Charles Hoskinson, the founder of Cardano and one of the co-founders of Ethereum, said one of the biggest lessons crypto users could take away from the collapse of Terra and other projects was learning to appreciate those that withstood the test of time.

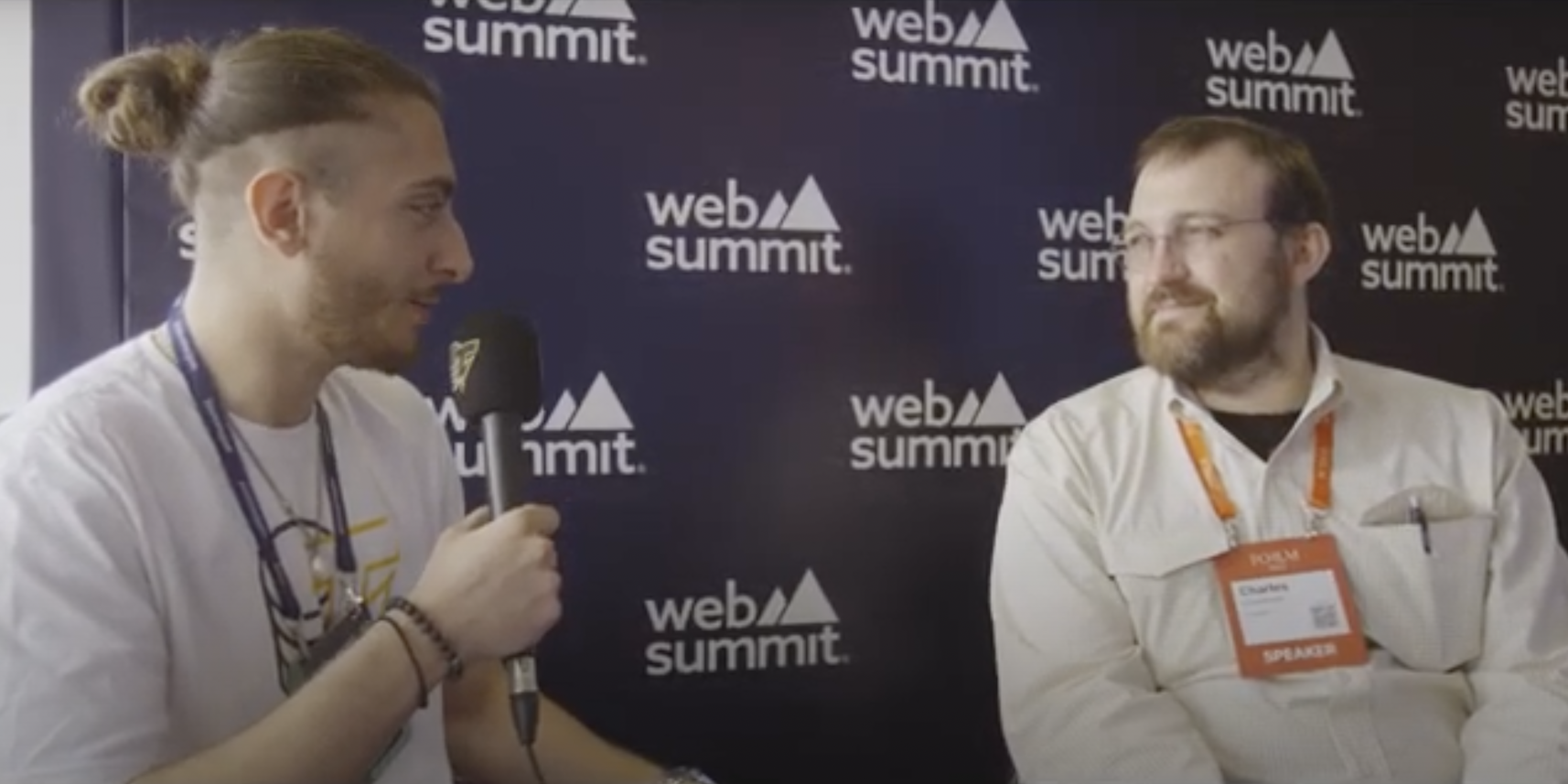

Speaking to Cointelegraph at the Web Summit tech conference in Portugal on Nov. 2, Hoskinson said he had seen many companies in the crypto space collapse, from Silk Road to Mt. Gox. According to Hoskinson, protocols that survived were “resilient under an adversarial load,” capable of weathering both bear and bull markets — something of which many decentralized finance projects were incapable.

“Just ‘cause you’re on top today, you’re not always going to be,” said Hoskinson. “Great cryptocurrencies have to go through several collapses. I was in Bitcoin when it was under a dollar, and I watched it go from a dollar to $30, to $40, to $256, to $80, to $1,200, to $250, to $20,000, to $4,000, to $64,000, now down to, what is that, $20,000 today, give or take? I watched that, and I watched all the companies come and go.”

“The way things were constructed, [Terra] was wildly profitable for a few people, and those few people happened to be well connected to the space, and so they lifted it up, and they made billions of dollars, and they made it off the back of retail investors — which is wrong. It’s going to result in a regulatory crackdown in that particular area.”

Related: Charles Hoskinson and Ethereum dev get into a war of words post-Vasil upgrade

Charles Hoskinson and Ethereum dev get into a war of words post-Vasil upgradeThe Cardano founder has frequently criticized the Ethereum protocol following his departure from the project, as well as the proof-of-work system connected to Bitcoin (BTC) mining. Like many other digital assets amid the market downturn, the price of Cardano’s native token (ADA) has fallen markedly since May, dropping more than 57% in six months to reach $0.38 at the time of publication.

Leave A Comment