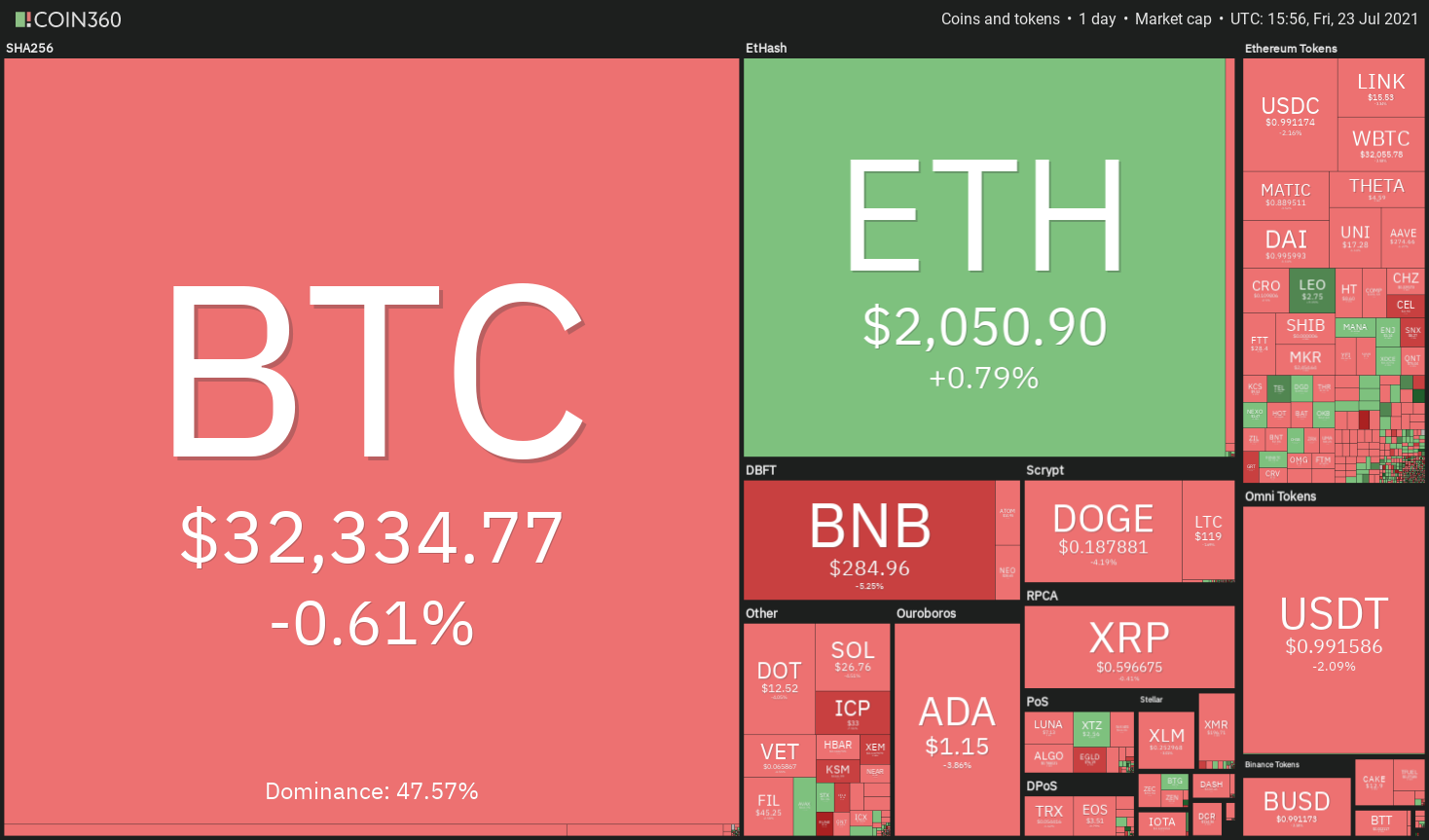

Bitcoin’s (BTC) recovery is facing resistance near $32,500, suggesting that the ride higher may not be an easy one. However, a positive sign is that demand for cryptocurrencies remains strong and lower levels continue to attract buyers.

A survey of 150 family office clients of Goldman Sachs shows that 15% have already invested in crypto-assets and 45% want to take the plunge. The family offices manage more than $6 trillion in assets, meaning, even a small percentage of inflow from this sector could eventually boost crypto prices.

JPMorgan Chase may soon allow its retail wealth clients to invest in cryptocurrencies. The bank’s advisers may not be allowed to recommend crypto to their clients but they can execute trades requested by them.

All this shows that investor interest in the crypto sector continues to increase. Could this result in a sustained recovery? Let’s study the charts of the top-10 cryptocurrencies to find out.

BTC/USDT

Bitcoin is witnessing a tough battle between the bulls and the bears near the 20-day exponential moving average ($32,569). The bulls did not give up much ground on July 22, which is a positive sign.

This level may attract selling from the bears but if bulls can overcome the resistance and push the price above it, the relief rally could rise to $36,670.

Contrary to this assumption, if the price turns down from the 20-day EMA or the 50-day SMA, the bears will again try to sink the pair to $28,000. If they succeed, the pair could witness panic selling, clearing the path for a possible drop to $20,000.

ETH/USDT

Ether’s (ETH) bounce off the critical support at $1,728.74 rose above the 20-day EMA ($2,014) on July 22. This suggests that bears may be losing their grip. The 20-day EMA has flattened out and the RSI has risen to the midpoint, indicating that bulls are attempting to make a comeback.

Conversely, if bulls drive the price above the 50-day SMA, the ETH/USDT pair could rally to the downtrend line. A breakout and close above this resistance will signal a possible change in trend. The pair may pick up momentum on a break above $3,000.

BNB/USDT

The bears are attempting to stall the relief rally in Binance Coin (BNB) near the downtrend line but a minor positive is that bulls have not given up much ground. The altcoin formed an inside day candlestick pattern on July 22, indicating indecision among bulls and bears.

On the other hand, if the price turns down from the current level, the bears will try to pull the price down to $251.41. A break below this support will suggest that bears have absorbed the demand and the pair could then drop to the critical support at $211.70.

ADA/USDT

Cardano’s (ADA) rebound off $1 is struggling to rise and sustain above $1.19. This indicates the bears have not given up and are attempting to stall the recovery at this level.

A breakout and close above the 20-day EMA ($1.23) will clear the path for a possible rally to the downtrend line.

The pair will turn negative and start a new downtrend if bears sink and sustain the price below $1. The next support to watch on the downside is $0.80 and then $0.68.

XRP/USDT

XRP’s rebound off the critical support at $0.50 has reached the 20-day EMA ($0.61). This may prove to be a difficult hurdle for the bulls to cross as the altcoin has not closed above the 20-day EMA since May 18.

Contrary to this assumption, if bulls drive the price above the 20-day EMA, the pair could rally to the 50-day SMA ($0.70) and then to $0.75. A breakout and close above this level will suggest the start of a move back toward the downtrend line of the descending channel.

DOGE/USDT

Dogecoin (DOGE) formed an inside day candlestick pattern on July 22, indicating indecision among the bulls and the bears. The sellers are aggressively defending the overhead resistance at $0.21 but the bulls are not giving up much ground.

Alternatively, if the bulls fail to clear the hurdle at $0.21, the DOGE/USDT pair could again drop to $0.15. If the support holds, the pair may extend its stay between $0.15 and $0.21 for a few more days.

A breakdown and close below $0.15 will signal the resumption of the downtrend. The next support on the downside is $0.10.

DOT/USDT

The bulls pushed Polkadot (DOT) above the breakdown level at $13 on July 22 but they are facing stiff resistance at the 20-day EMA ($13.78). If the price turns down from this resistance, it will suggest that the sentiment remains negative.

Contrary to this assumption, if bulls drive the price above the 20-day EMA, it will suggest that bears are losing their grip. That could result in a move to the overhead resistance at $16.93. A breakout and close above this level could start a sustained relief rally to $20 and then to $26.50.

UNI/USDT

Uniswap’s (UNI) rebound has risen to the 20-day EMA ($17.85) where the bears may mount a stiff resistance. If the price turns down from this level, it will suggest that the sentiment remains negative.

Conversely, if bulls drive the price above the 20-day EMA, the UNI/USDT pair could reach the downtrend line. A breakout and close above this resistance will invalidate the bearish setup. That could start an up-move to $25 and then $30.

Related: Axie Infinity refreshes record high as AXS ascends 131% in just 3 days

BCH/USDT

The rebound in Bitcoin Cash (BCH) has reached the 20-day EMA ($461), which has acted as a stiff resistance in the past few days. The bears will again try to stall the relief rally at this resistance.

On the other hand, if bulls drive the price above the 20-day EMA, the pair could rally to the stiff overhead resistance at $538.11. If the price turns down from this level, the pair could remain stuck between the large range of $370 to $538.11 for the next few days.

LTC/USDT

Litecoin (LTC) rose above the $118 level on July 22, suggesting aggressive buying at lower levels. The bulls will now try to extend the relief rally and push the price back above the 20-day EMA ($126).

Contrary to this assumption, if the price turns down from the 20-day EMA once again, it will indicate that the sentiment remains negative. The bears will then make one more attempt to extend the down move. A break below $100 could open the doors for a fall to $70.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.

Leave A Comment