Bitcoin (BTC) price action has been surprisingly bullish since May 27. Weekends, especially holiday weekends, are notoriously volatile and indecisive, with major whipsaws in price movements being the norm. Even in bull markets, bearish price action is often the norm, but BTC bucked that trend.

Global food shortage fears mount at commodities prices rise

The global food supply is a primary yet easily overlooked factor contributing to Bitcoin’s future price potential. Since the beginning of the Covid-19 pandemic, governments worldwide have shut down their seaports and airports, effectively cutting off and interrupting the flow of goods. This disruption will take years to return to normal, but that is not the primary cause of concern.

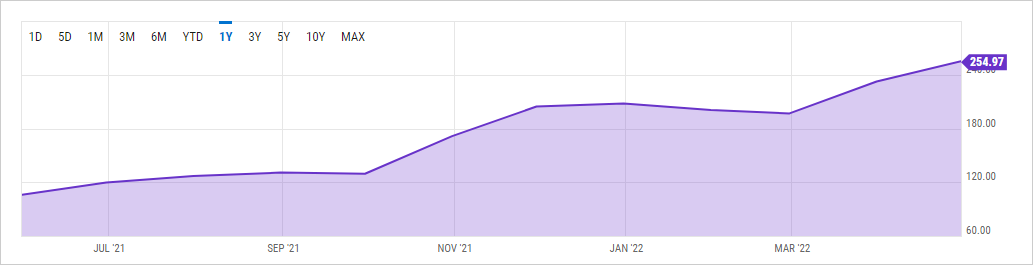

In the United States, fertilizer costs have risen exponentially over the past 18 months. In January 2021, the Fertilizer Price Index stood at $78.83 and is currently at $254.97, increasing nearly +225%. A combination of supply chain disruptions and continued shortages is likely to continue disrupting this market.

Equity markets around the globe continue to face significant pressure. Rising inflation, soaring commodity costs, supply chain disruptions and the conflict in Ukraine have put risk-on investors and traders on the defensive.

Several high-impact economic events are scheduled to occur this week, which will likely pause any major price action moves in equities and cryptocurrencies. The European Union unemployment data release comes on June 1, along with the Bank of Japan’s interest rate decision and manufacturing data. In addition, U.S. unemployment numbers and non-farm payroll data will be released on June 3.

Adding to a busy week, on June 3, three former U.S. Federal Reserve Presidents are also slated to speak: John Williams and James Bullard talk on June 1, Lael Brainard on June 3.

Technical levels may limit Bitcoin’s recovery to $37,000

Bitcoin is coming off a new historical record of (BTC). Since the beginning of the current weekly candlestick, buyers have returned and have pushed BTC above the entire trading range of the past two weeks and well above the 50% range of the flash crash on the May 9, 2022 weekly candlestick.

If Bitcoin price can close above the daily Kijun-Sen at or above $31,350, then BTC has a very open path to hit the $37,000 value area. Additionally, the 2022 volume profile is very thin, between $32,000 and $37,000. But $37,000 may be where the bulls face sellers again.

While stock prices remain in bear market territory and commodities remain at all-time highs, at the very least, a temporary reversal is likely to occur. If the old technical analysis adage, “volume precedes price,” plays out again, traders should see food commodities and oil sell-off while stocks and Bitcoin rise.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Leave A Comment