Bitcoin (BTC) has been ranging from $30,400 to 36,400 for the last 12 days, and it has been difficult to pinpoint the exact reason for investors’ lack of appetite. Some analysts have pointed to the Grayscale Bitcoin Trust (GBTC) unlocking in mid-July finally giving institutional investors a chance to offload their funds, but this is not likely to be the main reason.

Meanwhile, industry leaders have suggested that the “crypto regulatory crackdown” taking shape in the United States is severely impacting investors’ sentiment, and this view is especially problematic considering China has recently banned all crypto mining activity in the country.

Lastly, renowned Bitcoin critics, including Aswath Damodaran, professor of finance at New York University’s Stern School of Business, have claimed that the cryptocurrency “failed miserably” as a currency.

Damodaran specifically cites Bitcoin’s limited use in microtransactions, even though El Salvador is pushing forward with a plan to democratize the Lightning Network solution.

Bulls have a better chance of winning the weekly expiry

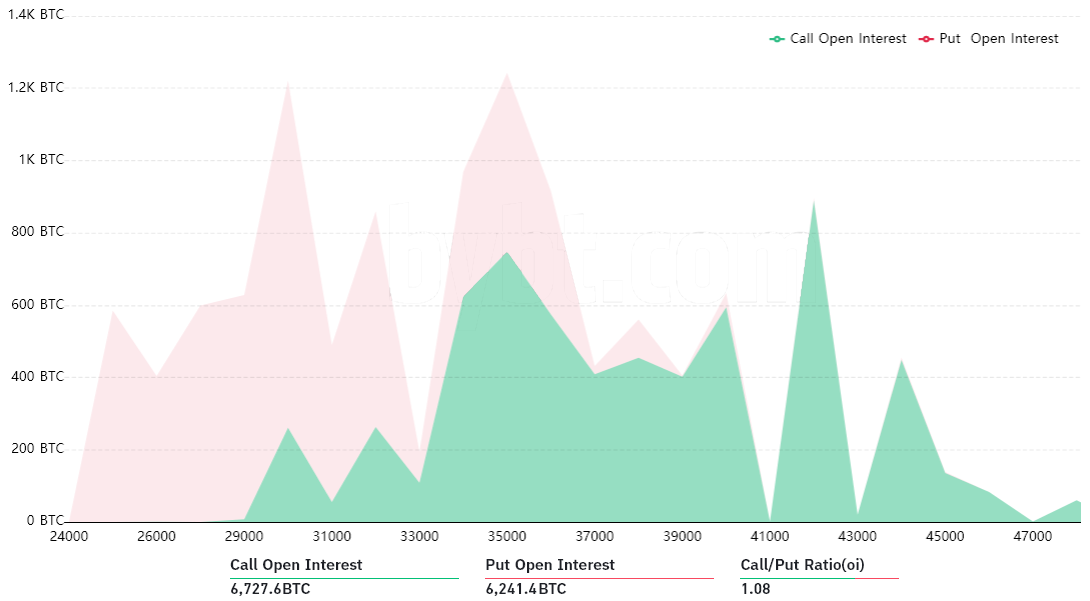

After bears had a victory in the recent quarterly $3-billion options expiry on Friday, the winds may have shifted the tide favorably to bulls this time around. While the $34,000 level presented a $310-million advantage for the neutral-to-bearish put options last week, this upcoming Friday, July 2, holds an entirely different setup.

Related: Crypto traders say negative funding rates are buy signals, but are they?

Only 18% of the protective put options have been placed at $33,000 or higher strikes. Therefore, if Bitcoin is trading above that level at 8:00 am UTC on Friday, only $38 million worth of those neutral-to-bearish instruments will last.

$34,000 is the make-or-break level for both sides

On the other hand, bulls will likely try to defend the $34,000 level, resulting in $45 million in call (buy) options open interest.

Truth to be told, both sides have incentives to break this reasonable equilibrium at $34,000. For example, above $35,000, bulls’ advantage increased from $7 million to $57 million.

Conversely, bears have the upper hand if Bitcoin trades below $33,000. In this case, protective put options open interest is $31 million higher than the neutral-to-bullish call options.

To sum up, it is impossible to predict whichever side will come out stronger on Friday’s expiry. However, this is the first time in over four weeks that bulls have a decent fighting chance.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Leave A Comment