The total value locked in decentralized finance (DeFi) projects is hovering around $62 billion as of mid-August, down from a peak of over $250 billion in December 2021. Capital is fleeing the crypto space amid war, soaring inflation and whatever other surprises 2022 may still have in store for us.

However, unlike previous crypto bull runs, it was not just retail interest that drew in this capital in the first place. Rather, major institutional players, which have recently opened up to crypto, quickly developed an appetite for the yields DeFi is known for. But now that winter is upon us, the pitfalls of high-yield platforms have become more apparent.

Value can’t come out of thin air

In some sense, value is always somewhat subjective, defined by one’s personal considerations and goals. A photo from a family collection means more to a member of that family than to a random outsider. Accordingly, a farmer would be quite willing to pay for a shipment of seeds, as those are crucial for their business, but a city dweller would likely prefer to pay up for the end product.

Still, even the simple examples above show how value often relies on real-world circumstances and processes. In the case of the farmer, it is also quite quantifiable, thanks to the free market bringing entire industries, governments and consumers together into a sophisticated and — more or less — functional system. Value defined in money creates value defined in the yield, whether it’s crops or fruits, and the great economic life cycle continues as these products make their way through the market.

“Yield” is a word dear to the blockchain industry, especially its DeFi sector, which has seen its total value locked shed billions of dollars in value since May amid the ongoing bear run. Still a largely nascent industry, crypto as a whole does not have nearly as much exposure to the real-world economy, especially when it comes to anything beyond speculative trading. And as lucrative as DeFi’s yields might seem, the question is always where they come from.

Related: Terra contagion leads to 80%+ decline in DeFi protocols associated with UST

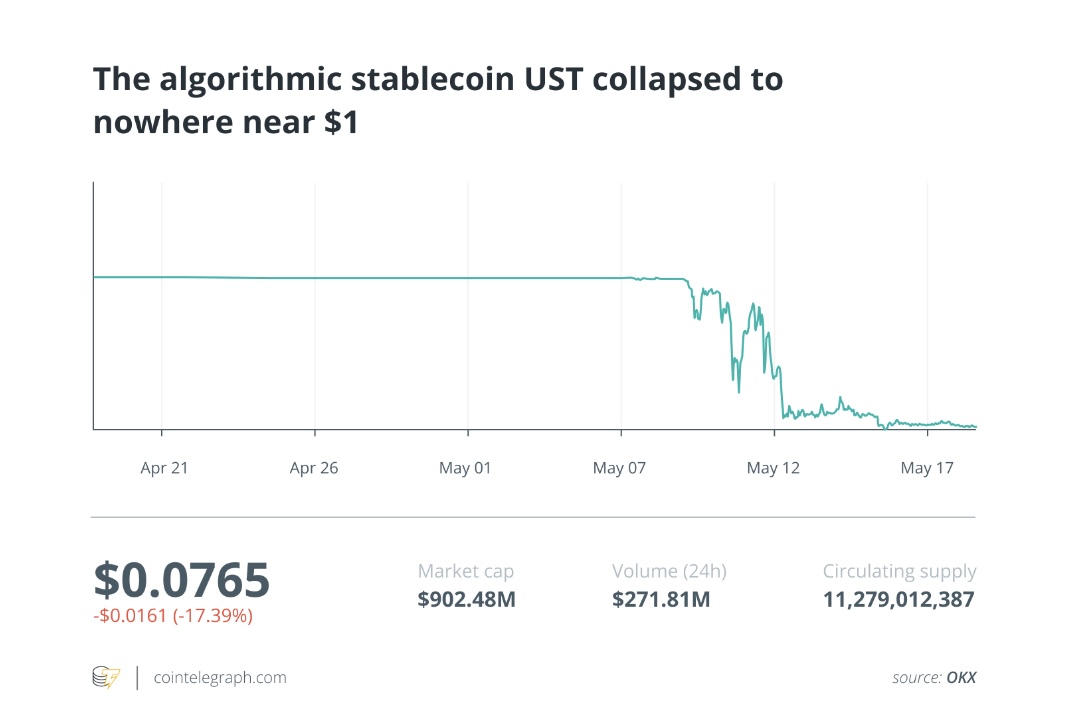

The sad tale of Anchor’s demise is a perfect example of how unsustainable the business models behind DeFi protocols can be. Its yields of almost 20% officially came from on-chain lending, but it received a cash infusion to keep operating — a clear sign that lending was not enough to keep the returns going. Given Anchor’s prominence as a pull factor for the entire Terra blockchain, you can credit its questionable yields with bringing the entire ecosystem down.

Equally telling is the fact that on-chain loans tend to remain on-chain within the largely siloed blockchain ecosystem. An on-chain protocol can only lend you an on-chain token, and as we know, on-chain assets are not very integrated into the real-world economy. So, whether you are going after an arbitrage opportunity or staking your loan into another yield protocol, your loan — as opposed to traditional finance lending — creates little in terms of real-world value. And healthy yields never come out of thin air.

Equally telling is the fact that on-chain loans tend to remain on-chain within the largely siloed blockchain ecosystem. An on-chain protocol can only lend you an on-chain token, and as we know, on-chain assets are not very integrated into the real-world economy. So, whether you are going after an arbitrage opportunity or staking your loan into another yield protocol, your loan — as opposed to traditional finance lending — creates little in terms of real-world value. And healthy yields never come out of thin air.

There is life off-chain

This lack of real-world value to underpin the yields and the entire offering is a major Achilles’ heel for the crypto scene. Many have compared Bitcoin (BTC) to digital gold, but gold has use cases besides sitting in a bank safe, from the jewelry industry to electronics. And while it can never replicate Bitcoin’s wild shot for the moon, its use cases will keep gold afloat even when its veneer as an inflation hedge fades.

The crypto space must seek to give up its inside-baseball mentality and look beyond on-chain activities to seek to establish a larger foothold in the real-world economy and processes. The blockchain industry must experiment with use cases geared toward competing with financial and other services in traditional markets besides advancing the blockchain space as such.

Some of the largest names in the DeFi space have already seen the writing on the wall. DeFi’s titans are already seeking exposure to real-world assets, transitioning to a business model with a more clear-cut risk-reward ratio and healthier yields produced by business-to-business lending. The entire blockchain industry should follow in this direction.

Some of the largest names in the DeFi space have already seen the writing on the wall. DeFi’s titans are already seeking exposure to real-world assets, transitioning to a business model with a more clear-cut risk-reward ratio and healthier yields produced by business-to-business lending. The entire blockchain industry should follow in this direction.

Related: Do Kwon reportedly hires lawyers in S. Korea to prepare for Terra investigation

This quest for real-world use cases should go beyond the core set of financial services. It should power a vast array of services, from decentralized data storage and identity solutions to the Internet of Things and mobility applications. The machine world is an especially interesting use case, as machines running 24/7 present a great source of liquidity brought about by real-world value. This liquidity could unlock a whole array of new DeFi business models and offer an opportunity for some of the existing protocols to switch to healthier yields.

The time of uninhibited yields shooting for the moon may be over, but there are plenty of interest-generating real-world activities waiting to be brought on-chain. All of them offer more familiar business models, allowing projects to up their risk management gain while also offering investors returns based on actual tangible outcomes. Blockchain adoption should be about more than just trading Bitcoin from your bank account — it’s a process that can and should transform entire industries and business models.

The time of uninhibited yields shooting for the moon may be over, but there are plenty of interest-generating real-world activities waiting to be brought on-chain. All of them offer more familiar business models, allowing projects to up their risk management gain while also offering investors returns based on actual tangible outcomes. Blockchain adoption should be about more than just trading Bitcoin from your bank account — it’s a process that can and should transform entire industries and business models.

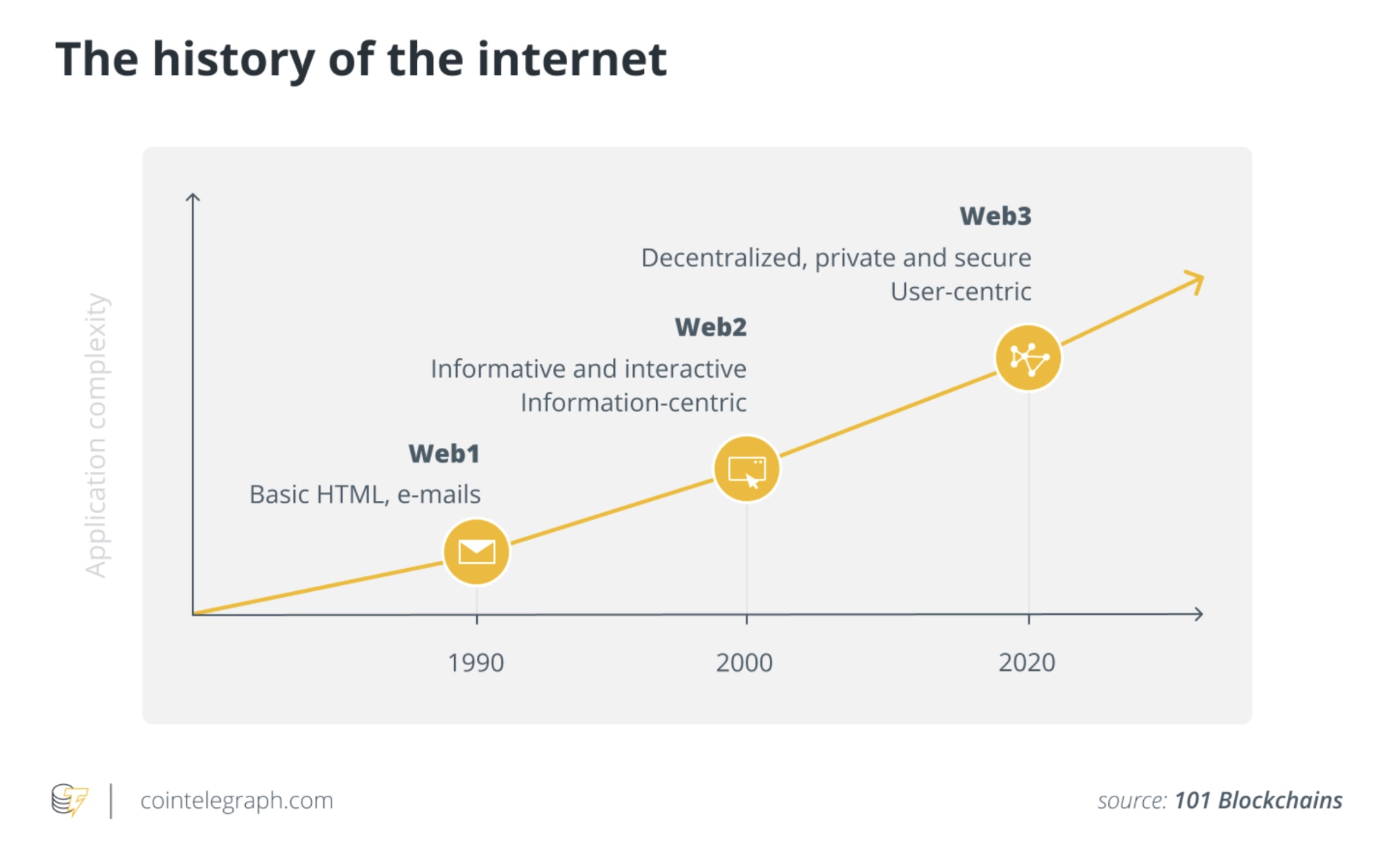

By carving itself a presence across multiple real-economy industries and sectors, the blockchain space has more than just healthier yields to win. In the long run, and with enough effort and polish, this is ultimately about turning the dream of Web3 into a self-fulfilling prophecy. A blockchain-based internet must begin with a host of decentralized apps and services slowly but surely taking over their centralized competitors, and the bear market at hand is just the time to start building them.

The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Leave A Comment