Nonfarm payrolls rose by 315,000 jobs in August, down from the July increase of 526,000 jobs. The report was just below the Dow Jones estimate of 318,000 jobs and the slowest monthly gain since April 2021. The S&P 500 rose in response to the report, but later erased its gains, indicating that bears continue to sell on rallies.

That may be because the U.S. dollar index (DXY), which had retreated from its Sept.1 20-year high, recovered part of its losses. The bears will have to pull the DXY lower to boost prices of stocks and the cryptocurrency markets as both are usually inversely correlated with the dollar index.

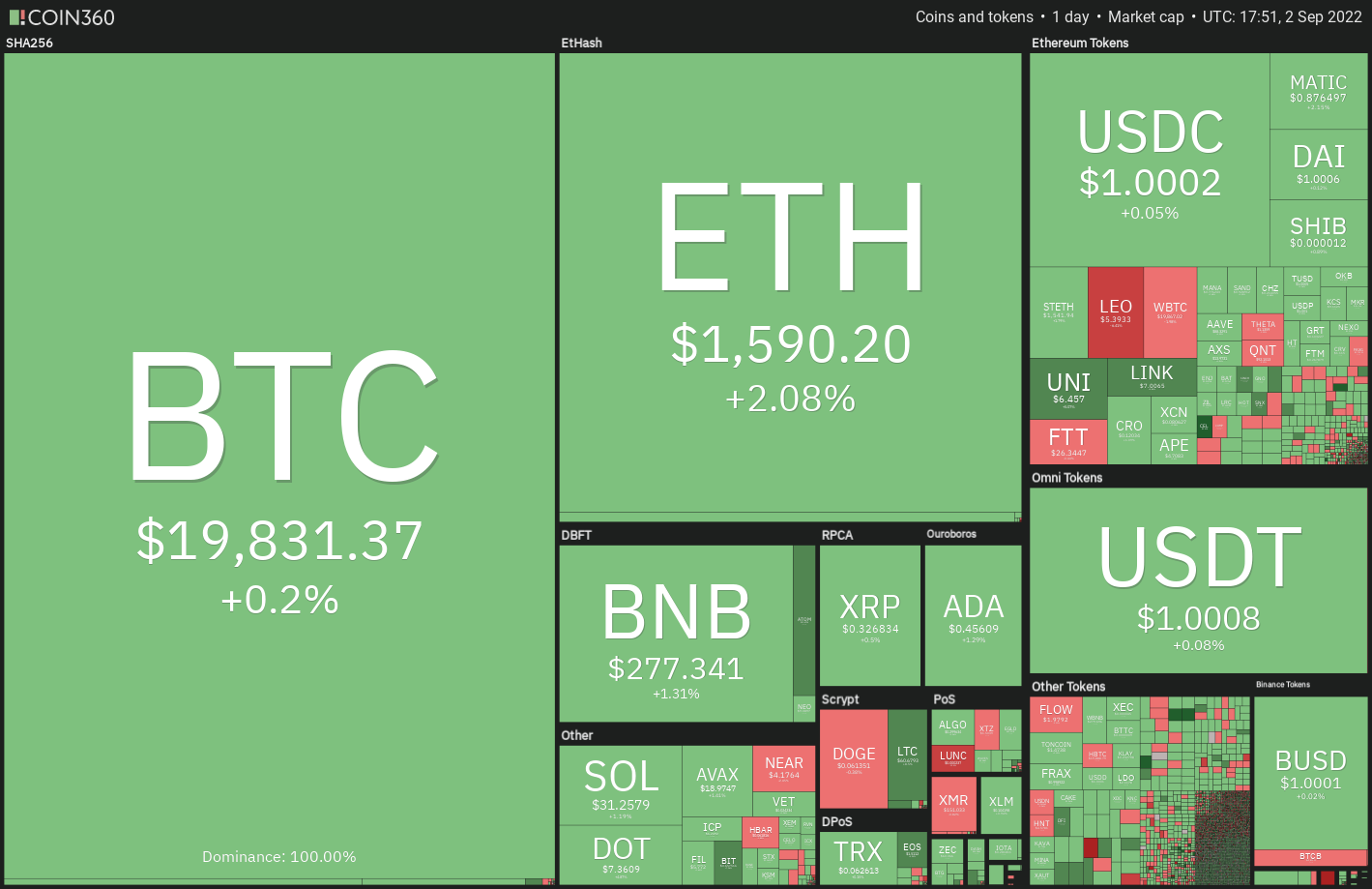

Could bulls push Bitcoin and altcoins above the overhead resistance levels? Let’s study the charts of the top-10 cryptocurrencies to find out.

BTC/USDT

Bitcoin broke and closed above the downtrend line on Sept. 1, which is the first indication that the short-term corrective phase could be ending.

This is an important level to watch out for because if buyers clear this hurdle, it will suggest that the negative sentiment could be weakening. The BTC/USDT pair could then attempt a rally to the 50-day simple moving average ($22,318).

Contrary to this assumption, if the price turns down from $20,576 or the 20-day EMA, the bears will make one more attempt to sink the pair to the critical support zone of $18,910 to $18,626. The bulls are expected to defend this zone aggressively.

ETH/USDT

Ether (ETH) turned down from the 20-day EMA ($1,61) on Aug. 31 but a positive sign is that the bulls did not allow the price to dip below the neckline of the head and shoulders (H&S) pattern.

Alternatively, if the price turns down from the overhead zone, the pair could again drop to the neckline. If this support breaks down, the pair could drop to $1,422 and then to $1,280. Although the pattern target of a breakdown from the H&S setup is $1,050, the bulls are likely to defend the support at $1,280 vigorously.

BNB/USDT

Binance Coin (BNB) turned down from the 20-day EMA ($289) on Aug. 31 and slipped below the strong support at $275 on Sept. 1. However, the long tail on the day’s candlestick shows aggressive buying at lower levels.

Conversely, if the price turns down from the current level or the 20-day EMA, it will suggest that the sentiment remains negative and bears are selling on minor rallies.

That will increase the possibility of a break below the support at $275. If that happens, the pair will complete a bearish H&S pattern. The pair could then slide to $240 and later to the pattern target at $212.

XRP/USDT

XRP has been trading between $0.32 and $0.34 since Aug. 28. This tight range trading indicates indecision among the bulls and the bears.

This negative view could invalidate in the near term if bulls drive the price above the 20-day EMA. The pair could then rise to the 50-day SMA ($0.36). Such a move will suggest that the pair may continue to consolidate between $0.30 and $0.39 for some more time.

ADA/USDT

Cardano (ADA) has been trading close to the 20-day EMA ($0.47) for the past three days but the bulls have failed to push the price above it. This suggests that the bears are defending the 20-day EMA but a minor positive is that the bulls have not given up much ground.

Contrary to this assumption, if the price breaks above the 20-day EMA, the pair could rise to the 50-day SMA ($0.49). The bulls will have to overcome this barrier to clear the path for a possible rally to the downtrend line.

SOL/USDT

Solana (SOL) has been stuck in a tight range between $30 and $33 since Aug. 27 which indicates indecision among buyers and sellers.

Alternatively, if the price turns up from the current level and breaks above the 20-day EMA, the pair could rise to the 50-day SMA ($39). Such a move could suggest that the pair may remain stuck between $30 and $48 for a few more days.

DOGE/USDT

Dogecoin (DOGE) once again bounced off the strong support at $0.06 on Sept. 1 but the rebound lacks strength. This suggests the absence of aggressive buying at these levels.

This negative view will invalidate in the short-term if bulls drive the price above the moving averages. If that happens, the pair could attempt a rally to the overhead resistance at $0.09.

Related: CEL climbs 50% as Celsius Network aims to return $50M to clients

DOT/USDT

Polkadot (DOT) had been stuck inside a tight range between $7.38 and $6.79 for the past few days, indicating indecision among the bulls and the bears.

Conversely, if the price turns down from the overhead zone, it will suggest that the sentiment remains negative and traders are selling on rallies. The bears will have to sink the price below $6.79 to gain the upper hand. The pair could then decline to the crucial support at $6.

MATIC/USDT

Polygon (MATIC) broke and closed above the moving averages on Sept. 1. This opens the doors for a possible rally to the overhead resistance at $1.05. The bears are likely to defend this level aggressively.

The 20-day EMA ($0.84) is flat but the RSI has jumped into the positive territory, indicating that the momentum favors the buyers. If bulls thrust the price above $1.05, the pair could extend its up-move to $1.19.

Conversely, if the price turns down and breaks below the 20-day EMA, the pair could again drop to $0.75. A break below this support could sink the pair to $0.63.

SHIB/USDT

Shiba Inu (SHIB) turned down from the 20-day EMA ($0.000013) on Aug. 30 and dropped to the important support at $0.000012. This suggests that bears are active at higher levels.

If bulls drive the price above the 20-day EMA, the SHIB/USDT pair could rally to the overhead resistance at $0.000014. This level may again act as a stiff hurdle but if bulls overcome it, the rally could extend to $0.000018.

Conversely, if the price once again turns down from the moving averages and breaks below $0.000012, the pair could decline to $0.000010.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.

Leave A Comment