Bitcoin (BTC) continues to frustrate investors with its tight range consolidation, giving no clue about the possible direction of the breakout. Typically, the longer the range, the stronger the eventual breakout from it. Therefore, traders should be on their toes to latch on to the breakout when it happens.

A minor positive in favor of the bulls is that they are holding on to a large part of the gains seen in 2023. That indicates a lack of urgency among the bulls to book profits as they anticipate the uptrend to resume.

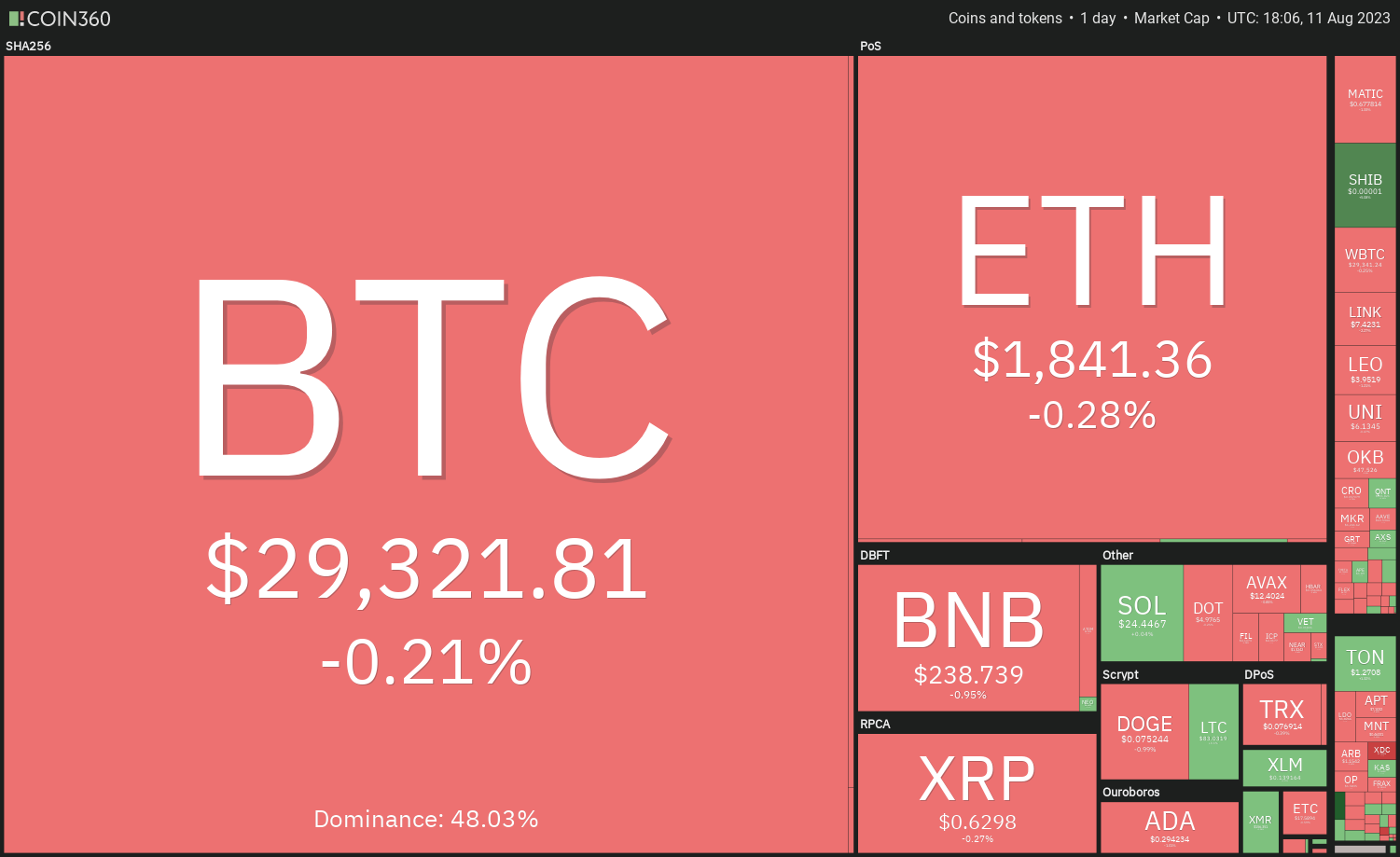

Do Bitcoin and the select altcoins show any signs of a potential breakout from their respective ranges? Let’s study the charts of the top-10 cryptocurrencies to find out.

Bitcoin price analysis

The bulls pushed Bitcoin above the 50-day simple moving average ($29,960) on Aug. 8 and 9 but could not sustain the higher levels. This suggests that the bears are selling on rallies.

When the price is stuck in a range, it is difficult to predict the direction of the breakout. However, traders should be ready for the start of a trending move soon.

If the price plunges below $28,585, the pair may descend to $26,000 and then to $24,800. Conversely, a break and close above $30,350 could propel the pair to $32,400. This is likely to be the final hurdle before the pair reaches $40,000.

Ether price analysis

Ether (ETH) has been trading between the 50-day SMA ($1,879) and the horizontal support at $1,816 for the past few days. This suggests uncertainty between the bulls and the bears about the next directional move.

On the contrary, if the price turns up and breaks above the 50-day SMA, it could open the gates for a rally to the psychological resistance at $2,000.

BNB price analysis

The failure to push BNB (BNB) above the resistance line of the triangle may have attracted selling. That has pulled the price below the moving averages.

If the price rebounds off the support line, the pair may spend some more time inside the triangle. Buyers will have to shove the price above the resistance line to clear the path for a potential rally to $265.

XRP price analysis

XRP (XRP) turned down from the 20-day EMA ($0.65) on Aug. 9, indicating that the bears are trying to flip the level into resistance.

Another possibility is that the price bounces off the 50-day SMA. If that happens, the pair may spend some more time oscillating between the moving averages. A break and close above $0.67 will be the first sign of strength. That could open the doors for a possible rally to $0.73.

Dogecoin price analysis

Dogecoin (DOGE) continues to trade inside the ascending channel pattern but the bulls are finding it difficult to overcome the barrier at the downtrend line.

Another possibility is that the price turns up from the 20-day EMA. If that happens, the likelihood of a rally above the downtrend line increases. That could start an up-move to $0.08 and next to the resistance line of the channel.

Cardano price analysis

Cardano’s (ADA) recovery attempt hit a wall at the 20-day EMA ($0.30) which suggests that the bears have not yet given up and are selling on rallies.

Contrarily, if the price turns down and breaks below $0.28, it will suggest that bears have the upper hand. The pair could then slump to $0.26 and eventually to the vital support at $0.24. The bulls are expected to guard this level with vigor.

Solana price analysis

Solana (SOL) has been trading above the 20-day EMA ($23.87) for the past three days, indicating that the price is stuck between $26 and $22.30.

The level to be wary of on the downside is $22.30. If this support cracks, it will suggest that the bulls may be rushing to the exit. That may start a fall to $18.

Related: Bitcoin trader reveals ‘important’ BTC price zone as bulls hold $29.3K

Polygon price analysis

The bulls failed to thrust Polygon (MATIC) above the 50-day SMA ($0.70) in the past two days but a positive sign is that they have not given up much ground.

Contrary to this assumption, if the price turns down sharply from the current level, the pair may retest the strong support at $0.64. If this level gives way, the pair may start a decline to the next support at $0.60.

Litecoin price analysis

Litecoin (LTC) is struggling to start a bounce off the strong support at $81.36, suggesting a lack of demand at higher levels.

Alternatively, the first important resistance to watch on the upside is the 20-day EMA. If buyers propel the price above $87.37, it will suggest the start of a stronger recovery to $96.46. This level may again attract strong selling by the bears.

Polkadot price analysis

Polkadot (DOT) has been trading near the $5 level for the past few days. Attempts by the bulls to push the price above the 20-day EMA ($5.08) on Aug. 9 met with stiff opposition from the bears.

On the other hand, if the price turns up from the current level and breaks above the moving averages, it will signal a comeback by the bulls. The pair could then move up to $5.33 and eventually to the downtrend line.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Leave A Comment