The Bitcoin (BTC) chart has formed a symmetrical triangle, which currently holds a tight range from $28,900 to $30,900. This pattern has been holding for nearly two weeks and could potentially extend for another two weeks before price makes a more decisive movement.

According to Bitcoin derivatives data, investors are pricing higher odds of a downturn, but recent improvements in global economic perspective might take the bears by surprise.

The macro scenario has improved and BTC miners are staying busy

According to Cointelegraph, macroeconomic conditions driven by the United States helped drive crypto markets higher on May 23. Before the market opened, United States President Joe Biden announced plans to cut trade tariffs with China, boosting investors’ morale.

According to the latest estimates, Bitcoin’s network difficulty will reduce by 3.3% at its next automated readjustment this week. The change will be the largest downward shift since July 2021 and it’s clear that Bitcoin’s downtrend has challenged miners’ profitability.

Still, miners are not showing signs of capitulation even as their wallets’ movements to exchanges hit a 30-day low on May 23, according to on-chain analytics platform Glassnode.

While miners’ sentiment and flows are important, traders should also track how whales and market markers are positioned in the futures and options markets.

Bitcoin derivatives metrics are neutral-to-bearish

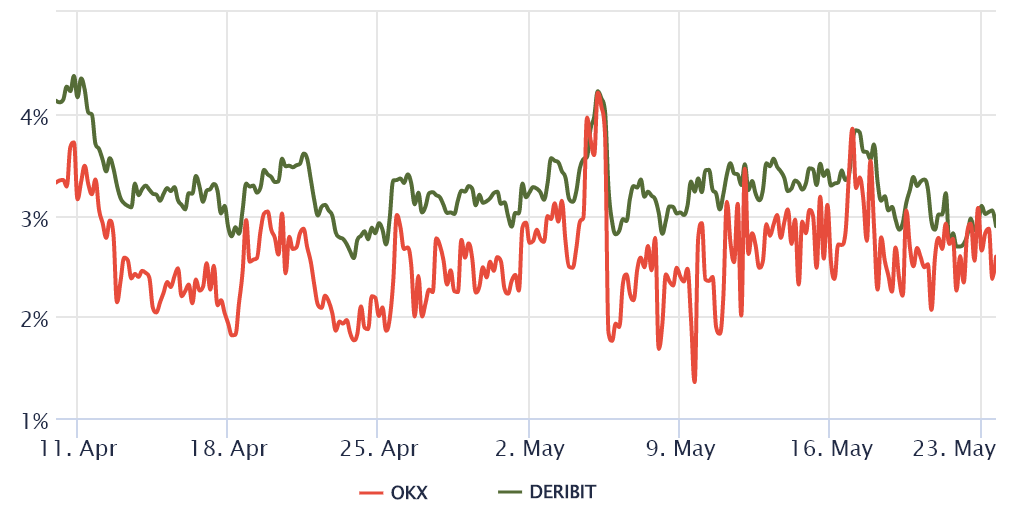

Retail traders usually avoid quarterly futures due to their fixed settlement date and price difference from spot markets. However, the contracts’ biggest advantage is the lack of a fluctuating funding rate; hence, the prevalence of arbitrage desks and professional traders.

These fixed-month contracts usually trade at a slight premium to spot markets because sellers are requesting more money to withhold settlement longer. This situation is known technically as “contango” and is not exclusive to crypto markets. Thus, futures should trade at a 5% to 15% annualized premium in healthy markets.

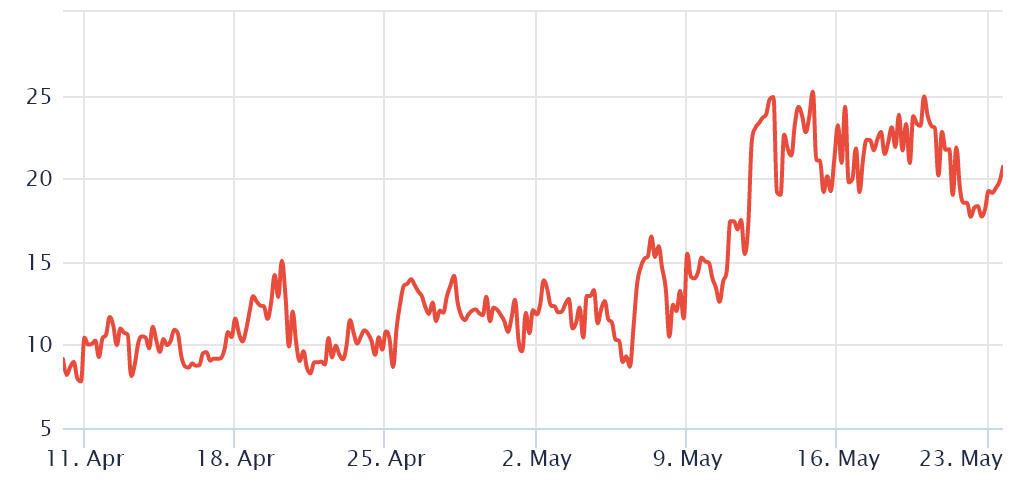

To exclude externalities specific to the futures instrument, traders also have to analyze Bitcoin options markets. The 25% delta skew is extremely useful because it shows when Bitcoin arbitrage desks and market makers are overcharging for upside or downside protection.

If option investors fear a Bitcoin price crash, the skew indicator will move above 12%. On the other hand, generalized excitement reflects a negative 12% skew.

Related: Bitcoin targets record 8th weekly red candle while BTC price limits weekend losses

Be brave when most are fearful

In short, BTC options markets are still stressed and this suggests that professional traders are not confident in taking downside risk. Bitcoin’s futures premium has been somewhat resilient, but the indicator shows a lack of interest from leveraged long buyers.

Taking a bullish bet might seem contrarian right now, but at the same time, an unexpected price pump would take professional traders by surprise. Therefore, it creates an interesting risk-reward situation for Bitcoin bulls.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision

Leave A Comment