DeFi tokens and protocols took a heavy hit on May 19 as Bitcoin price dropped to $30,000 and while BTC has entered what some analysts describe as a ‘compression’ phase, the total value locked in DeFi and the value many of the sector’s tokens have yet to rebound to the levels seen before the market crash.

Curve DAO token (CRV) stands among the few DeFi tokens that have seen a strong recovery over the past two weeks due to reduced Ethereum gas fees, the launch of Convex Finance and the DeFi sector beginning to find a bottom.

Convex Finance launch attracts CRV holders

One source of the sudden rise in price and momentum for CRV is Convex Finance (CVX), an optimizer for the Curve Protocol that enables swaps of similar assets like stablecoin to stablecoin transactions.

Introducing Convex Finance! A new platform, built by Defi Natives, to simplify your Curve-boosting experience to maximize your yields.

Read more here! https://t.co/65Dog7RdqE

— Convex Finance (@ConvexFinance) April 15, 2021

Since it’s official launch on May 17, the Convex protocol has rapidly gained a substantial user base thanks to yields as high as 52.16% and some analysts have suggested that the protocol is challenging Yearn.finance for CRV-related deposits.

Data from Defi Llama shows that in the two and a half weeks since the launch of Convex Finance, the total value locked (TVL) on the protocol has surpassed $2.3 billion with stakers on the protocol earning $4.3 million in total revenue.

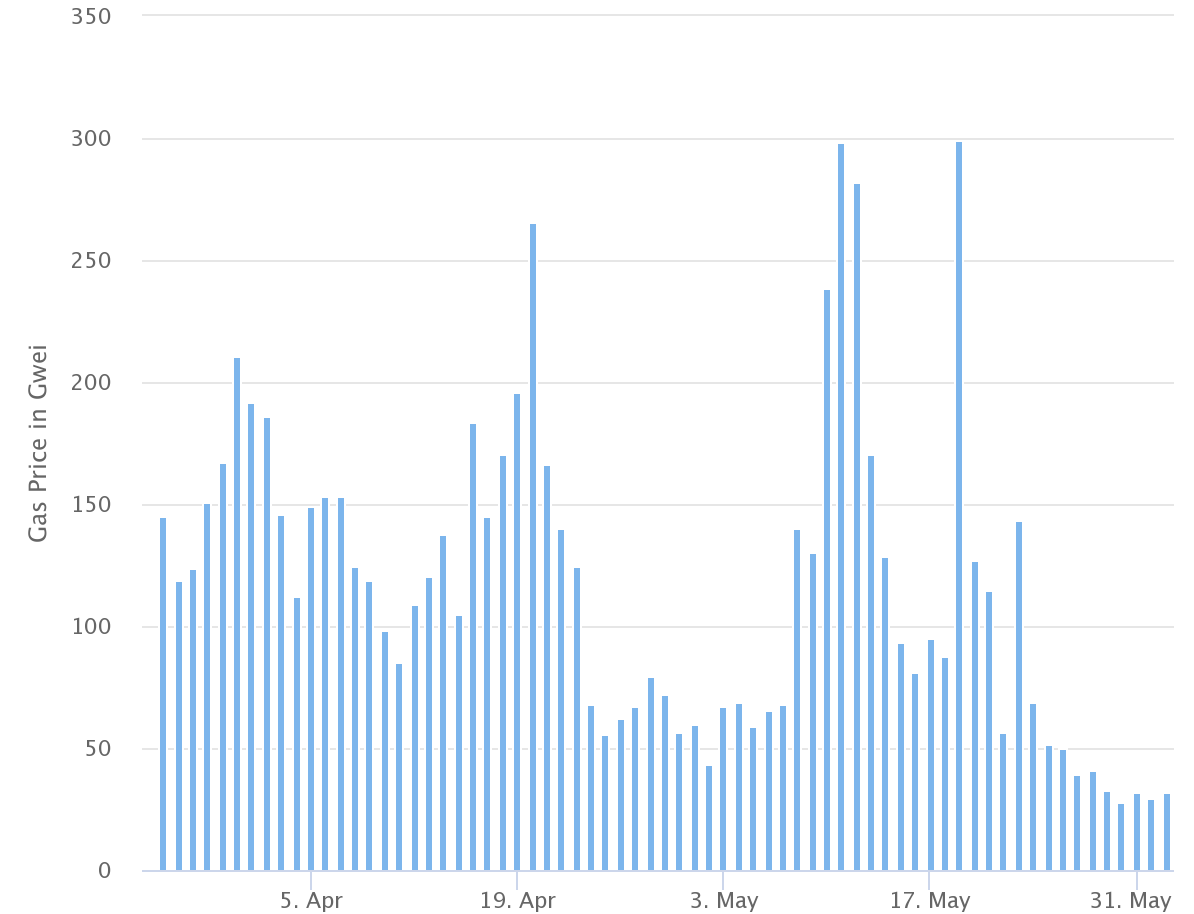

Curve Finance and the wider DeFi ecosystem could also be benefitting from the sharp decline in gas fees on the Ethereum (ETH) network, which had previously priced out many retail traders from performing the simple approval and confirmation transactions required to stake and claim earnings from DeFi protocols.

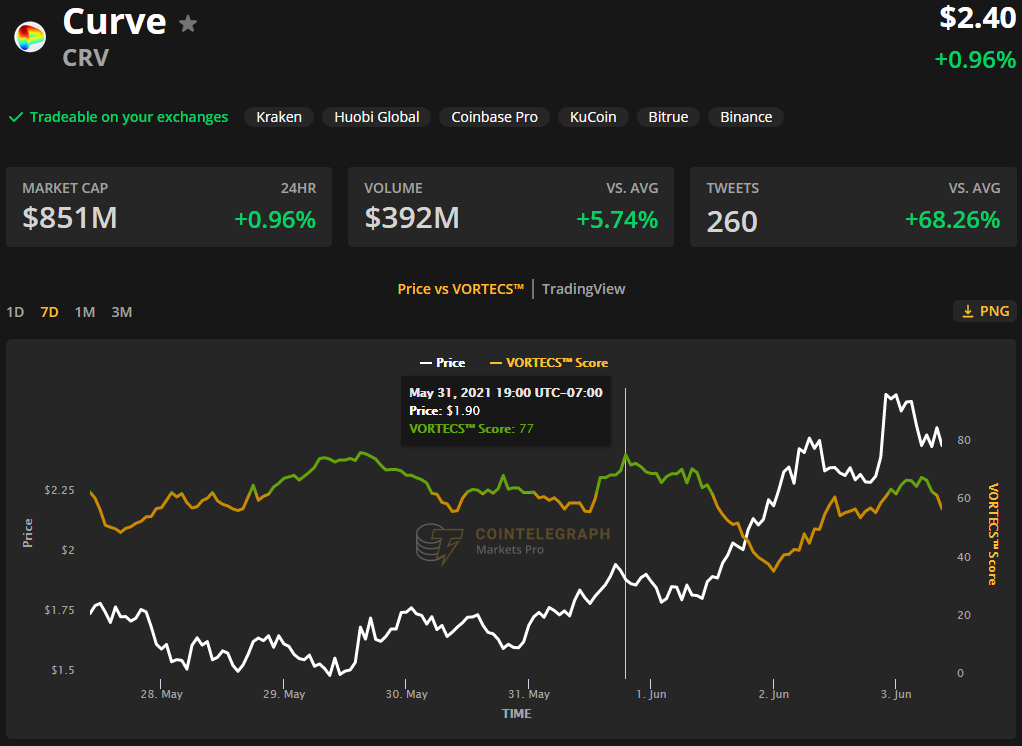

The VORTECS™ indicator flashed before the breakout

VORTECS™ data from Cointelegraph Markets Pro began to detect a bullish outlook for CRV on May 31, prior to the recent price rise.

The VORTECS™ Score, exclusive to Cointelegraph, is an algorithmic comparison of historic and current market conditions derived from a combination of data points including market sentiment, trading volume, recent price movements and Twitter activity.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Leave A Comment