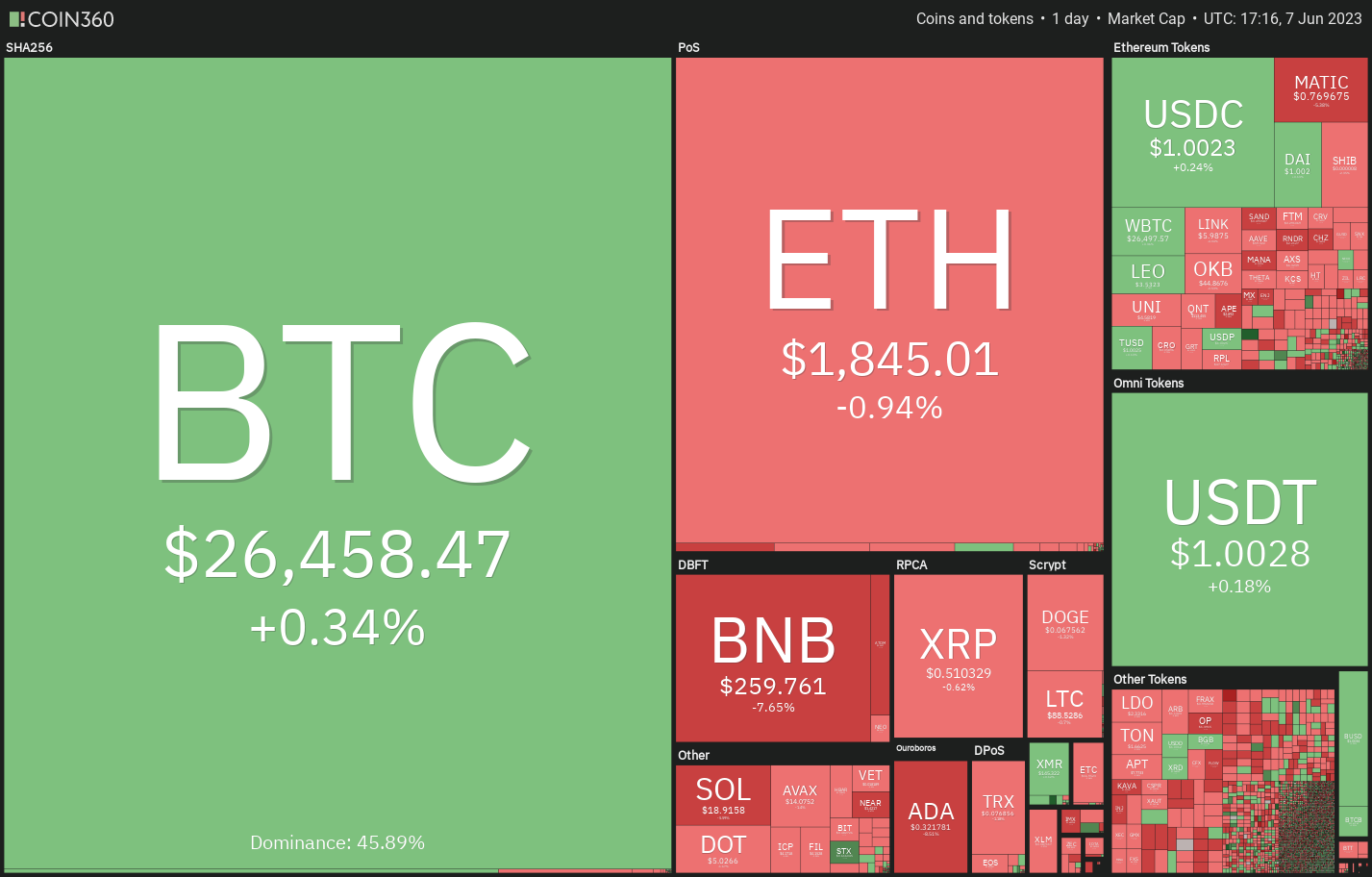

Bitcoin (BTC) and altcoins have been volatile in the past two days as the cryptocurrency markets come to terms with the actions of the United States Securities and Exchange Commission (SEC) against two of the biggest crypto exchanges, Binance and Coinbase.

After the initial knee-jerk reaction to the news and the subsequent rebound, markets are likely to enter a range as traders reflect upon the uncertainty around the lawsuits. The initial response has been encouraging as the markets have not collapsed, indicating the growing maturity of the crypto space.

What are the critical support levels to watch for on the downside? Will lower levels attract buyers? Let’s study the charts of the top-10 cryptocurrencies to find out.

Bitcoin price analysis

Bitcoin snapped back from the vital support at $25,250 on June 6, indicating that the bulls are trying to fiercely guard the level. However, the recovery is facing selling near the moving averages.

The bulls are expected to aggressively purchase the dips to the zone between $25,250 and the support line of the channel. On the upside, buyers will have to thrust the price above the resistance line of the channel to signal the end of the corrective phase. The BTC/USDT pair may then rally to $31,000.

Ether price analysis

Ether (ETH) dipped below the resistance line of the falling wedge pattern on June 5 but the bears could not build upon the strength. This shows demand at lower levels.

On the contrary, if the price rebounds off the resistance line of the wedge, it will suggest that the bulls have flipped the line into support. Buyers will have to drive the price above $1,928 to start the northward march to $2,000 and subsequently to $2,200.

BNB price analysis

BNB (BNB) plummeted sharply on June 5, which yanked the price below the strong support at $280. There was a meek attempt to start a recovery on June 6 but the bears did not allow the price to sustain above $280.

If bulls want to make a comeback, they will have to push the price back above the breakdown level of $265. If they can pull it off, the BNB/USDT pair could pull back to $280 and later to the 20-day exponential moving average ($299).

XRP price analysis

In an up-move, traders generally buy the dip to the 20-day EMA ($0.49) and they did just that in XRP (XRP) on June 5 and 6 as seen from the long tail on the candlesticks.

Meanwhile, buyers are likely to have other plans. They will try to clear the overhead hurdle and if they do that, it will indicate the start of a new uptrend. The XRP/USDT pair could rally to $0.60 and then to $0.80.

Cardano price analysis

Cardano (ADA) tumbled below the uptrend line of the ascending triangle pattern on June 5, invalidating the bullish setup.

On the upside, the first sign of strength will be a close inside the channel. Such a move will suggest that the break below the channel may have been a bear trap. The pair could attract strong buying above $0.39.

Dogecoin price analysis

Dogecoin (DOGE) broke below the immediate support at $0.07 on June 5 but rebounded sharply off the support near $0.06.

If bulls want to make a comeback, they will have to push the price back above the 20-day EMA. The DOGE/USDT pair could then attempt a rally to $0.08.

Polygon price analysis

Polygon (MATIC) slipped below the $0.82 support on June 6 but the bulls aggressively purchased the dip as seen from the long tail on the day’s candlestick.

If bears want to prevent the decline, they will have to quickly push the price back above $0.82. That may trap the aggressive bears, resulting in a short squeeze, which could push the price back toward $0.94.

Related: ARK Invest buys Coinbase shares the same day SEC serves lawsuit

Solana price analysis

Solana (SOL) rebounded off the strong support at $18.70 on June 5 and 6 as seen from the long tail on the day’s candlesticks but the bulls could not clear the hurdle at the 20-day EMA ($20.50).

Alternatively, if the price rebounds off the current level or $15.28, it will indicate demand at lower levels. The bulls will then try to drive the price above $22.30. If they succeed, the pair may climb to $24 and later attempt a rally to $27.12.

Polkadot price analysis

Polkadot (DOT) collapsed below the crucial support of $5.15 on June 5 but bounced back sharply on June 6 and rose above the breakdown level.

On the upside, the first crucial resistance to watch out for is the 20-day EMA ($5.29). A rally above this level will be the first indication that the selling pressure may be reducing. The pair may pick up momentum above $5.56.

Litecoin price analysis

Litecoin (LTC) plunged below the moving averages on June 5 and recovered sharply on June 6 but the bulls could not sustain the price above the 20-day EMA ($90). This suggests that bears are selling on rallies.

Contrarily, if the price turns up from the current level or the uptrend line, it will suggest that the pair may remain stuck inside the triangle for a while longer. The bulls will have to catapult the price above the triangle to start the next leg of the up-move.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Leave A Comment