Bitcoin (BTC) has gone silent over the weekend. CryptoQuant CEO Ki Young Ju said in a recent post on X (formerly Twitter) that Bitcoin’s velocity has declined to a 3-year low. He said this could either be considered positive as whales were holding on to their positions or negative because the transfer to new investors was not happening.

The range-bound action continues to perplex investors about the next possible trending move. In that regard, there was a positive commentary from JPMorgan analysts who said that Bitcoin’s downtrend could be ending. They believe that the declining open interest in Bitcoin futures contracts on the Chicago Mercantile Exchange suggests that the long liquidation is over.

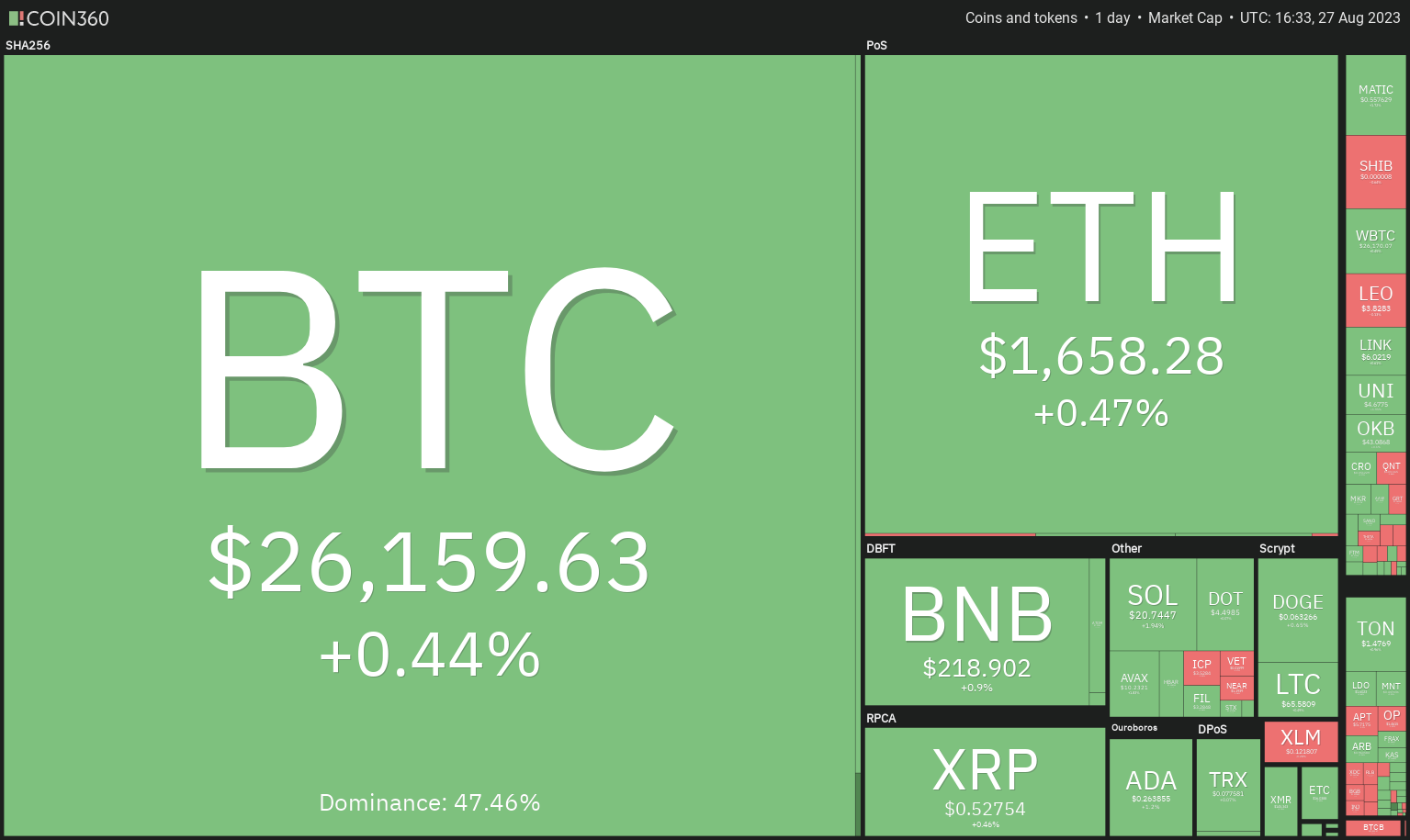

Let’s study the charts of the top-5 cryptocurrencies that may move up in the near term and identify the levels that need to be crossed for the bulls to take charge.

Bitcoin price analysis

Bitcoin formed an inside-day candlestick pattern on Aug. 26, indicating indecision between the bulls and the bears about the next directional move.

The BTC/USDT pair may start a stronger recovery if buyers thrust the price above the 20-day EMA. That could open the doors for a possible rally to the 50-day simple moving average ($28,888).

If bears want to strengthen their position, they will have to pull the price below $24,800. If they do that, the pair could start a downtrend to $20,000.

On the contrary, if the pair sustains above the moving averages, it will signal that the bulls have absorbed the selling. There is a minor resistance at $26,314 but if this crossed, the pair could climb to $26,610 and later to $26,833.

Toncoin price analysis

Toncoin (TON) is forming an inverse head and shoulders pattern, which will complete on a break and close above $1.53.

The bears are likely to have other plans. They will try to guard the $1.53 level and tug the price below the moving averages. If they manage to do that, the pair could decline to $1.25 and eventually to $1.15.

Instead, if the price turns down and breaks below the 20-EMA, it will signal that traders are booking profits near $1.53. The pair may then drop to the 50-SMA and subsequently to $1.33.

Monero price analysis

Monero’s (XMR) sharp rebound off the uptrend line for the second time in the past few days shows that the bulls are fiercely defending the level.

If the price turns down sharply from the 20-day EMA, it will suggest that bears continue to sell on rallies. The pair could then retest the uptrend line. The repeated retest of a support level tends to weaken it. If this level gives in, the pair may collapse to $125 and then to $115.

The first sign of weakness will be a break and close below the moving averages. That could pull the price to the uptrend line. A break below this support could send the pair tumbling to $125.

Related: FTX suspends user accounts amid Kroll cyber breach concerns

Mantle price analysis

Mantle (MNT) has been in a strong downtrend since topping out at $0.60 on July 20. The sharp downtrend sent the RSI into oversold territory, indicating that a relief rally was possible.

Contrarily, if the price turns down from the 20-day EMA, it will suggest that the bears continue to sell on every minor rally. That could result in a retest of the support at $0.41. If this level cracks, the pair may slide to $0.35.

If the price breaks below the moving averages, it will signal advantage to bears. That will increase the possibility of a break below $0.41.

Alternatively, if the price sustains above the 20-EMA, it will indicate that the bulls are buying the minor dips. The pair may then attempt a rally to $0.47 and subsequently to $0.52.

Quant price analysis

Quant (QNT) rebounded off the strong support at $95 on Aug. 17 and rose above the moving averages on Aug. 26. This shows a strong demand at higher levels.

That could increase the likelihood of a rally above the downtrend line. If that happens, the QNT/USDT pair could start a rally to $120. This positive view could invalidate in the near term if the price turns down and plummets below the moving averages. The pair may then slide to the support at $95.

On the downside, the moving averages are expected to act as strong supports. A break and close below the 50-SMA will indicate that the recovery may be over. The pair may then slump to $98.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Leave A Comment