The United States equity markets are attempting a recovery after weeks of relentless selling. Along similar lines, on-chain monitoring resource Material Indicators expects the crypto market to recover, but they anticipate Bitcoin (BTC) to spend some time in a range before “a real breakout.”

The seven-day moving average of the on-chain transaction volume tracked by Glassnode hit a nine-month low on May 23. This suggests that Bitcoin’s lackluster price action in 2022 has led to reduced participation from traders.

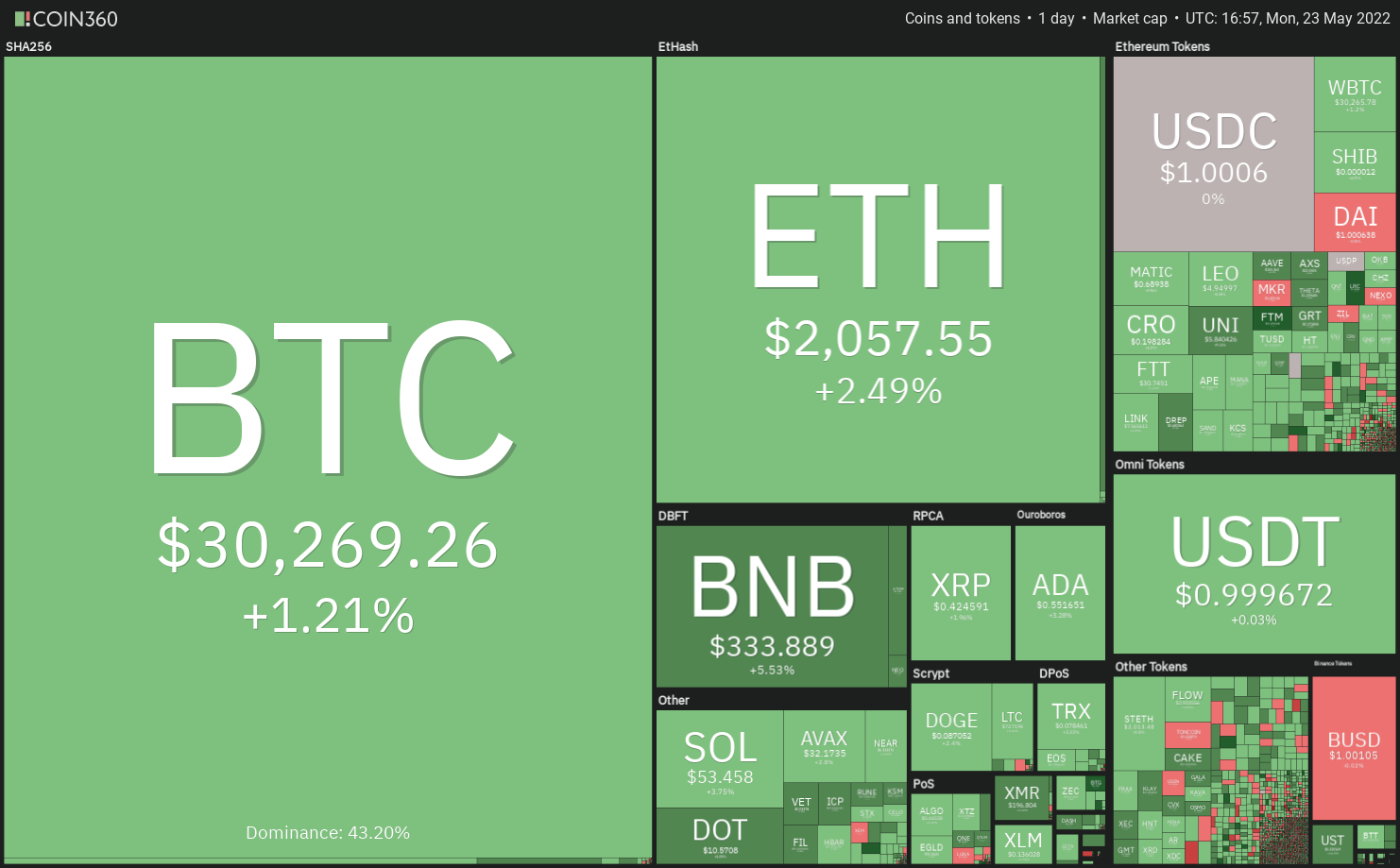

Could Bitcoin and altcoins overcome their immediate resistance levels and start a relief rally? Let’s study the charts of the top-10 cryptocurrencies to find out.

BTC/USDT

Bitcoin held the $28,630 support on May 20, indicating that bulls are buying at lower levels. The buyers have pushed the price above the downtrend line, which is the first sign of a recovery.

Alternatively, if the price turns down from the current level or the 20-day EMA, it will suggest that the sentiment remains negative and traders are selling on rallies. The bears will have to sink the price below $28,630 to clear the path for a possible retest of the crucial support at $26,700.

ETH/USDT

Ether (ETH) bounced off the uptrend line on May 21, indicating that bulls are buying the dips to this level. The buyers will now try to push the price to the overhead resistance at $2,159 where the bears may pose a strong challenge.

On the other hand, if the price turns down from the current level or the overhead resistance and breaks below the uptrend line, it will suggest that the pair may remain stuck between $2,159 and $1,700 for a few days.

BNB/USDT

The bulls have pushed Binance Coin (BNB) above the 20-day EMA ($324) which is the first sign that the downtrend may have ended.

This bullish view will be invalidated in the short term if the price turns down and breaks below $320. That would indicate selling by the bears at higher levels. The pair could then gradually drop to $286.

XRP/USDT

Ripple (XRP) is attempting a recovery after the bulls successfully defended the immediate support at $0.38 on May 19. The buyers will now try to push the price to the 20-day EMA ($0.47).

Conversely, if bulls push the price above the 20-day EMA, it could suggest a possible change in the short-term trend. The pair could then rise to the overhead zone between $0.50 and $0.55 which may act as a major obstacle.

On the downside, the bears will have to sink and sustain the price below $0.38 to open the doors for a possible retest of the May 12 intraday low at $0.33.

ADA/USDT

The bulls successfully defended the psychological level at $0.50 in the past few days, indicating demand at lower levels. The buyers will now try to push Cardano (ADA) above the 20-day EMA ($0.60).

Contrary to this assumption, if the price turns down from the 20-day EMA, it will indicate that bears continue to sell on rallies. The bears will then try to pull the price below $0.50 and retest the crucial support at $0.40.

SOL/USDT

The bulls purchased the dip to $47 on May 20 and are attempting to push Solana (SOL) toward the 20-day EMA ($61). The bears are expected to defend this level aggressively.

A break and close above the 20-day EMA will be the first indication that the bulls are back in the game. The pair could then rally to the breakdown level at $75. Alternatively, if the price turns down and breaks below $47, the pair could slide to the strong support at $37.

DOGE/USDT

Dogecoin (DOGE) is consolidating in a downtrend. The bulls defended the $0.08 support in the past few days and are attempting to push the price to the overhead resistance at $0.10.

The buyers will have to propel the price above $0.10 to suggest that the downtrend may be weakening. The pair could then rally to $0.12.

Alternatively, if the price turns down from the current level and breaks below $0.08, the pair could retest the critical support at $0.06.

Related: Monero enters ‘overbought’ danger zone after XMR price gains 75% in two weeks

DOT/USDT

The bulls are attempting to push and sustain Polkadot (DOT) above the overhead resistance at $10.37. If they succeed, the price could rally to the 20-day EMA ($11.57).

Contrary to this assumption, if the price turns down from the 20-day EMA, it will suggest that the trend remains negative and traders are selling on rallies. The bears will then try to pull the pair below $9.22 and retest the crucial support at $7.30.

AVAX/USDT

Avalanche (AVAX) rebounded off the support line of the pennant, indicating that bulls are defending this level aggressively. The buyers will now try to push the price above the pennant.

If the price turns down from the 20-day EMA but does not re-enter the pennant, it will suggest a possible change in trend. The buyers will then again attempt to clear the overhead hurdle at the 20-day EMA and push the pair toward $51.

On the contrary, if the price turns down from the current level or the 20-day EMA and breaks below the support line, it will suggest that bears are active at higher levels. The pair could then slide to $23.

SHIB/USDT

Shiba Inu (SHIB) is attempting to rise above the immediate resistance at $0.000013 but the long wick on the day’s candlestick suggests that bears are attempting to stall the rally.

If buyers propel the price above the 20-day EMA ($0.000014), the pair could attempt a rally to $0.000017. This level could again act as a stiff resistance.

Alternatively, if the price turns down and breaks below $0.000010, the pair could slide to $0.000009. This is an important level to keep an eye on because if it cracks, the next stop could be $0.000005.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.

Leave A Comment