Ethereum’s native token Ether (ETH) is poised for a mini bull run above $3,000 primarily due to a classic bullish reversal pattern on its shorter-timeframe chart, and a huge spike in ETH outflows from Coinbase.

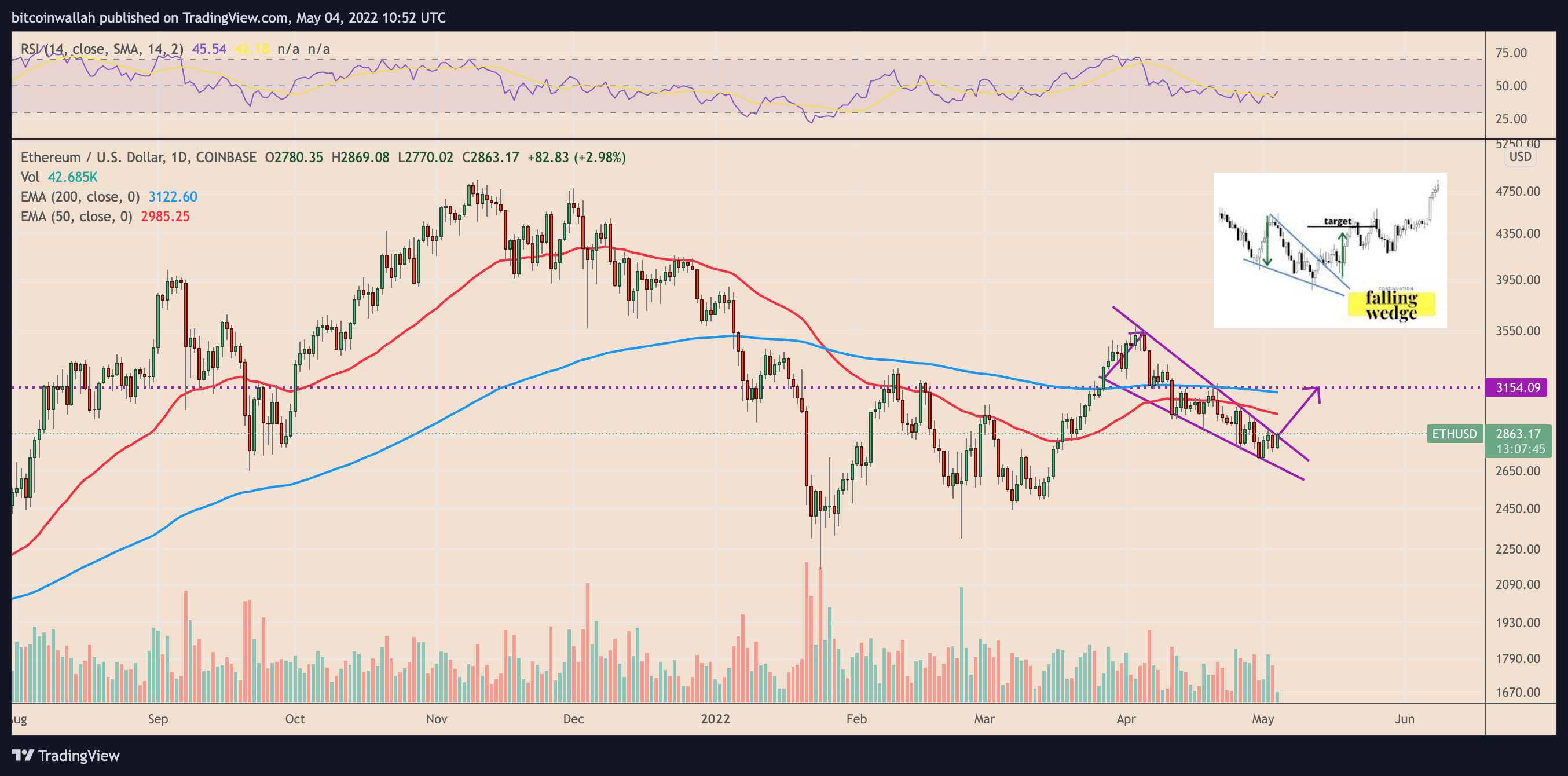

ETH price forming falling wedge

ETH’s price has been forming a falling wedge pattern since late March 2022, which raises its prospects of undergoing a breakout move in May.

Falling wedges appear when the price trends lower inside a range defined by two descending, contracting trendlines.

As a rule of technical analysis, these wedges resolve after the price breaks out of their range to the upside and rises to a level at length equal to the maximum distance between the pattern’s upper and lower trendline when measured from the breakout point.

Coinbase ETH outflows hit all-time high

The interim upside outlook in the Ether market coincides with bullish on-chain data.

Notably, the number of ETH leaving Coinbase, the second-largest crypto exchange by volume, reached its highest level on May 3, data from CryptoQuant shows.

$ETH Coinbase Outflow hits an all-time-high

Live Chart https://t.co/PiITw2ZFf3 pic.twitter.com/tlFQndUhvQ

— CryptoQuant.com (@cryptoquant_com) May 4, 2022

Simultaneously, the ETH balance on all the crypto exchanges fell on May 3 to its lowest level since August 2018, according to one of Glassnode’s on-chain metrics.

They also coincide with a recent recovery in the upside sentiment of small Ether traders, namely an increase in the number of addresses that have a minimum balance of 0.1 ETH, 1 ETH and 10 ETH.

Bearish long-term prospects

Ether’s likelihood of crossing the $3,000-level has not plucked it out of its prevailing, long-term bearish setup, however.

As Cointelegraph covered earlier, ETH risks breaking below its ascending triangle range in Q2/2022 with its downside target sitting anywhere between $1,820 and around $2,670, depending on the breakout point.

Related: Smart money is accumulating ETH even as traders warn of a drop to $2.4K

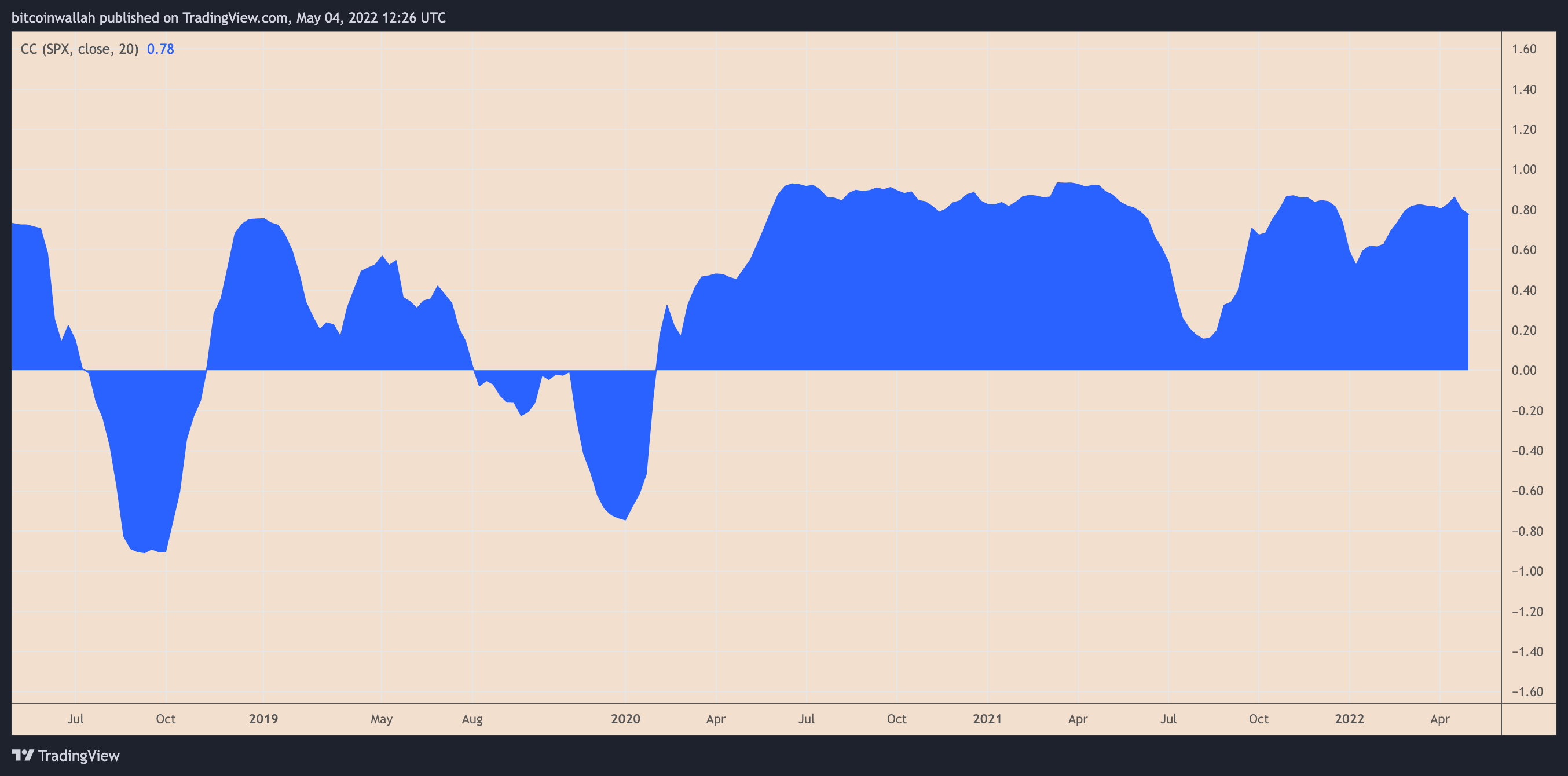

Researchers from Strategas Research Partners and Morgan Stanley anticipate that the U.S. benchmark index, the S&P 500, will decline by another 15-16% into 2022, reports Bloomberg. As a result of its consistent positive correlation, ETH also faces similar downside prospects this year.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Leave A Comment