Bitcoin (BTC) led the cryptocurrency markets higher on Aug. 29 following Grayscale’s victory in the lawsuit against the United States Securities and Exchange Commission. However, the rally could not be sustained as analysts cautioned that the victory did not guarantee the approval of a spot Bitcoin exchange-traded fund.

Still, the victory may prove to be bullish for Grayscale. Glassnode analysts said in a X (formerly Twitter) post on Aug. 30 that the Grayscale Bitcoin Trust (GBTC) could return to premium next year. It is important to note that GBTC has been trading at a discount to spot Bitcoin price for the past two-and-a-half years.

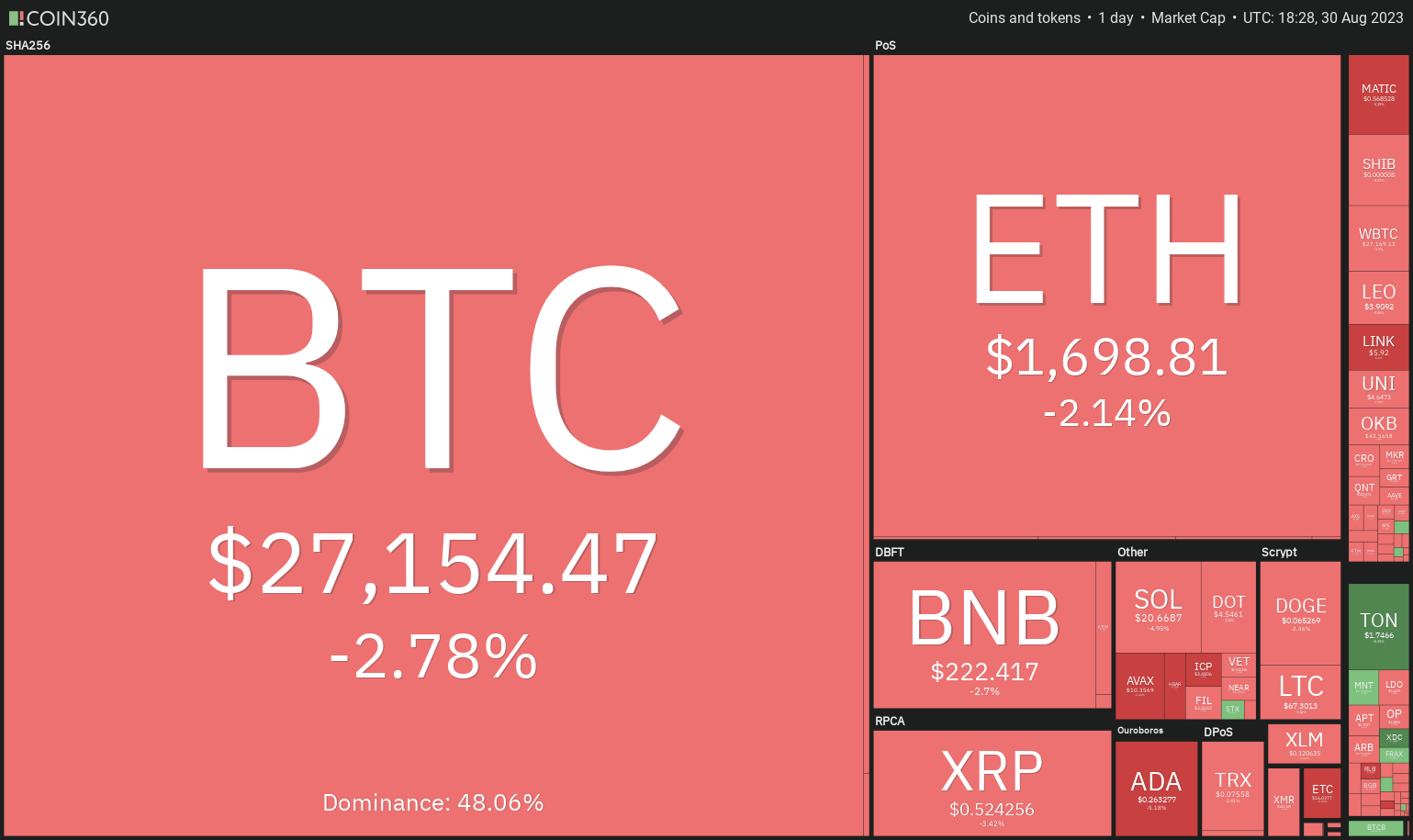

Could bulls defend the support levels in Bitcoin and altcoins? Will that lead to a stronger recovery soon? Let’s study the charts of the top-10 cryptocurrencies to find out.

Bitcoin price analysis

Bitcoin’s range resolved to the upside with a sharp breakout on Aug. 29. This move indicates that the price is likely to oscillate inside the large range between $24,800 and $31,000 for a few days.

Buyers will try to defend the breakout level of $26,833. If they succeed, it will signal that the bulls have flipped the level into support. The BTC/USDT pair may first rise to the 50-day simple moving average ($28,689) and thereafter attempt a rally to $31,000.

If bears want to trap the aggressive bulls, they will have to pull the price below $26,833. If they do that, it will indicate that the bears are selling on every recovery attempt. The pair could then retest the strong support at $24,800.

Ether price analysis

Ether (ETH) once again rebounded off the crucial support at $1,626 on Aug. 28, indicating that the bulls are buying the dips.

The price has turned back below the 20-day EMA on Aug. 30, signaling that bears have not yet given up. If the price maintains below the 20-day EMA, the pair could tumble to $1,626. Contrarily, if the price turns up and climbs back above the 20-day EMA, the pair may reach the overhead resistance at $1,816.

BNB price analysis

After a tight range trading near $220 for a few days, BNB (BNB) surged higher on Aug.29. The relief rally is facing resistance at the 50-day SMA ($235) as seen from the long wick on the day’s candlestick.

On the downside, if the price slides below $220, it will indicate that the bears remain in control. The pair could then slump to the Aug. 22 intraday low of $203.

XRP price analysis

XRP (XRP) has been trading between $0.50 and $0.56 for the past few days. This suggests that the bulls are buying near the support and the bears are selling close to the resistance.

Alternatively, if the price rebounds off $0.50, the pair may extend its stay inside the tight range for some more time. Buyers will have to shove and sustain the price above $0.56 to signal the start of a sustained recovery. The pair may then rise to the 50-day SMA ($0.64).

Cardano price analysis

The bulls pushed Cardano (ADA) above $0.28 on Aug. 29 but they could not sustain the higher levels. That kept the price below the resistance at $0.28.

Instead, if the price dives below the uptrend line, it will signal that the bears are trying to make a comeback. The pair could then skid to the vital support at $0.24.

Dogecoin price analysis

Dogecoin (DOGE) reached the 20-day EMA ($0.07) on Aug. 29 but the bulls are struggling to sustain the price above it.

Alternatively, if the pair does not give up much ground from the current level, it will suggest that the bulls are maintaining their buying pressure. That could open the gates for a potential rally to $0.08.

Solana price analysis

Solana’s (SOL) recovery hit a roadblock at the 20-day EMA ($21.77) on Aug. 29 indicating that the sentiment remains negative and traders are selling on rallies.

The bulls are likely to have other plans. They will try to build upon the recovery by pushing the price above the overhead resistance at $22.30. If they can pull it off, the pair may rise to the 50-day SMA ($23.59). If the price turns down from this level, the pair may remain range-bound between the 50-day SMA and $19.35 for some time.

Related: Why is Dogecoin price up today?

Toncoin price analysis

Toncoin (TON) soared above the neckline of the inverse head and shoulders pattern at $1.53 on Aug. 29. This signals a potential trend change.

If the bears want to prevent the rally, they will have to quickly sink the price back below $1.53. Such a move could trap the aggressive bulls, resulting in a long liquidation. The pair may then slump to $1.25.

Polkadot price analysis

Polkadot (DOT) broke and closed above the 20-day EMA ($4.64) on Aug. 29 but the long wick on the candlestick shows selling at higher levels.

If the price breaks below $4.50, the DOT/USDT pair may swing between the 20-day EMA and $4.22 for some time. On the other hand, a break and close above the 20-day EMA could propel the pair to the overhead resistance at $5.

Polygon price analysis

Polygon (MATIC) is facing stiff resistance in the zone between $0.60 and $0.65 as seen from the long wick on the Aug. 29 candlestick.

If bears want to seize control, they will have to drag the price below $0.51. That could resume the downtrend with the next support at $0.45. On the upside, a break and close above the 50-day SMA ($0.67) could signal that the bulls are in the driver’s seat.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Leave A Comment