A strong bull market tends to attract speculators and newbie traders who hop on to the rally with an aim to get rich quickly. In their eagerness to earn huge profits, traders throw caution out of the window and take on excessive leverage. While this strategy is fruitful during the asset’s up-move, sharp corrections wipe out most accounts due to the use of massive leverage.

Bitcoin’s (BTC) recent market drop below $30,000 caused the Bitcoin futures open interest to plummet from $27 billion to $11 billion. This suggests that several leveraged traders would have taken a huge hit. Although painful, these corrections reduce greed and the asset transfers from weak hands to strong hands who venture out to buy when the sentiment is negative.

Another positive sign in favor of Ether is that the Grayscale Ethereum Trust’s price is overtook at an 11% premium to Ether’s spot price, indicating strong demand from institutional investors. In comparison, the Grayscale Bitcoin Trust price still trades at a discount to Bitcoin.

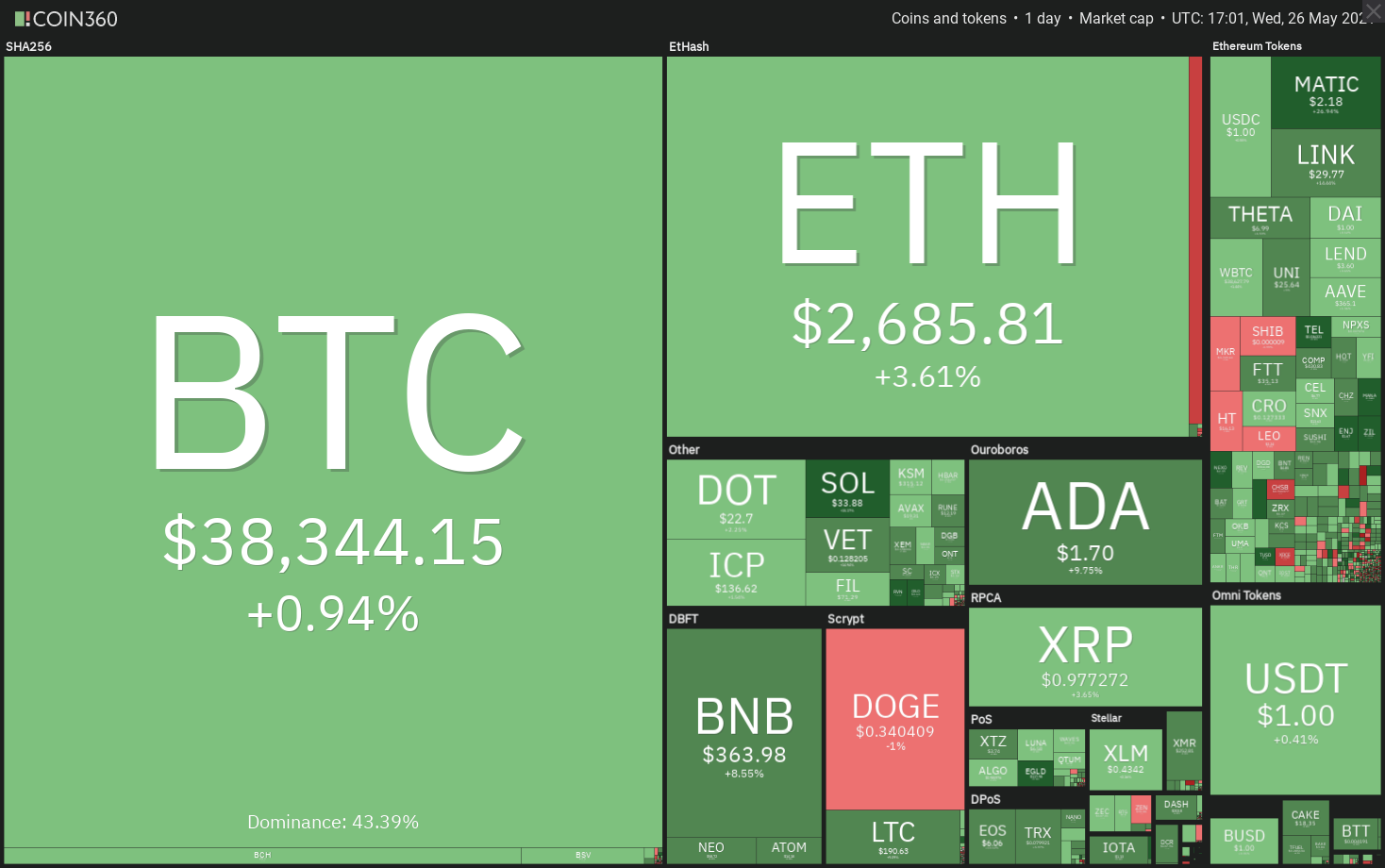

This suggests that traders should keep an eye on both Bitcoin and Ether to confirm that a bottom is in place. Let’s analyze the charts of the top-10 cryptocurrencies to spot any signs of a bottoming formation.

BTC/USDT

Bitcoin broke above the downtrend line on May 24, which suggests strong buying at lower levels. The bears tried to pull the price back below the downtrend line on May 25 but failed.

If the price turns down from the current level, the bears will try to pull the price down to $34,000. This is an important support to watch because if it cracks, the BTC/USDT pair could retest the critical support at $30,000.

On the upside, the bulls will have to push and sustain the price above the 20-day EMA to gain the upper hand. If they manage to do that, the pair could rally to $50,000.

ETH/USDT

Ether’s pullback has risen above the 38.2% Fibonacci retracement level at $2,738.74 today, indicating aggressive buying at lower levels. However, the bears are trying to stall the relief rally near the moving averages.

But if the bears sink and sustain the price below $2,000, the ETH/USDT pair could retest the critical support at $1,728.74.

Contrary to this assumption, if buyers push the price above the 20-day EMA ($2,936), the pair could rally to the 61.8% Fibonacci retracement level at $3,362.72. Such a move will indicate the short-term downtrend is over.

BNB/USDT

After hesitating near the $348.70 resistance on May 25, Binance Coin (BNB) cleared the hurdle today. This has opened the gates for a move to $428. However, the bears may not give up easily and they are likely to mount a stiff resistance between $428 and the 20-day EMA ($444).

On the contrary, if the price turns down from the overhead resistance and slips below $348.70, the pair could correct to $257.40. Such a move will suggest that bears continue to sell at higher levels and that could delay the confirmation of a bottom.

ADA/USDT

Cardano (ADA) formed a Doji candlestick pattern on May 25 as the bears defended the 20-day EMA ($1.64). The uncertainty resolved to the upside today and buyers have pushed the price above the 20-day EMA.

If the price turns down from $2, the pair could drop to $1.55. A strong rebound off this level could keep the pair range-bound between $1.55 and $2 for a few days. A wider range could develop if the bears sink the price below the 50-day SMA ($1.47).

DOGE/USDT

A tough battle is waging between the bulls and the bears near the downtrend line. Although the bulls had pushed Dogecoin (DOGE) above the downtrend line on May 25, they could not sustain the higher levels.

The gradually downsloping 20-day EMA ($0.40) and the RSI below 46 suggest the bears are in control. Contrary to this assumption, if the price turns up from the current level and rises above the 20-day EMA, the pair could rally to $0.47.

XRP/USDT

The bulls pushed XRP above the $0.88 resistance on May 24, suggesting the start of the relief rally. The bears tried to sink the price back below $0.88 on May 25 but failed. This indicates the bulls are trying to flip $0.88 to support.

If they manage to do that, the pair could retest the May 23 low at $0.65. If this support also cracks, the pair could extend the decline to $0.56.

Conversely, if the bulls successfully defend the $0.88 support during the next dip, the pair could rise above the moving averages and rally to the downtrend line. A breakout of this resistance could start the next leg of the up-move.

DOT/USDT

The bulls are attempting to push Polkadot (DOT) to the overhead resistance at $26.50. This level may act as a stiff resistance but if the bulls can scale this wall, the altcoin could rally to the 20-day EMA ($30.42).

If they succeed, the DOT/USDT pair could drop to $20 and then to $15. A bounce off this support could keep the pair range-bound between $15 and $26.50 for a few days.

A break below $15 will favor the bears while a break above $31.28 will indicate the downtrend could be over.

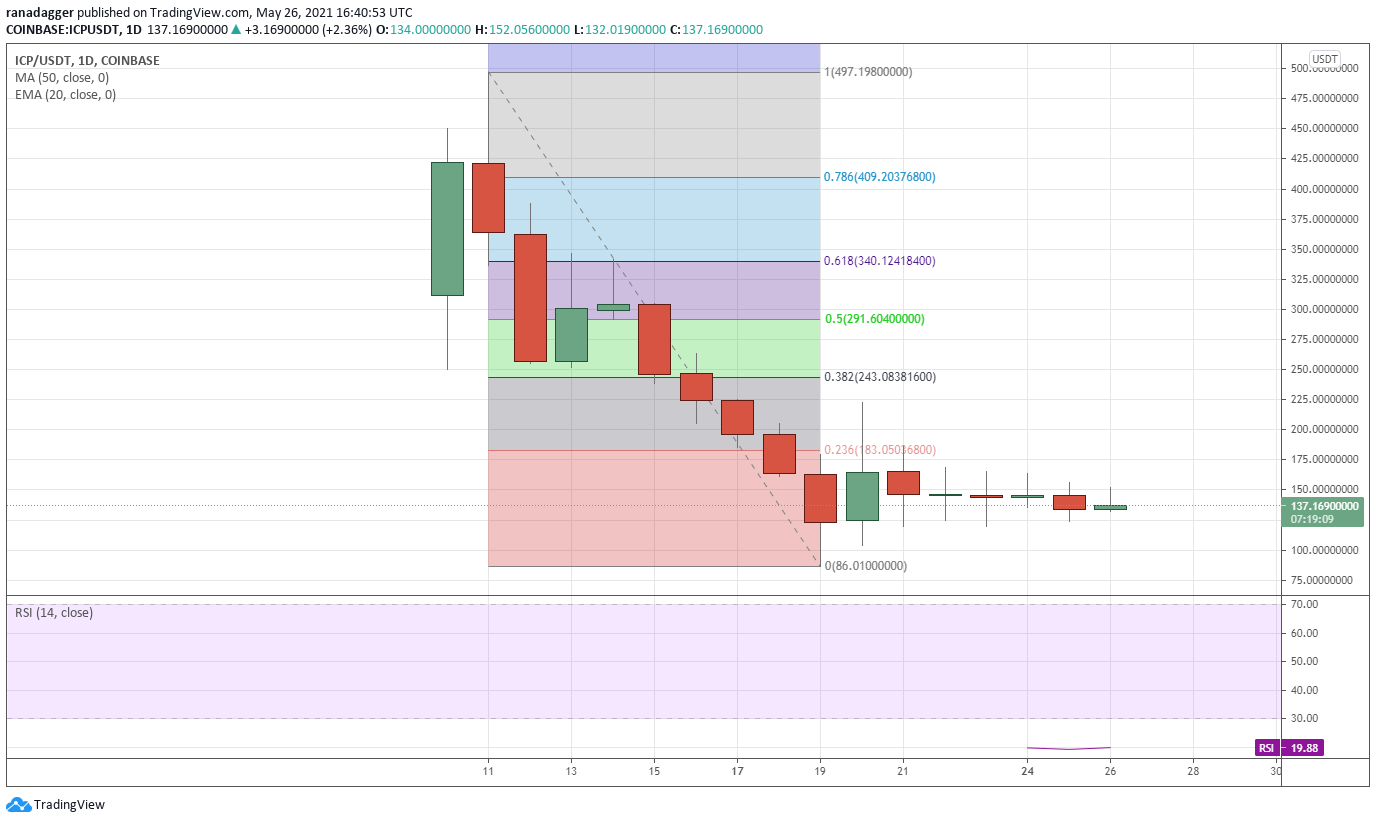

ICP/USDT

After the initial slide, Internet Computer (ICP) has been consolidating in a tight range for the past few days. This suggests indecision among the bulls and the bears about the next directional move.

Conversely, if the bulls propel the price above $168.57, the pair may rally to $186.06 and then to $222.34. A break above the 38.2% Fibonacci retracement level at $243.08 could signal that the downtrend could be over.

UNI/USDT

Uniswap (UNI) rebounded sharply on May 24, suggesting strong buying by the bulls at lower levels. The relief rally could now reach the 20-day EMA ($29.59), which is likely to act as a stiff resistance.

If that happens, the pair could rally to the 50-day SMA ($34.25). This positive view will invalidate if the bears sink the price below $21.50. The next support on the downside is $16.49 and then $13.04.

BCH/USDT

Bitcoin Cash (BCH) rose above the $685.36 resistance on May 24 and the bulls flipped the level into support on May 25, which is a positive sign. If the bulls push the price above $800, the altcoin could rally to the moving averages.

A bounce off this support will suggest the sentiment has turned positive and the traders are buying on dips. That will enhance the prospects of a break above the moving averages.

Conversely, if the bears sink the price below $685.36, the pair could drop to $538.11 and then retest the May 23 low at $468.13.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.

Leave A Comment