Bitcoin (BTC) investors are known for being bullish, and even during 50% corrections like the current one, most analysts remain optimistic. One reason for investors’ endless optimism and belief in infinite upside could be BTC’s decreasing issuance and the 21 million coins fixed supply limit.

However, not even the most accurate models, including the stock-to-flow (S2F) from analyst Plan B, can predict bear markets, crashes, or FOMO-induced (fear of missing out) pumps. Traders usually misinterpret these concepts as value and price expectations can be easily mistaken.

Bitcoin does not exist in a vacuum, even if BTC maximalists think so. Therefore, its price action heavily depends on how many dollars, euros, and yuans are in circulation and interest rates, real estate, equities, and commodities. Even global economic growth and inflationary expectations impact the risk appetite for people, companies, and mutual funds.

Bitcoin’s current price drivers

Regardless of what these valuation models predict, price is exclusively composed by the market participants at any given moment. Opposite to what one might expect, data from CryptoQuant shows only 2.5 million Bitcoin currently deposited on exchanges. Compare this to the 10.7 million that hasn’t been moved in the last 12 months according to ‘HODL wave’ data, and we can say that long-term holders have no say in the price.

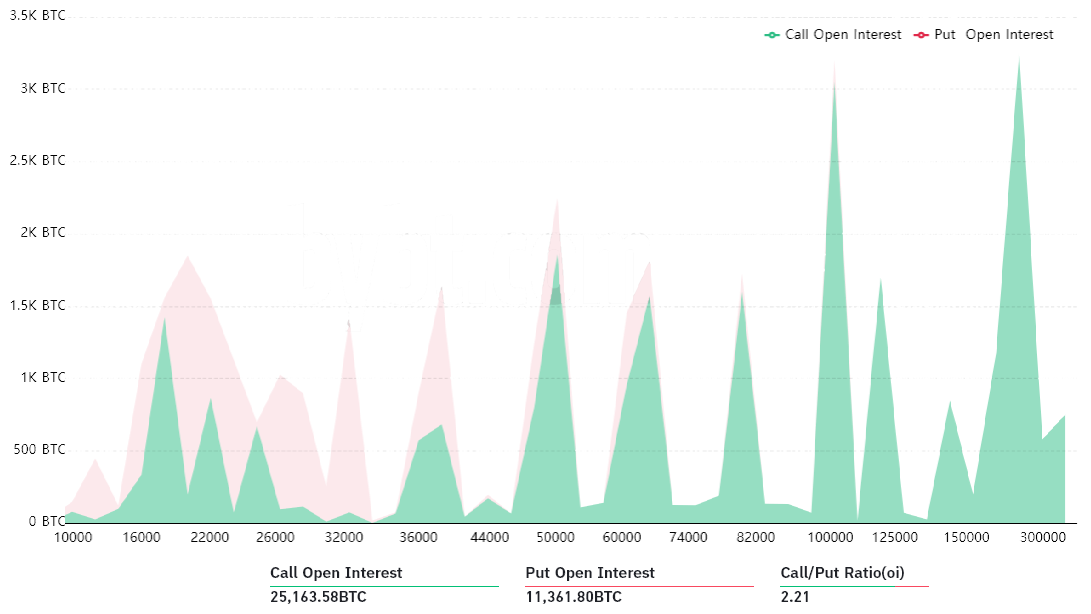

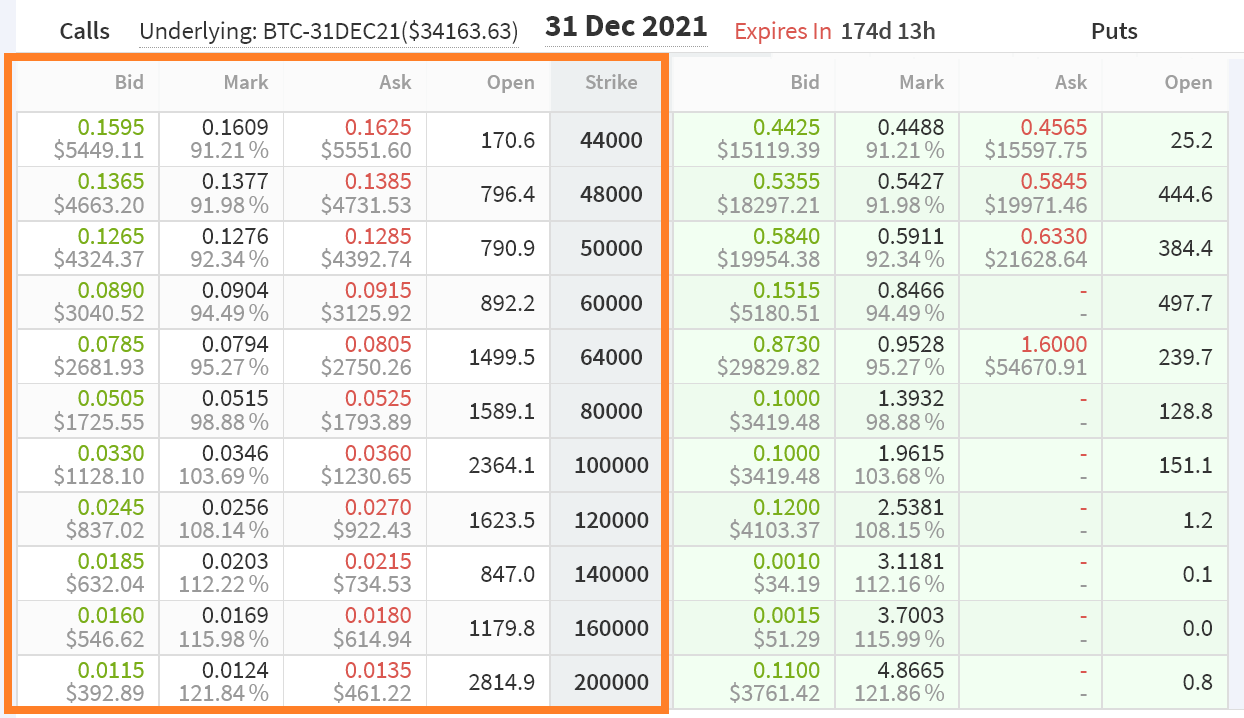

As the difference between value (subjective) and price (historical and objective) becomes more evident, it is easier to understand why some investors expect $100,000 or higher targets for the end of 2021. However, to correctly interpret what odds are being placed for those prices, one needs to analyze the calls (buy) existing in the options markets.

Cointelegraph previously explained how $100,000 to $300,000 strikes should not be taken as precise analysis-backed price estimates. Investors typically sell higher-strike calls while simultaneously buying the more costly call option with a lower strike.

In short, assuming that investors are exclusively buying the ultra-bullish call options is naive and usually wrong. However, even the option strategies involving selling those options are generally neutral-to-bullish.

$100,000 is still in play according to options markets

According to the Black & Scholes model, the current $1,185 price for the $100,000 call option has a 13% mathematical probability. It is worth noting that this methodology considers the price exclusively on Dec. 31 at 8:00 am ET and does not count the $99,999 price as a success.

Despite this, there is strong evidence that professional traders are still valuing the year-end $100,000 options. It might seem far-fetched right now, but Bitcoin’s volatility opens room for surprise, especially considering that there’s still half a year ahead.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Leave A Comment