Bitcoin (BTC) is on track to form two successive Doji candlestick patterns on the weekly charts but a positive sign is that the price is sustaining above the 20-week exponential moving average ($28,072). This suggests that the bulls have not lost their grip.

Popular trader TechDev used the three-week timeframe to show that Bitcoin’s compression above the 20-period moving average was approaching values seen only four times since Bitcoin’s creation. Interestingly, on all three previous occasions, the expansions happened to the upside, suggesting that history favors the bulls.

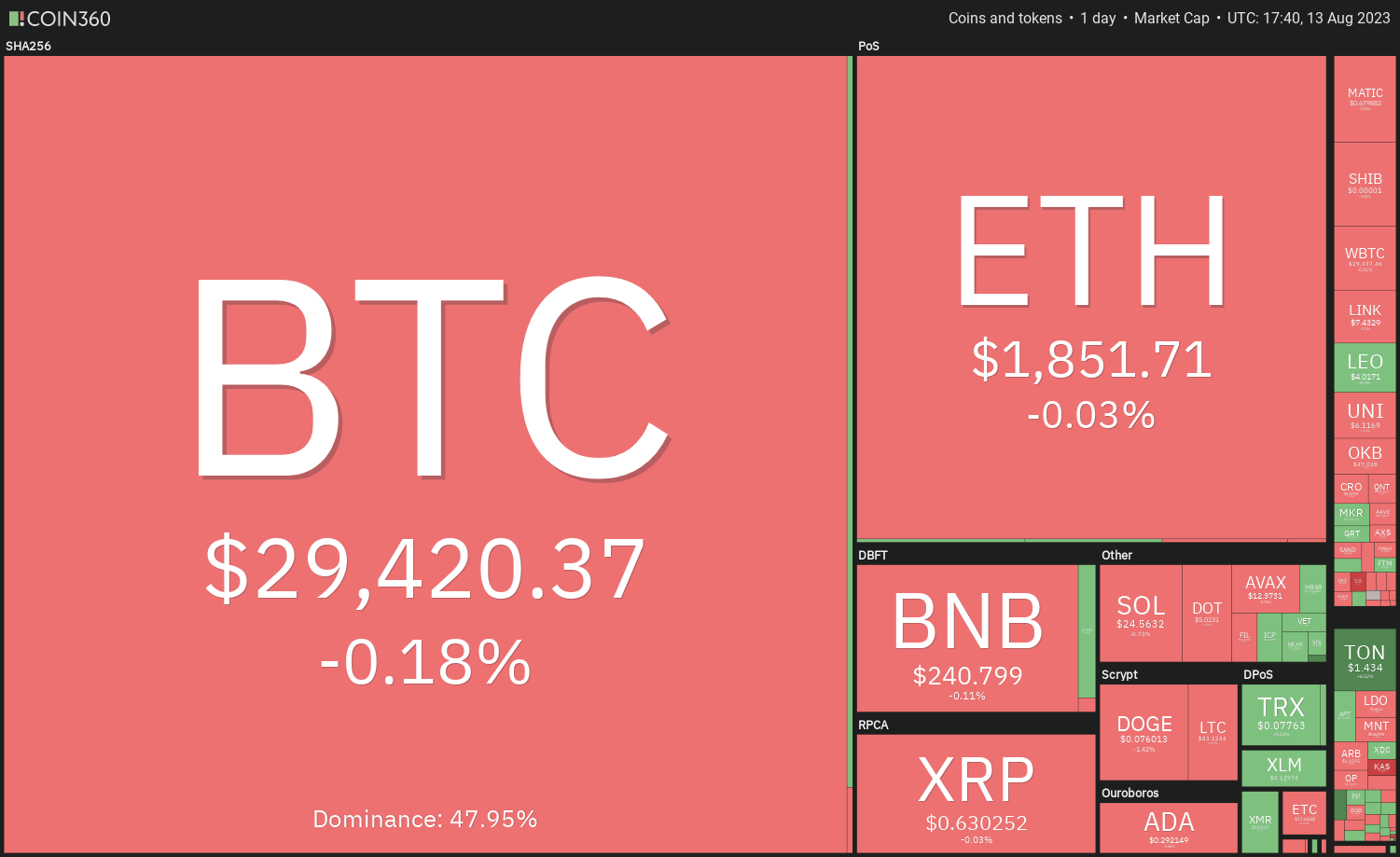

While several altcoins are looking to Bitcoin for direction, some have outperformed in the near term. Let’s study the charts of the top-5 cryptocurrencies that are looking positive over the next few days.

Bitcoin price analysis

Bitcoin has been trading near the 20-day EMA ($29,447) for the past two days, signaling indecision between the bulls and the bears.

The next trending move is likely to begin after the price escapes this range. If the price dives below $28,585, the selling could pick up momentum and the pair may dump to $26,000.

On the upside, a break and close above $30,150 may attract buyers. The pair could then surge to the $31,804 to $32,400 resistance zone.

If the price turns up and breaks above the 20-EMA, it will suggest that the bulls are trying to seize control. The pair may first rise to $29,738 and if this hurdle is cleared, the rally could reach the overhead resistance at $30,350.

Shiba Inu price analysis

Shiba Inu (SHIB) is in a strong recovery but buyers are facing resistance near the overhead resistance at $0.000012.

Contrarily, if the price slumps below $0.000010, the pair may extend its pullback to the 20-day EMA. This remains the key level to watch out for because a break below it may signal that the recovery may be over.

If the price skids and sustains below the 20-EMA, it will suggest that the bulls are losing their grip. The pair may then tumble to the next major support at the 50-SMA. This level may witness aggressive buying by the bulls.

Uniswap price analysis

Uniswap (UNI) rebounded off the 50-day SMA ($5.79) on Aug. 7 and rose above the 20-day EMA ($6.09) on Aug. 8. This shows that buyers are active at lower levels.

Instead, if the price rebounds off the 20-day EMA, it will indicate that the bulls are trying to flip this level into support. If they manage to do that, the pair may rise above the immediate resistance at $6.35 and reach $6.70.

Alternatively, if the price rebounds off the 50-SMA and rises above the 20-EMA, it will suggest buying on dips. The pair could then rise to $6.35. Buyers will have to surmount this resistance to come out on top. The pair may then soar to $6.70.

Related: Voyager’s token transfer to Coinbase sparks sell-off suspicions

Maker price analysis

Maker (MKR) has been trading above the breakout level of $1,200 for the past few days, indicating that the bulls are attempting to flip the level into support.

If bears want to prevent the uptrend, they will have to quickly yank the price back below the breakout level of $1,200. That could open the gates for a decline to the 50-day SMA ($1,041).

If buyers drive the price above the triangle, the MKR/USDT pair may start an up-move toward the pattern target of $1,463. On the other hand, a break below the triangle could signal that bears are back in the game. The pattern target on the downside is $986.

XDC Network price analysis

XDC Network (XDC) has pulled back to the 20-day EMA ($0.062) which is an important support to watch out for.

On the contrary, a break and close below the 20-day EMA could sink the pair to the 61.8% Fibonacci retracement level of $0.056. Such a move could delay the start of the next leg of the uptrend.

Contrary to this assumption, if the price continues higher from the current level and breaks above the downtrend line, it will invalidate the bearish setup. The failure of a negative setup is a positive sign. That could open the doors for a potential rally to $0.082.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Leave A Comment