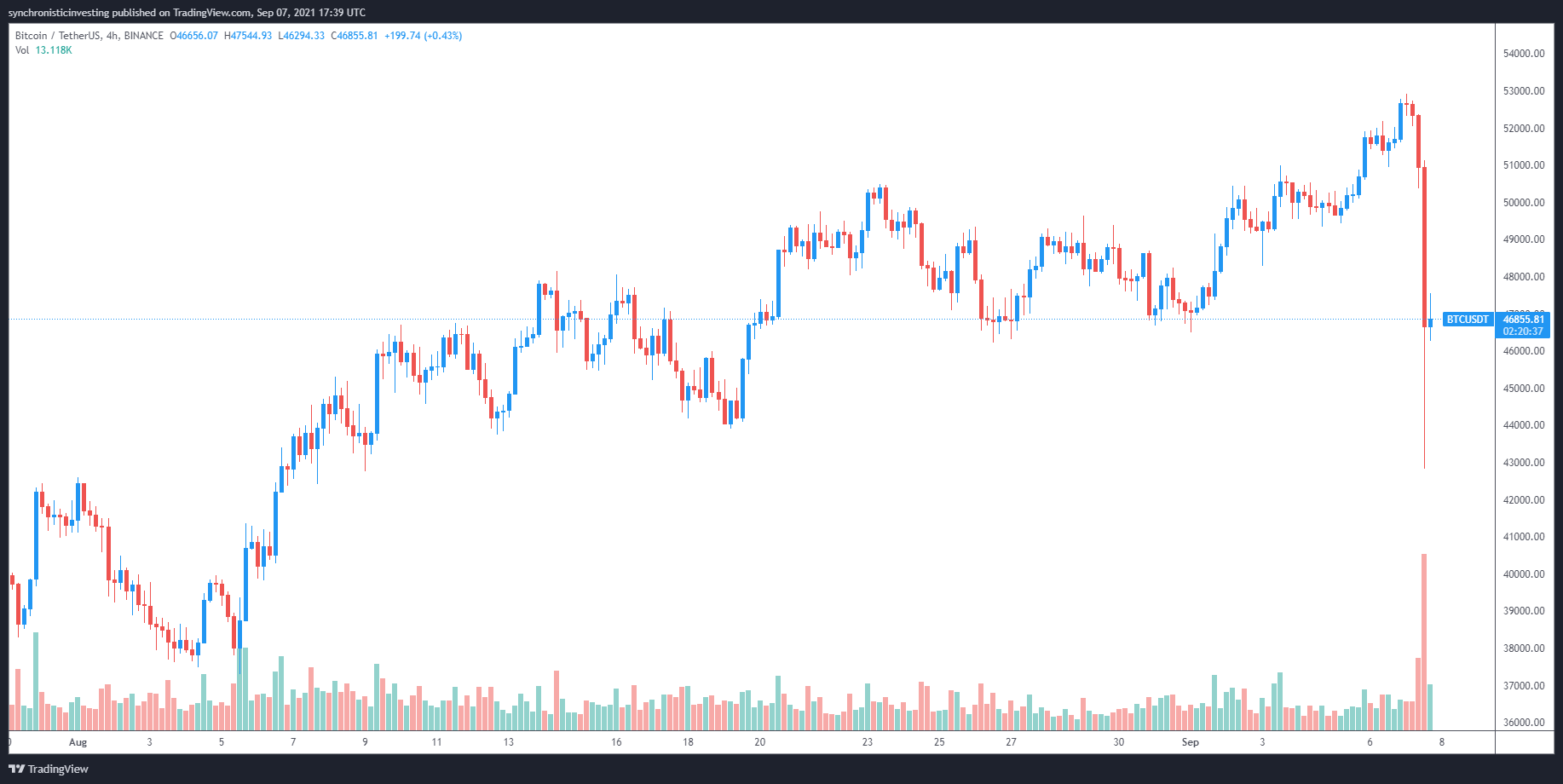

Traders were caught flat-footed on Sep. 7 after a sharp collapse in the price of Bitcoin saw the digital asset fall below $43,000 and this led to widespread liquidations in derivative markets as more than $3.54 billion was liquidated.

Amount of Liquidations in the past 24 hours by exchanges in total $3.54 was liquidated!

In the past 24 hours, 330,243 traders were liquidated. The largest single liquidation order happened on @HuobiGlobal #BTC $BTC value $43.7M

Data source: @bybt_com pic.twitter.com/hNgctWgCgP

— CryptoDiffer (@CryptoDiffer) September 7, 2021

Bullish sentiment had been on the rise coming out of the Labor Day holiday weekend in the United States because Bitcoin was officially recognized as legal tender in El Salvador, but the celebration was quickly extinguished by BTCs 16% plunge.

Data from Cointelegraph Markets Pro and TradingView shows that the sell-off in BTC began during the early trading hours and accelerated into midday as the price of Bitcoin fell to a low of $42,837 before dip buyers arrived to bid it back above $46,500.

Longs are heavily liquidated as BTC sells off

A fact-focused analysis of the current state of the market was offered by on-chain analyst Willy Woo, who posted the following tweet outlining today’s developments.

Day opened with equities risk-off.

Some sell down of BTC.

Medium levels of fundamental inflows (selling).

Then stop hunt / liquidity collapse.

$1.1b of BTC liquidations.

Overall unsupported by investor fundamentals on-chain.

Exchanges are now in outflows (buying)

— Willy Woo (@woonomic) September 7, 2021

As noted by Woo, the wider financial markets opened the day risk-off, which put pressure on the crypto market that cascaded as the day progressed.

The ensuing sell-off resulted in $1.1 billion worth of Bitcoin liquidations, but on-chain data does not suggest that investors are in a rush to close their positions and the most recent activity shows that exchanges are back in buying mode.

A follow-up tweet from Woo shows just how unexpected today’s move in the market was, a good reminder that risk management is always something to keep in mind in the crypto market.

Woo said,

“Not entirely sure WTF just happened, but that’s the sequence of events. The sell-off was mainly on derivative markets (like most crashes).”

Possible outlier detected

Further analysis of today’s move in Bitcoin was provided by market analyst and Cointelegraph contributor Michaël van de Poppe, who also highlighted the role that overleveraged traders played in today’s price action.

#Bitcoin lost that $49K level as crucial support and smacked through it.

What just happened?

Overleveraged positions getting liquidated in a chain reaction, causing a massive wick.

If this wick closes above $47/48K, it will be an outlier.

Opportunities.

— Michaël van de Poppe (@CryptoMichNL) September 7, 2021

According to Poppe, if BTC can manage to close above the $47,000 to $48,000 range following this pullback, the move will be considered an outlier to the previously established trend and a good buying opportunity should the uptrend resume.

Related: El Salvador buys the dip as Bitcoin price flash crashes to $42.9K

Not all traders were caught off guard

Not all participants in the market were caught unawares by today’s downside move, as highlighted in the following tweet posted by analyst and pseudonymous Twitter user Crypto_Ed_NL.

Feeling lucky you did not get liquidated in that corrective move earlier today?

Wait with getting new, dry pants…might not be over yet! pic.twitter.com/DIp9USNfK7

— Crypto_Ed_NL (@Crypto_Ed_NL) September 7, 2021

A follow-up tweet included the following chart showing that the scenario played out just as Crypto_Ed_NL had warned.

“BTC reached the green box. Let’s see how it bounces… should be it for this correction in my opinion.

The overall cryptocurrency market cap now stands at $2.103 trillion and Bitcoin’s dominance rate is 42.1%.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Leave A Comment