading volume on Tuesday that has lifted its price 40% to an intraday high at $25.64, while the Binance Smart Chain-based Venus (XVS) DeFi platform has rallied 63% to an intraday high of $143.41.

The overall cryptocurrency market cap now stands at $2.076 trillion and Bitcoin’s dominance rate is 39.4%.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Leave A Comment