Bitcoin (BTC) remains stuck inside a narrow range, making it difficult to predict the direction of the next possible breakout. The United States dollar index (DXY), which generally moves in inverse correlation to Bitcoin, dropped below 100 but that has failed to propel Bitcoin higher. This suggests that Bitcoin is charting its own course in the near term.

Therefore, the earnings season from big companies this week may sway the U.S. equities markets but may not have the same effect on Bitcoin. It is becoming increasingly difficult to pinpoint the event or the news flow that will cause Bitcoin’s price to escape the range.

Could the DXY stage a recovery? Will that limit the upside in Bitcoin and the major altcoins? Let’s analyze the charts to find out.

S&P 500 Index price analysis

The S&P 500 Index (SPX) is in a strong uptrend. The price has reached the resistance at 4,513, which may act as a minor hurdle. But if bulls do not give up much ground from the current levels, it will suggest that traders anticipate the rally to continue.

On the way down, the 20-day exponential moving average (4,420) is the important support to watch out for. If this support gives way, it will signal that the bulls may be booking profits. That may sink the price to the 50-day simple moving average (4,293).

U.S. dollar index price analysis

The U.S. dollar index broke below the moving averages on July 7 and continued its downward spiral. The bears yanked the price below the vital support at 100.82 on July 12, completing a bearish descending triangle pattern.

This remains the key level to watch for. If the price turns down from this level, it will suggest that the bears have flipped the previous support into resistance. That could start a downtrend which could reach 97 and then collapse toward the pattern target of 93.64.

If bulls want to prevent the decline, they will have to quickly push and maintain the price above 100.82.

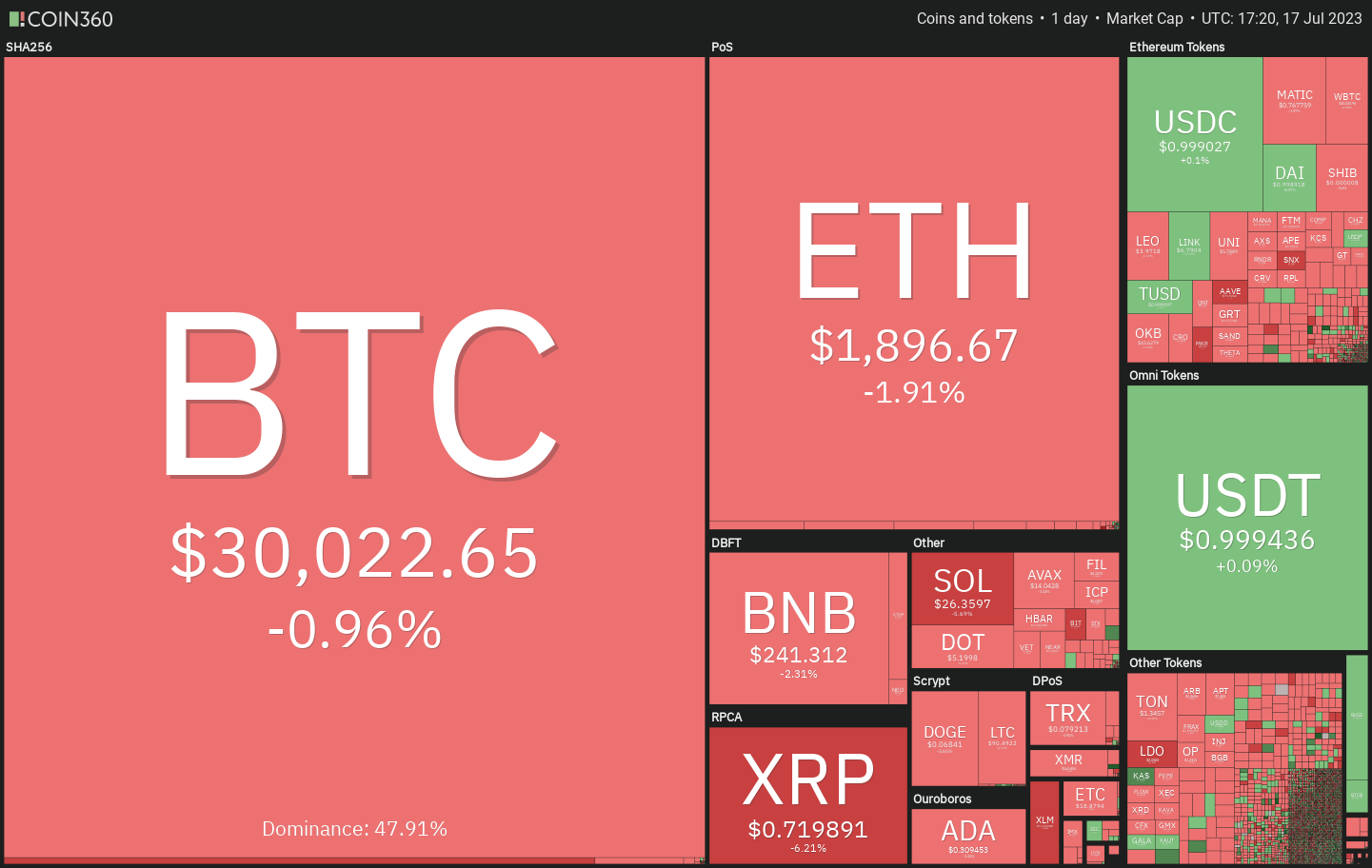

Bitcoin price analysis

Bitcoin bulls have defended the 20-day EMA ($30,173) for the past three days but a negative sign is that they have failed to start a strong bounce off it. This suggests a lack of aggressive demand at current levels.

Buyers will have to shove the price above $32,400 to signal the start of the next leg of the uptrend. The BTC/USDT pair could then surge toward $40,000. Instead, if the price tumbles below $29,500, the pair may skid to the 50-day SMA ($28,671).

Ether price analysis

Ether (ETH) is trying to maintain above the 20-day EMA ($1,897), suggesting that the lower levels are attracting buyers.

The crucial support to watch on the downside is the 50-day SMA ($1,853). If this level cracks, it will suggest that the ETH/USDT pair may remain inside the large range between $2,000 and $1,626 for some more time.

XRP price analysis

XRP (XRP) is finding support in the zone between the 50% Fibonacci retracement level of $0.69 and the 61.8% retracement level of $0.64.

Another possibility is that the price turns down from the current level and breaks below $0.64. If that happens, it will signal an urgency among the bulls to exit their positions. That could sink the pair to the 20-day EMA ($0.58).

BNB price analysis

BNB (BNB) turned down from the 50-day SMA ($253) and re-entered the symmetrical triangle pattern on July 14. This shows that the bears are fiercely defending the overhead resistance at $265.

Buyers will have to propel and maintain the price above the triangle to gain the upper hand. The momentum could pick up after the bulls kick the price above the overhead resistance at $265. Alternatively, a break below the triangle will signal that the bears are back in the driver’s seat. The pair could resume its downtrend below $220.

Solana price analysis

Solana (SOL) formed an inside-day candlestick pattern on July 15 and 16, which suggests short-term uncertainty about the next directional move.

Contrarily, if the price turns down and plunges below $26, it will suggest that the advantage has tilted in favor of the bears. The pair could first slide to $24 and thereafter to the 20-day EMA ($22.53).

Related: Bitcoin ‘full breakout’ not here yet as BTC price spends month at $30K

Cardano price analysis

Cardano’s (ADA) pullback has reached near the breakout level of $0.30. Usually, such a deep correction delays the start of the next leg of the up-move.

It is unlikely to be an easy path higher for the bulls. The bears will try to stall the recovery at $0.34 and again at $0.36. On the downside, a break and close below $0.30 could tilt the advantage in favor of the bears.

Dogecoin price analysis

Dogecoin (DOGE) is witnessing a tough battle between the bulls and the bears near the overhead resistance at $0.07.

Contrary to this assumption, if the price turns down and breaks below the moving averages, it will suggest that bears continue to sell on rallies. That could keep the DOGE/USDT pair stuck inside the $0.07 to $0.06 range for some more time.

Polygon price analysis

Usually, the price turns down and retests the breakout from a pattern and Polygon (MATIC) is doing just that. The price could drop to $0.72.

This positive view will be invalidated if the price continues lower and plummets below the uptrend line. The pair could then slump to $0.60.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Leave A Comment