The persistent challenges decentralized finance face have been well documented by a handful of analysts and the recent collapse of the Terra ecosystem re-enforced the fact that something is critically wrong with DeFi.

I think DeFi today is completely broken for 99% of the population.

The promise of a more transparent financial system has been overtaken by greed.

UST/LUNA is just the latest in a string of bad developments:

— Peter Yang (@petergyang) May 11, 2022

Let’s take a look at what experts say DeFi needs to do in order to have another revival.

Improved usability

To date, the promise of open and uncensored access to a global decentralized financial system has been largely hampered by the complicated interface, confusing multi-step staking processes and lack of clarity surrounding the yields on various tokens.

What do you think DeFi needs to reach mass adoption?

a) Better ease of use

b) Greater education about DeFi

c) Less exploits and rugpulls

d) Greater liquidity and on-ramps

e) Clear government regulation pic.twitter.com/dX4Qpd2Dsh

— Rugdoc.io (@RugDocIO) January 9, 2022

The user experience for most platforms is sub-par to what would be expected when dealing with multi-million dollar platforms and the layouts can be complicated, along with poor documentation that leaves users frustrated.

Adding to the confusion, an ever-growing list of blockchain networks with their own DeFi ecosystems can seem daunting to newcomers who may have never used a software wallet before.

Ultimately, a better system of educating the public about DeFi in a trusted setting is something that is needed to help the mass adoption process, otherwise you face the same problem of the current financial system where only a small portion of the population reaps the benefits.

Ultimately, a better system of educating the public about DeFi in a trusted setting is something that is needed to help the mass adoption process, otherwise you face the same problem of the current financial system where only a small portion of the population reaps the benefits.

Security needs to become priority #1

The DeFi sector is often referred to as the wild west due to the ability for anyone to launch a project with flashy promises only to pull the string on naive investors and leave them with a worthless token.

Well-meaning projects also fall victim to smart contract vulnerabilities that see their liquidity drained. A recent example of this was the February, 2022 hack of the Wormhole token bridge which resulted in the loss of 120,000 wrapped Ether (wETH) tokens.

In order for more people to feel safe exploring the expanding DeFi ecosystem and to keep governments off the back of the industry, a greater level of security and protection from malicious actors and protocol exploits will be required.

Related: Buterin: How to create algo stablecoins that don’t turn into Ponzis or collapse

Self-regulate, or be regulated

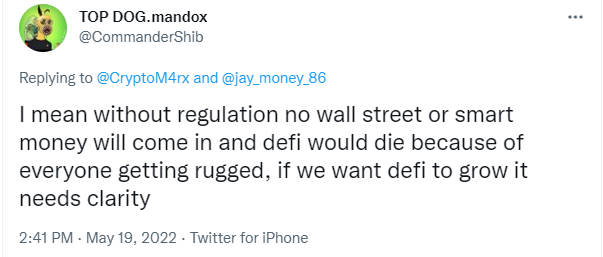

A third factor that is at the top of the list for many DeFi analysts is the need for greater regulatory clarity.

While the mere mention of such a thing generates a slew of objections from many crypto investors who value its unregulated nature, the majority of the general public who are not yet involved with cryptocurrencies and DeFi are likely to remain wary until the government gives the asset class a stamp of approval.

Thanks to the recent Terra ecosystem collapse, regulation could be one of the first challenges that DeFi has to resolve.

Thanks to the recent Terra ecosystem collapse, regulation could be one of the first challenges that DeFi has to resolve.

What those regulations eventually look like is unknown, but they will help to establish a starting point which could help the DeFi sector evolve and mature.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Leave A Comment