When the markets are trending, traders should be active if they want to earn money. On the other hand, in a ranging market, it is better to wait on the sidelines with patience or traders may lose money due to choppy random moves in either direction.

Bitcoin’s (BTC) sideways price action since the sharp fall on Aug. 17 shows that the bulls and the bears are unsure about the next directional move. Therefore, it is better to wait for the breakout to happen before waging large bets.

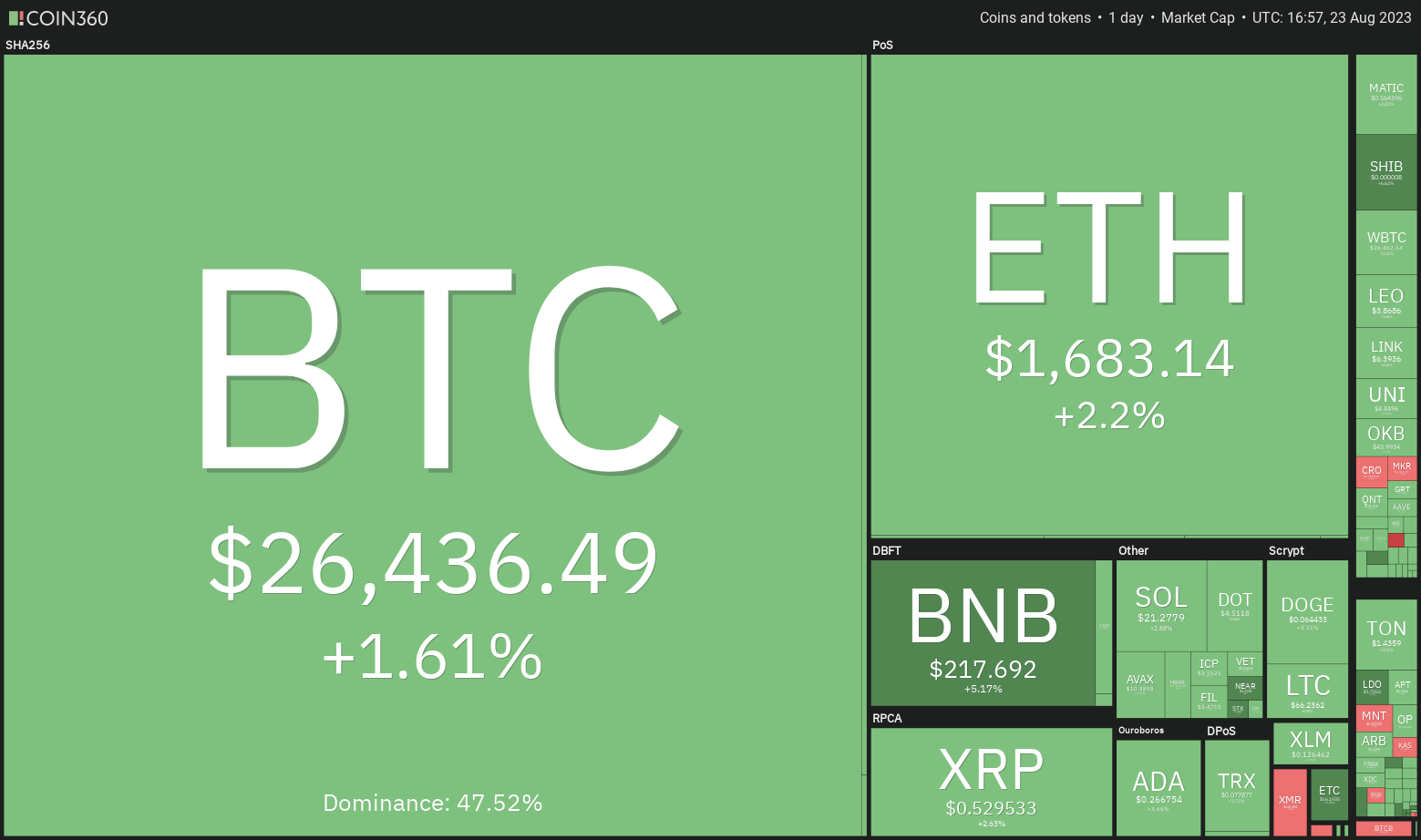

What are the important support and resistance levels that need to be crossed for a trending move to start in Bitcoin and altcoins? Let’s study the charts of the top-10 cryptocurrencies to find out.

Bitcoin price analysis

The long tail on Bitcoin’s Aug. 22 candlestick is a positive sign as it shows that the bulls are fiercely trying to protect the support at $24,800.

Although the downsloping 20-day EMA indicates advantage to bears, the oversold levels on the relative strength index (RSI) point to a possible recovery in the near term.

The bears will have to sink and sustain the price below $24,800 to further strengthen their hold. That could open the doors for a potential drop to $20,000.

Ether price analysis

Ether (ETH) once again dipped below the strong support at $1,626 but the long tail on the candlestick shows solid buying at lower levels.

If the price turns down from this level, the bears will again try to yank the pair below the $1,626 to $1,550 support zone. If they succeed, the index could start a downward move toward $1,368.

Contrarily, a break above the 20-day EMA will enhance the prospects of the pair remaining inside the $2,000 to $1,626 range for a few more days.

BNB price analysis

BNB (BNB) bounced off the psychological support at $200 on Aug. 17, indicating that the bulls are trying to arrest the decline at this level.

Instead, if the price rises above the 20-day EMA, it will suggest that the bears are losing their grip. The pair may then rise to the resistance line, which is an important level for the bears to defend.

XRP price analysis

XRP (XRP) turned down from the overhead resistance at $0.56 but a minor positive is that the bulls have not allowed the price to skid below $0.50.

If the price breaks below $0.50, the pair could start its descent toward the next major support at $0.41. That could indicate a range-bound action between $0.41 and $0.50.

Alternatively, if buyers thrust the price above the 20-day EMA, it will suggest that bulls are on a comeback. The pair may then rise to the 50-day SMA ($0.63).

Cardano price analysis

The long tail on Cardano’s (ADA) Aug. 22 candlestick shows strong demand at lower levels. The price is currently stuck inside the range between $0.24 and $0.28.

This negative view could invalidate in the near term if buyers propel the price above $0.28. If they do that, the pair may start a relief rally to the 50-day SMA ($0.29) and thereafter to $0.32.

Solana price analysis

Solana (SOL) plunged below the immediate support at $20 on Aug. 22 but the bulls purchased the dip, indicating demand at lower levels.

Contrary to this assumption, if the price turns down from the current level or the 20-day EMA, it will signal that the bears have not given up. That will increase the likelihood of a break below $19.35. If that happens, the pair may drop to $18 and eventually to $16.

Dogecoin price analysis

Dogecoin (DOGE) rebounded off the support at $0.06 on Aug. 21 and 22, indicating that the bulls are buying the dips to this level.

Buyers will have to kick the price above the moving averages to start a rally to the next major resistance above $0.08. On the downside, a break and close below $0.06 could signal the start of a downward move to $0.05.

Related: Here’s what the latest Bitcoin price correction reveals

Polkadot price analysis

The bears tried to tug Polkadot (DOT) below the vital support at $4.22 but the bulls held their ground as seen from the long tail on the Aug. 22 candlestick.

Meanwhile, the bears are likely to have other plans. They will try to sell on minor rallies and pull the price below $4.22. If they succeed, the DOT/USDT pair could start the next leg of the downtrend. The next support is at $4.

Polygon price analysis

Polygon (MATIC) snapped back from $0.53 on Aug. 22, indicating that the bulls are trying to keep the price above the crucial support at $0.51.

A break and close below $0.50 will signal the resumption of the downtrend. The pair could then tumble to $0.45 and later to $0.42. On the contrary, a rally above $0.60 could set up a rally to $0.65 and then to $0.69.

Shiba Inu price analysis

Shiba Inu (SHIB) fell below the 50-day SMA ($0.0000084) on Aug. 20 but the bulls did not allow the price to retest the important support at $0.0000072.

Conversely, if the price turns down from the moving averages, it will suggest that the bears remain in control. The pair could then collapse to the strong support at $0.0000072 and subsequently to $0.0000064.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Leave A Comment