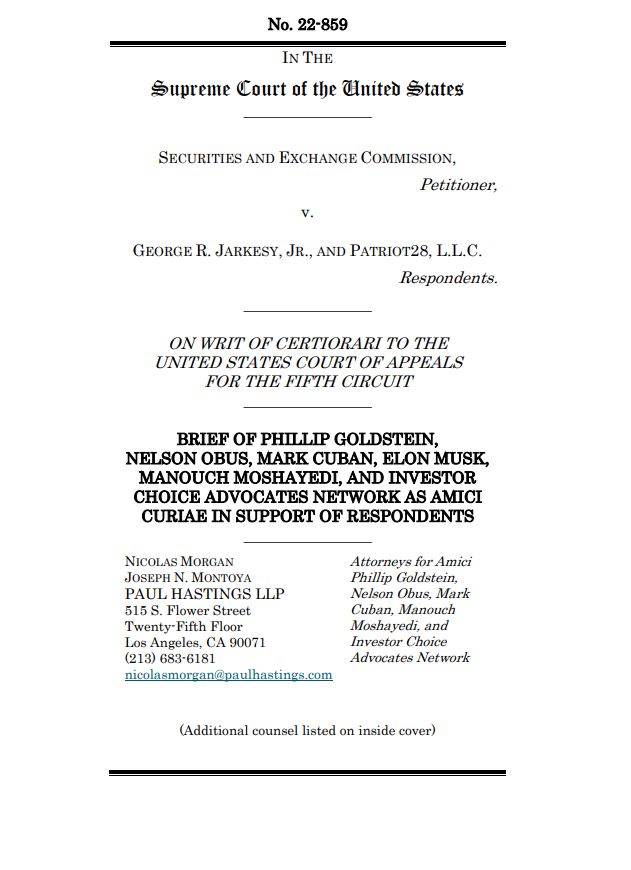

Elon Musk, Mark Cuban, with others, have collaboratively submitted a shared amicus brief to the Supreme Court, wherein they raise concerns about the Securities and Exchange Commission’s (SEC) approach to conducting internal proceedings without the inclusion of juries.

Mark Cuban, a billionaire crypto investor and DeFi advocate who actively engages in the cryptocurrency space, and Elon Musk, the CEO of Tesla and SpaceX, who recently reshaped Twitter into X and wields influence and controversy in crypto, both assert that these administrative proceedings produce disparate outcomes for individuals facing SEC charges. Consequently, this approach has raised concerns, particularly in light of the potential infringement on the Seventh Amendment right to a jury trial.

The context of this legal challenge centers around the SEC v. Jarkesy case. In this specific case, George Jarkesy contends that his Seventh Amendment rights were violated. He argues that the SEC’s internal adjudication process, which lacks a jury and is overseen by an administrative law judge appointed by the commission, contradicts these rights. This effectively results in a single entity fulfilling the roles of judge, jury and enforcer.

Musk is facing his third notable legal dispute with the financial regulatory agency. This comes in the wake of prior lawsuits in 2018 and 2019. Currently, the regulatory body is pursuing the involvement of a federal court to request Musk’s testimony regarding his acquisition of Twitter, with a specific focus on his public statements about the transaction, as disclosed in legal records.

Related: Elon Musk trials $1 subscription signup fee for new X users in New Zealand, Philippines

Nonetheless, Musk and Cuban maintain a steadfast position. They are appealing to the justices to endorse the decision made by the 5th Circuit. Their legal representatives contend that opting for administrative proceedings over the option of federal court juries runs counter to the SEC’s stated mission. Furthermore, such decisions could have the potential to negatively impact both investors and the markets that the SEC is committed to protecting.

Magazine: Crypto regulation: Does SEC Chair Gary Gensler have the final say?

Leave A Comment