In her monthly Expert Take column, Selva Ozelli, an international tax attorney and CPA, covers the intersection between emerging technologies and sustainability, and provides the latest developments around taxes, AML/CFT regulations and legal issues affecting crypto and blockchain.

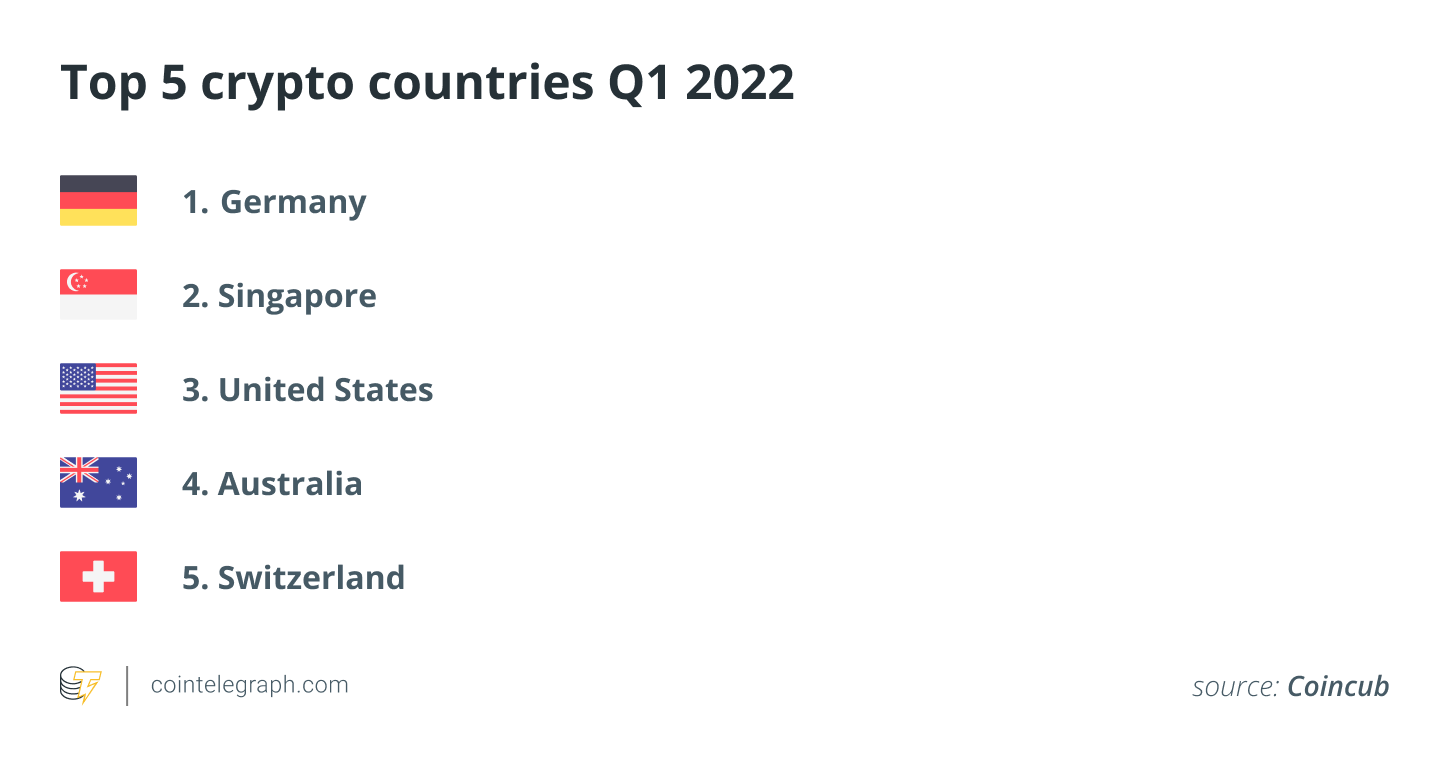

Germany has risen to the top spot of Coincub’s guide to the most crypto-friendly countries in Q1 2022. The European country allows its long-term domestic savings industry to utilize crypto investments, supported by its zero-tax policy on long-term capital gains from crypto, and its number of Bitcoin and Ethereum nodes is second only to the United States.

Blockchain adoption

Blockchain adoption

In 2019, Germany was the first country to adopt a blockchain strategy to harness the technology’s potential for advancing digital transformation and to help make it an attractive hub for the development of blockchain, Web3 and metaverse applications in fintech, climate tech, business and govtech, including Germany’s digital identities project.

The German Savings Banks Association — a network of 400 savings banks in German-speaking countries — started developing fintech blockchain applications to enable customers to buy and sell cryptocurrencies. Various companies such as Volkswagen, About You, SAP, BrainBot and BigchainDB have been developing NFT, metaverse, Web3, govtech and crypto payment applications that are widely used in e-commerce to purchase goods. Jacopo Visetti, an adviser to C3 — a team of operators and investors who back companies working to reduce emissions — explained to me:

“C3 is a climate tech company developing advanced technological infrastructure allowing to bridge carbon credits from international standards to the blockchain by means of tokenization.”

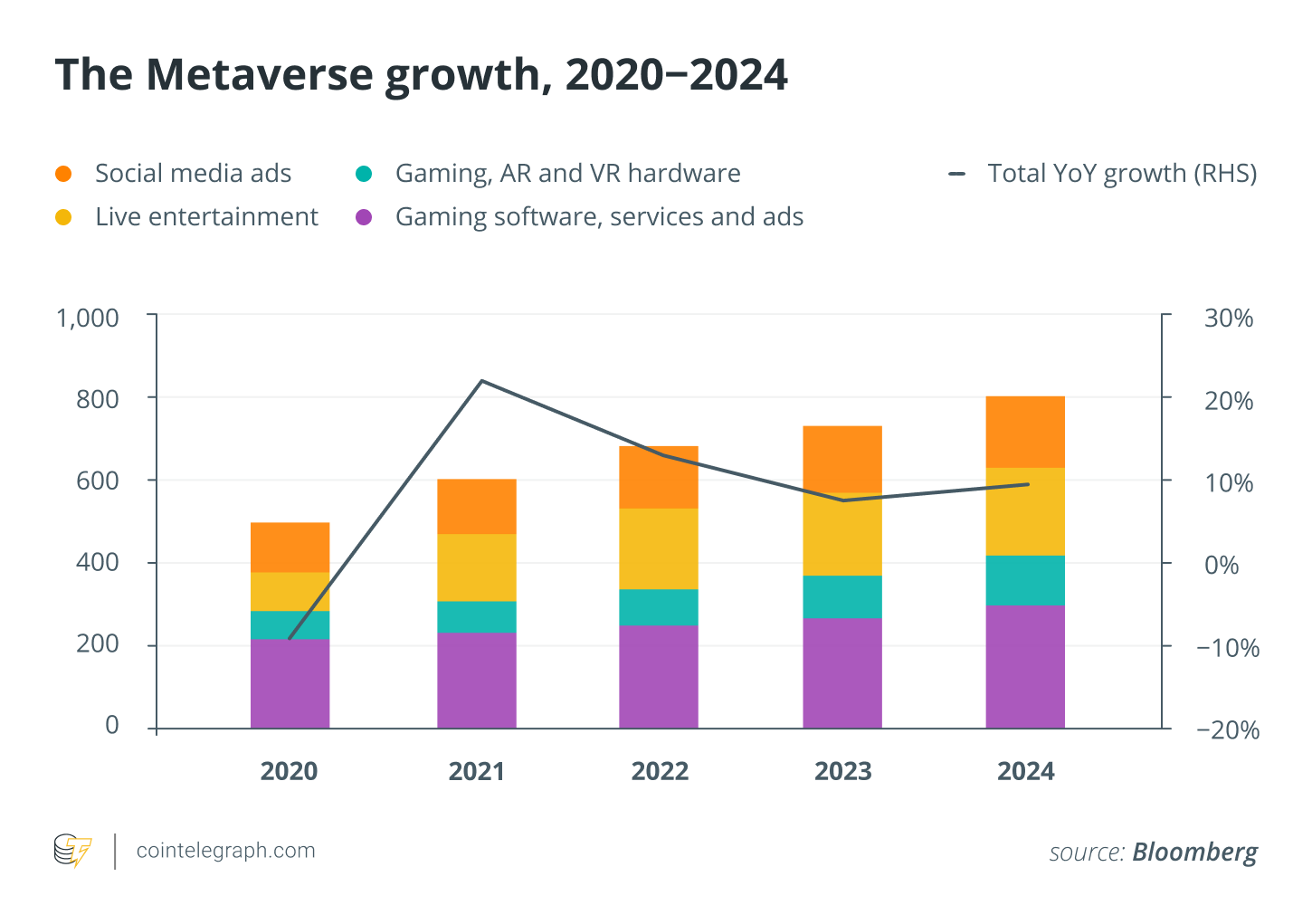

To fund the development of these technologies, Roundhill Investments, an ETF sponsor focused on innovative thematic funds, launched the Roundhill Ball Metaverse UCITS ETF on the Deutsche Börse Xetra, describing it as Germany’s first metaverse exchange-traded fund. Furthermore, Germany’s Fund Location Act allows pension funds, insurance companies, family offices and corporate investment funds to allocate up to 20% of their assets in digital assets.

Crypto adoption

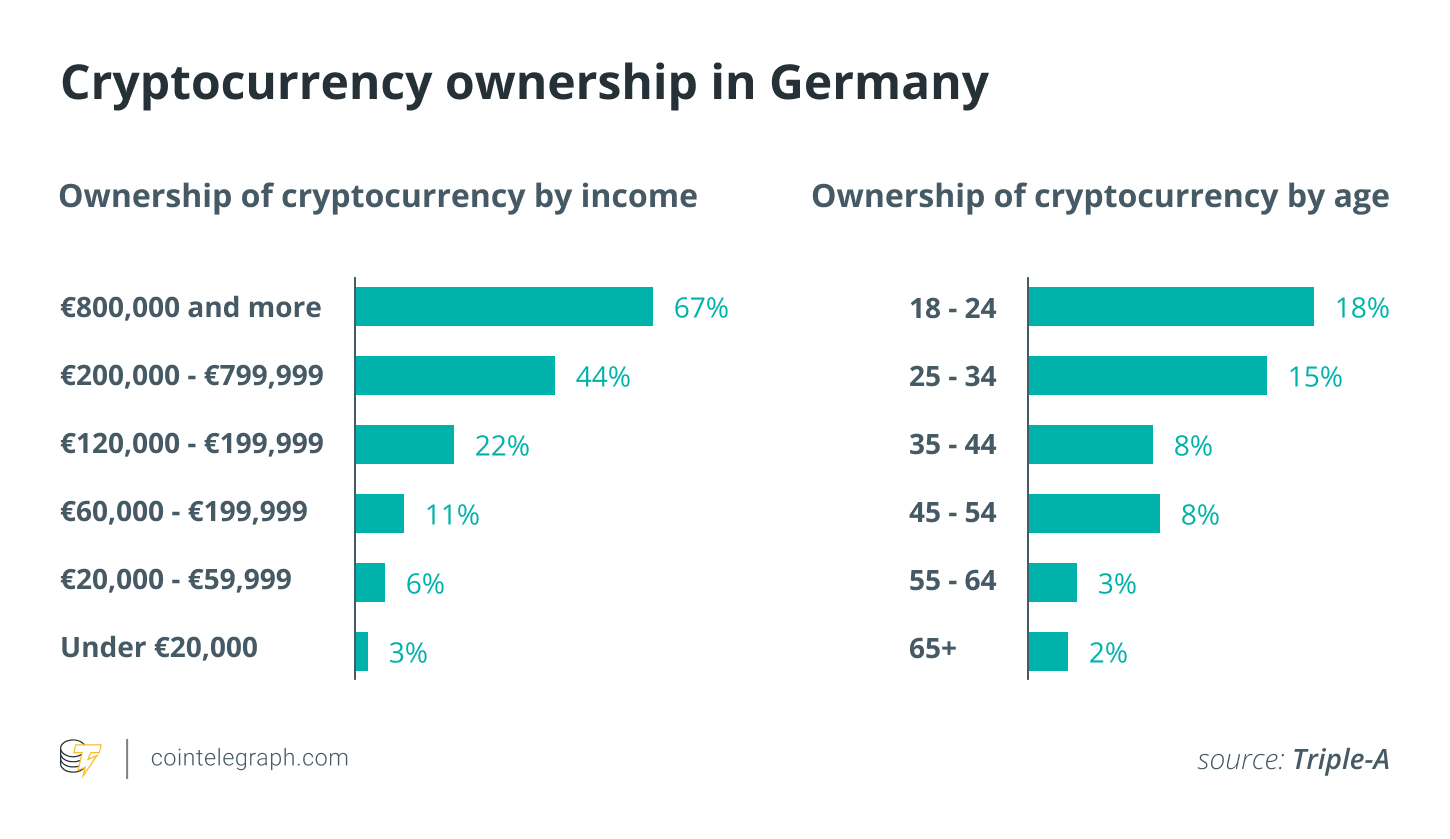

As of the end of 2021, approximately 2.6% of Germans have used cryptocurrency. And according to a recent report from KuCoin, 44% percent of Germans are motivated to invest in crypto.

German investors can get involved with crypto and blockchain via companies and platforms such as 1inch Exchange, Nuri, FinLab, Minespider, the NAGA Group, Tangany, Coindex, CryptoTax, Upvest, Fiona, Blocksize Capital, USDX Wallet, Bitbond and the Iota Foundation, or they can shop on Sugartrends using Dash. As Mark Mason, communications and business relations manager at Dash, explained to me:

German investors can get involved with crypto and blockchain via companies and platforms such as 1inch Exchange, Nuri, FinLab, Minespider, the NAGA Group, Tangany, Coindex, CryptoTax, Upvest, Fiona, Blocksize Capital, USDX Wallet, Bitbond and the Iota Foundation, or they can shop on Sugartrends using Dash. As Mark Mason, communications and business relations manager at Dash, explained to me:

“Dash is an alternative cryptocurrency that provides financial freedom without borders. It accelerates financial inclusion by allowing people to use their phones as bank accounts. It is decentralized, permissionless and censorship-resistant.”

Related: What the SEC can learn from the German regulator

Germany is among the top 10 countries for crypto mining and is home to the European Union’s largest mining company, Northern Data — which is powered almost entirely by renewable energy. Crypto mining is taxable as a business.

Startups

Numerous blockchain startups have settled in Germany’s crypto capital of Berlin, with fintech angel investor Christian Angermayer’s Apeiron Investment Group backing Berlin-based Denario and Penta, as well as Cologne-based Nextmarket and Frankfurt-based Northern Data.

Paycer, a Hamburg-based fintech startup company specializing in cryptocurrencies and decentralized finance, is developing a bridge protocol that will aggregate DeFi and cross-chain crypto services and combine them with traditional banking services.

Berlin-based fintech startup Forget Finance, on the other hand, focuses on motivating young people to save and invest in crypto using online coaching via a mix of AI bots and real financial experts.

Central bank digital currency

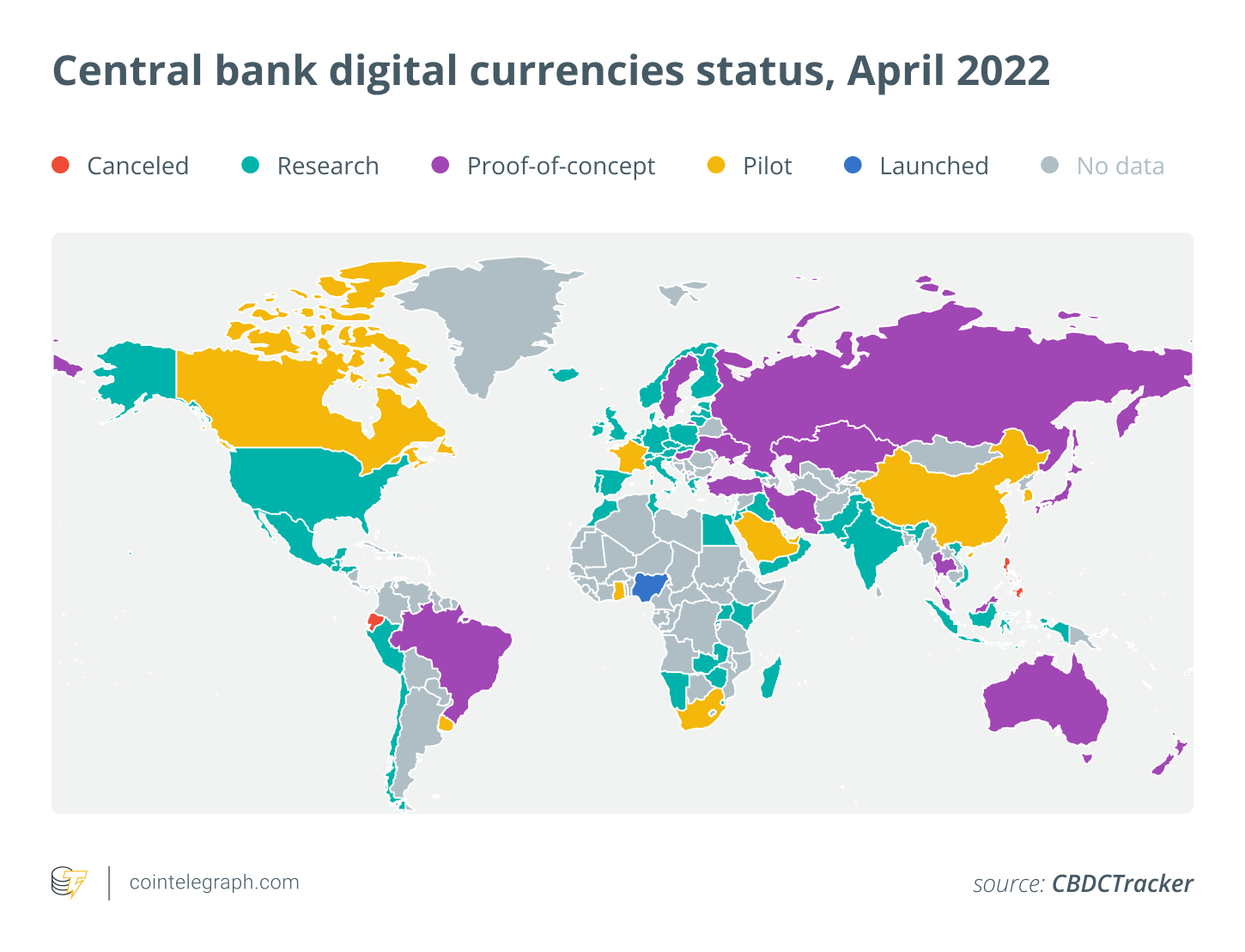

According to a survey from Deutsche Bundesbank, Germany’s central bank, the share of cash payments in point-of-sale transactions made by German consumers dropped from 74% in 2017 to 60% in 2020. Accordingly, Bundesbank has been working on distributed ledger technology asset settlements. Meanwhile, the European Central Bank is exploring creating a CBDC, dubbed the digital euro. Recent research commissioned by the ECB, based on discussions with panels of EU citizens, emphasizes security and universal acceptance as primary concerns.

Nonfungible tokens and the metaverse

Nonfungible tokens and the metaverse

The metaverse is the next wave of Web3, changing how we interact, socialize, work, play video games, fund charities, purchase and sell nonfungible tokens, and attend concerts, sports events and conferences. In 2017, the ZKM Center for Art and Media in Karlsruhe acquired a number of NFTs, well ahead of the craze of 2021, and it is now exhibiting works from its own collection and private lenders on the “ZKM Cube” — an outdoor, publicly viewable cube-shaped screen. Margit Rosen, head of the collection, archives and research department at the ZKM, shared the details with me in an interview.

Since the onset of the NFT craze, German sportswear company Adidas has teamed up with Bored Ape Yacht Club and with Prada for a charitable climate-focused NFT art project on the Polygon blockchain to raise awareness. Additionally, the German auto company Volkswagen has launched a successful interactive NFT ad campaign.

Since the onset of the NFT craze, German sportswear company Adidas has teamed up with Bored Ape Yacht Club and with Prada for a charitable climate-focused NFT art project on the Polygon blockchain to raise awareness. Additionally, the German auto company Volkswagen has launched a successful interactive NFT ad campaign.

Brian Shuster, founder and CEO of Utherverse, explained to me: “Utherverse has been building and operating an online virtual world community where one can socialize in real time, attend events and start a business, since 2005. Utherverse has combined the best of the internet, gaming and virtual reality for the ultimate metaverse experience. For example, Secret City is a game developed by Utherverse Digital Inc., with 81% of its users in Germany. Having developed more than 100 patents and pending patents for core internet technologies and the metaverse, we are the undisputed leaders of metaverse architecture and VR economics. There’s a ton of noise out there relating to the metaverse, and frankly, most companies claiming to offer properties and token coins have dangerously underestimated the complexity of the task at hand. Almost every company that’s tried to make a metaverse work has failed. The third generation of Utherverse and its utility token is expected to be unveiled in Q2 of 2022.”

Related: While men wanted, women did: Empowering female creators with NFTs and crypto

Illicit use of crypto

Germany is a member of Europol’s Joint Cybercrime Action Taskforce, which works to fight transnational cybercrime. According to a 2022 report from Europol:

“The use of this virtual currency for criminal activities and laundering of profits has grown over the past years in terms of volume and sophistication. […] The criminal use of cryptocurrency is no longer confined to cybercrime activities, but now relates to all types of crime that require the transmission of monetary value.”

After being tipped off, Germany’s Federal Criminal Police Office, or the Bundeskriminalamt, took down the servers of Hydra, the world’s largest illegal dark web marketplace. Hydra has facilitated over $5 billion in Bitcoin (BTC) transactions since launching. Germany’s move was followed by the U.S. Treasury Department issuing sanctions against Hydra in a coordinated international effort intended to “disrupt the proliferation of malicious cybercrime services, dangerous drugs, and other illegal offerings” available through the Russia-based site.

Related: The world has synchronized on Russian crypto sanctions

Gurvais Grigg, public sector chief technology officer at Chainalysis, told me: “The takedown of Hydra is notable not just because it was the largest darknet market in operation, but also because it offered money laundering services that enabled the conversion of cryptocurrency into Russian rubles.” He continued:

“Taken together with the sanctions against Garantex as well as Suex and Chatex last year, government agencies are clearly targeting cashout points that cybercriminals use for ransomware, darknet market sales, scamming and, potentially, sanctions evasion.”

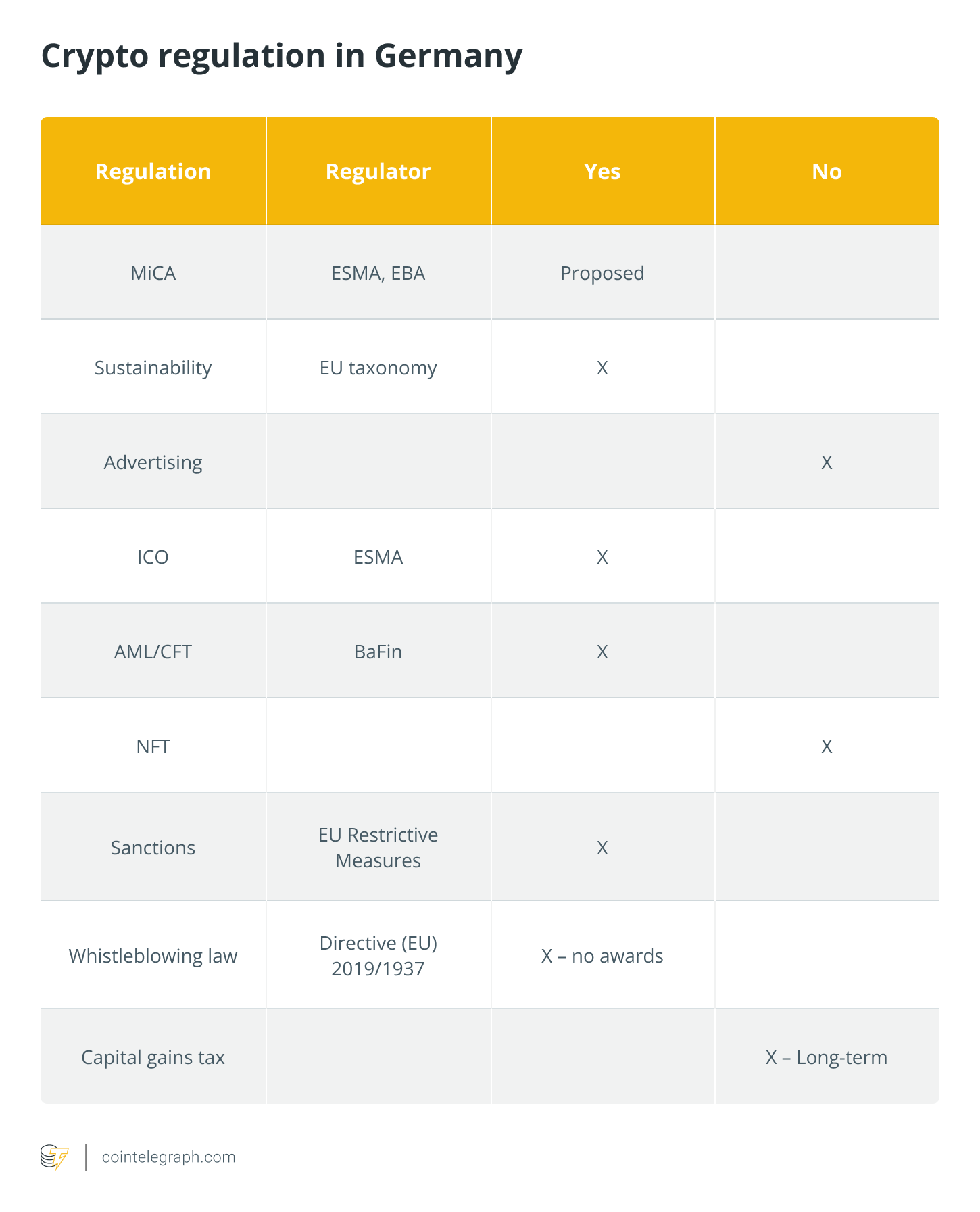

Regulation of digital assets

Germany is one of the few countries in Europe that has started to regulate cryptocurrencies ahead of the European Union’s Markets in Crypto Assets, or MiCA, regulation. According to Robin Matzke, a lawyer and blockchain expert who advised the German Bundestag, Germany’s crypto custody regulation requires those who control private keys on behalf of others and serve the German market to receive a license from the Federal Financial Supervisory Authority, regardless of whether they hold other similar licenses within the EU.

Related: European ‘MiCA’ regulation on digital assets: Where do we stand?

The EU’s new Transfer of Funds Regulation also provides disclosure rules for “unhosted” wallets, or crypto wallets not managed by a custodian or centralized exchange. Lone Fønss Schrøder, CEO of the blockchain company Concordium, explained:

“The new draft regulations require significant changes in the way current cryptocurrency transfers are made. It may be a huge challenge for the decentralized crypto solutions that hold anonymity as a core value and are committed to peer-to-peer (P2P) and self-custody. Moreover, many projects could be held back by their community from changing their solutions.”

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Selva Ozelli, Esq., CPA, is an international tax attorney and certified public accountant who frequently writes about tax, legal and accounting issues for Tax Notes, Bloomberg BNA, other publications and the OECD.

Leave A Comment