The decentralized finance (DeFi) sector faced its first real challenge during last week’s market sell-off that saw more than $1 trillion wiped from the global cryptocurrency market cap as traders feverishly ran for the safety of stablecoins amid tumbling prices.

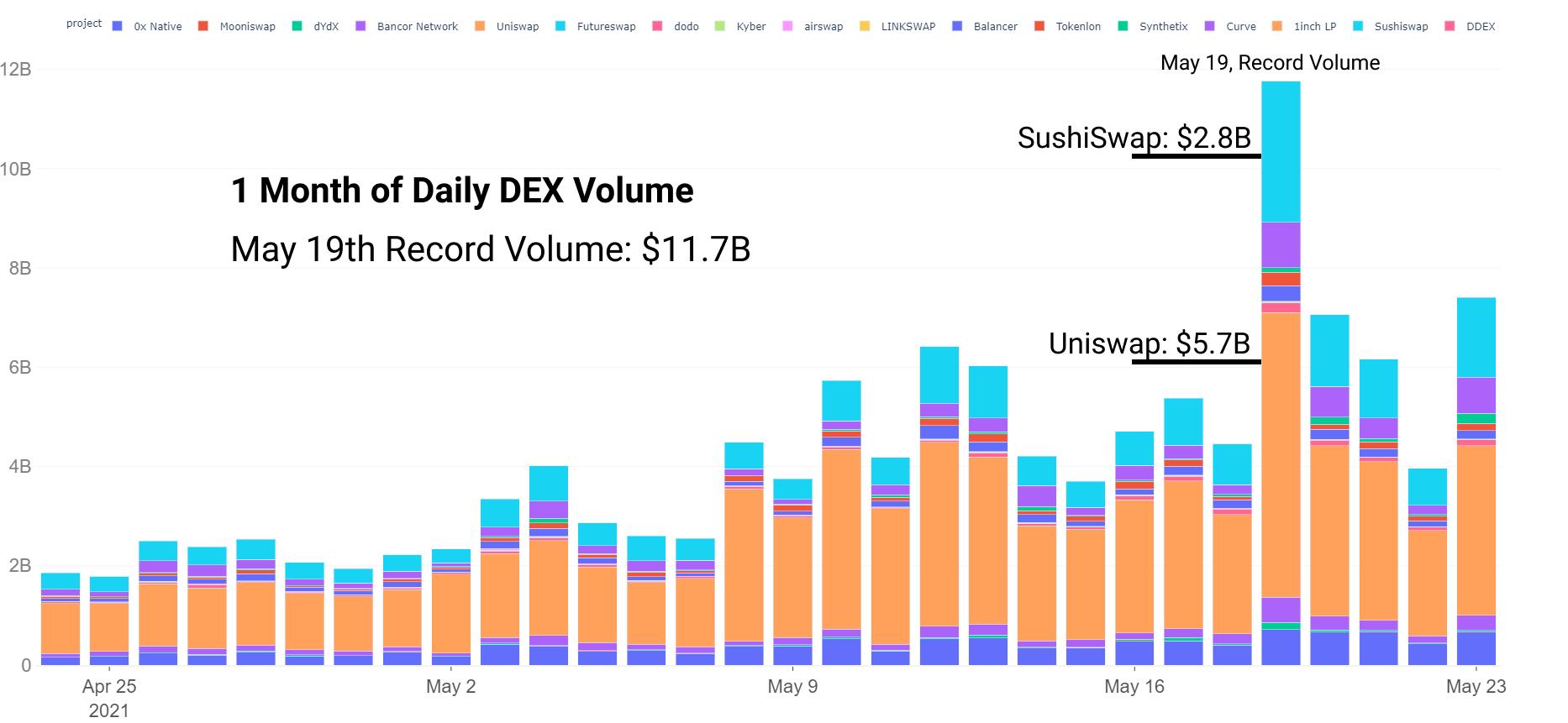

Despite rapidly declining token prices, the nascent DeFi sector held its own as decentralized exchanges experienced a record $11.7 billion in trading volume on May 19. Uniswap (UNI) led with $5.7 billion in volume, followed by SushiSwap (SUSHI) which saw $2.8 billion in 24-hour trading volume.

New users increase despite declining TVL

The pullback in prices, combined with users removing liquidity and rotating into stablecoins led to a 42% decline in the total value locked on smart contracts, which also closely tracked the falling price of Ether.

Throughout last week’s downturn, the percentage of the Ethereum supply locked in smart contracts remained above 23% while the supply on exchanges “jumped from 11.13% to 11.75%.”

Despite falling prices, new users continue to enter the DeFi ecosystem and the total number of unique 30-day traders on the top DEXs surpassed the 1 million mark for the first time amid last week’s sell-off.

Stablecoins hold their pegs

Much of the strength seen in DeFi during the sell-off can be attributed to the healthy stablecoin market and the ability for major stablecoins like USD Coin (USDC), Tether (USDT) and Dai (DAI) to maintain their dollar peg “for the majority of the crash with volume-weighted average prices (VWAP) staying at $1.00 the majority of the time.”

Posey said:

“This behavior allows collateral to stay healthy, liquidations remain at a healthy level, and DAI to maintain its peg.”

The one stablecoin that struggled to maintain its peg was TerraUSD (UST), which lost its peg on May 18 as the value of its collateral from LUNA fell below that of the stablecoin it collateralized. This led to “unhealthy behavior in its lending market Anchor (ANC),” causing a higher than average number of liquidations on the protocol’s native lending platform.

Overall, stablecoins performed their intended function and pegs held steady across the ecosystem with the on-chain stablecoin transfer volume reaching a record $52 billion during the height of the sell-off.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Leave A Comment