Bitcoin (BTC) and the crypto market have been accelerating heavily in recent weeks, as Bitcoin has surged by 60% from the July lows, while Ether (ETH) has been showing strength with a 90% rally as altcoins have been seeing massive gains across the board.

The sentiment has flipped heavily as well. Three weeks ago, the majority of the people were discussing a potential breakdown to $20,000, including the effects of a death cross. But now, a golden cross could happen on Bitcoin with a potential breakout above $48K certainly on the table.

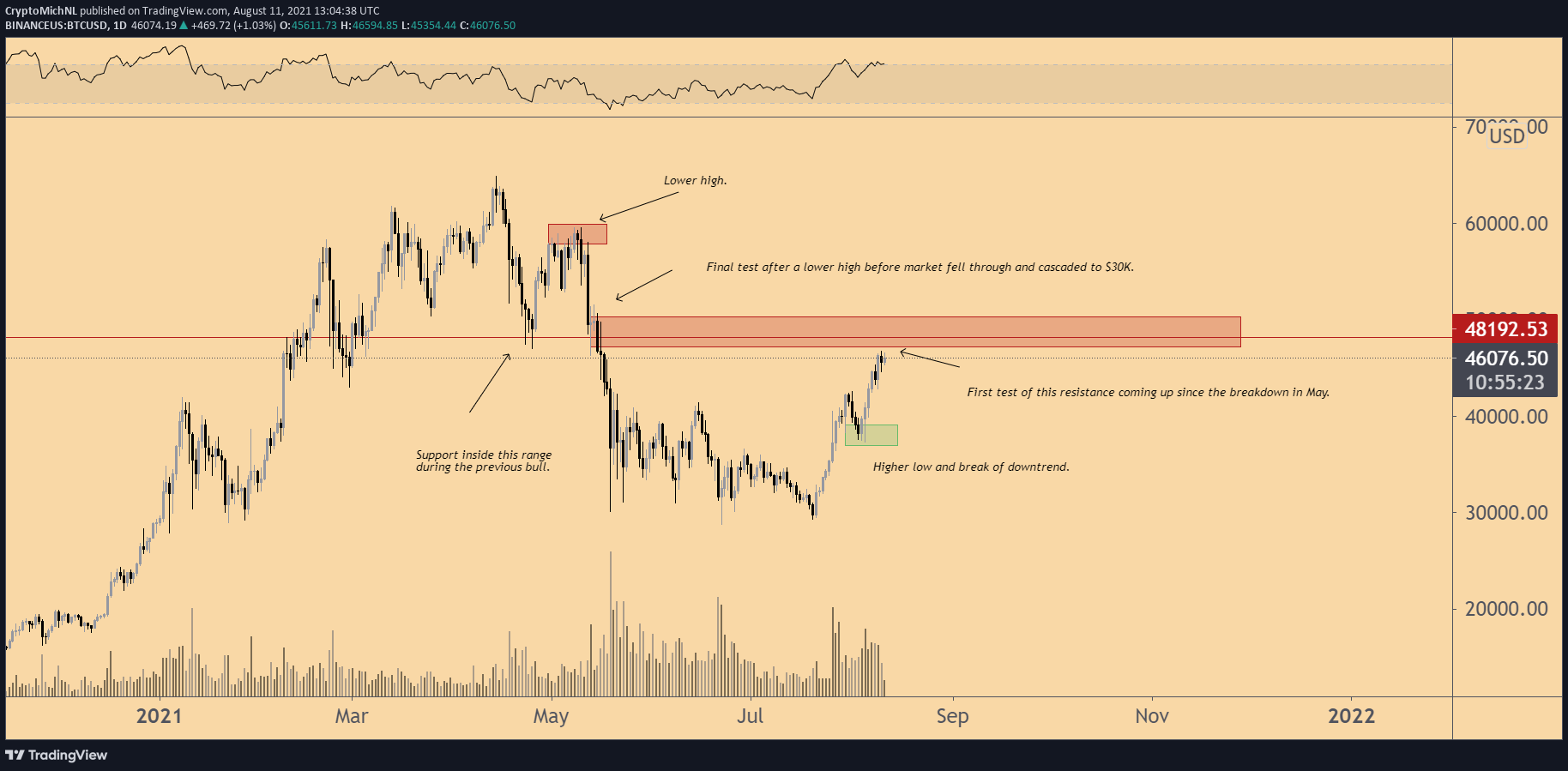

Key resistance at $48K

Thus, the $48K region is a critical price point, as that was the support before the market started to spiral downward. Now, this resistance is receiving its first test, which will unlikely be broken upon the first attempt.

On the other hand, the market has reversed the downtrend. Since the all-time high, lower highs were created and lower lows, signaling a bear market. This downtrend led to a more than 50% correction, leading to expectations of a prolonged bear market.

The recent run has negated this bearish argument, as a new higher high was established. Next to that, a new higher low was created, confirming the new direction.

Therefore, if the market can’t break above $48K in the coming weeks, the level to watch for support and, ultimately, the critical level to sustain this momentum is found around $37,500. Simply put, higher highs will be made if BTC manages to maintain above this level.

The last thing to note, however, is the potential bearish divergence. This isn’t confirmed. But given the recent weakness around the 200-Daily Moving Average, a near-term correction is still likely as the market is approaching a higher timeframe resistance.

Total market cap facing final resistance zone

A similar construction is found there as Bitcoin with the $48K level. So an immediate breakout is also unlikely.

A higher low has to be established if the market rejects at $2 trillion. Similarly to Bitcoin’s $37.5K support level, the same can be said about $1.5 trillion for the total crypto market cap.

Altcoin market cap at risk of 25% correction?

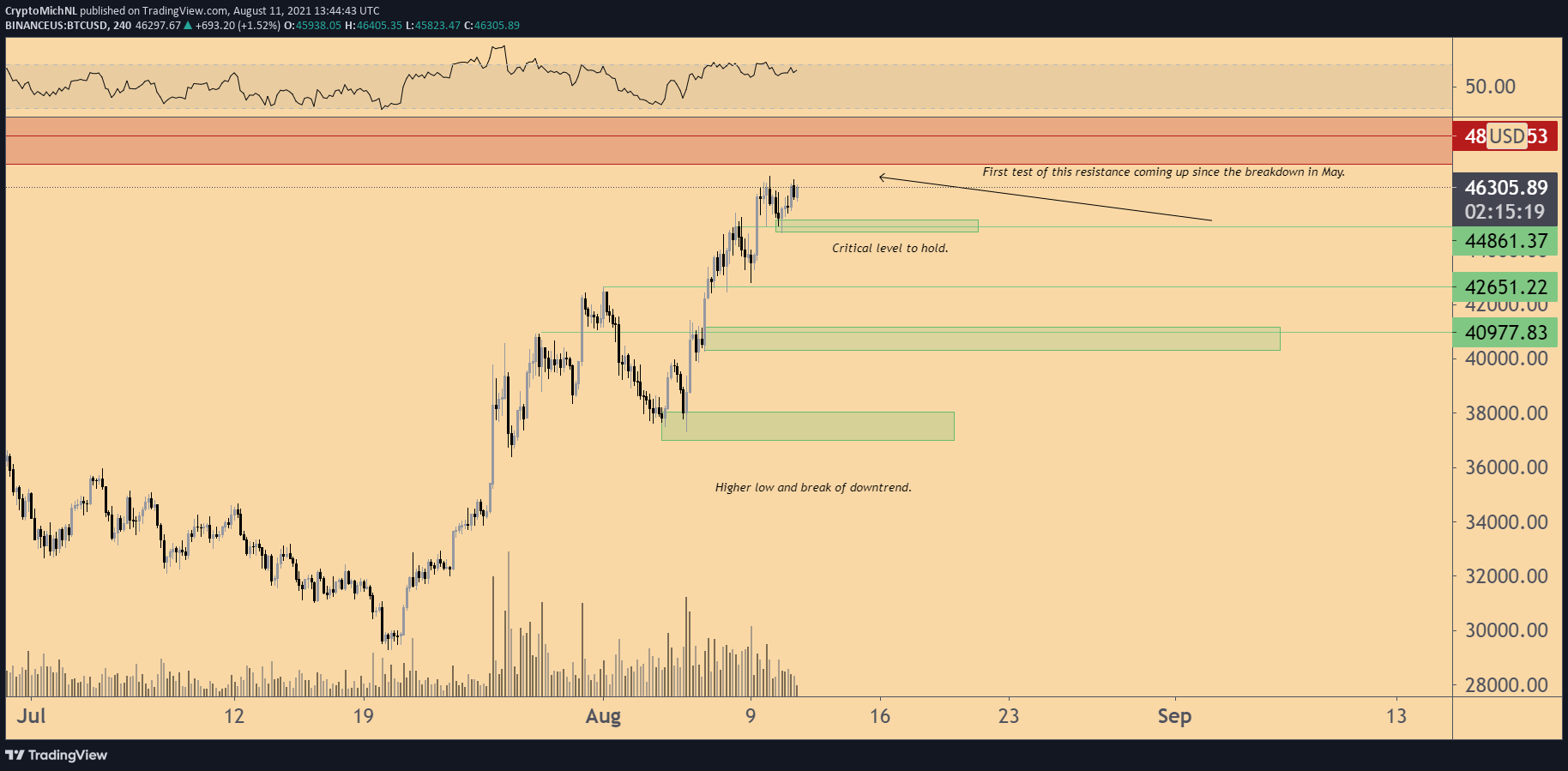

Bitcoin: Key levels to watch on lower time frames

However, once a reversal takes place, many support levels are found for Bitcoin’s price. The first level of support is seen at $42.6K, while the big support zone is found at $40.8K.

Such a correction of 15% would be very healthy for the market and gives people the opportunity to reenter at slightly lower levels. However, Bitcoin’s price should stay above $37.5K to sustain the current bullish momentum of higher highs and higher lows.

If that isn’t possible, then the market may be in store for more blood.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Leave A Comment