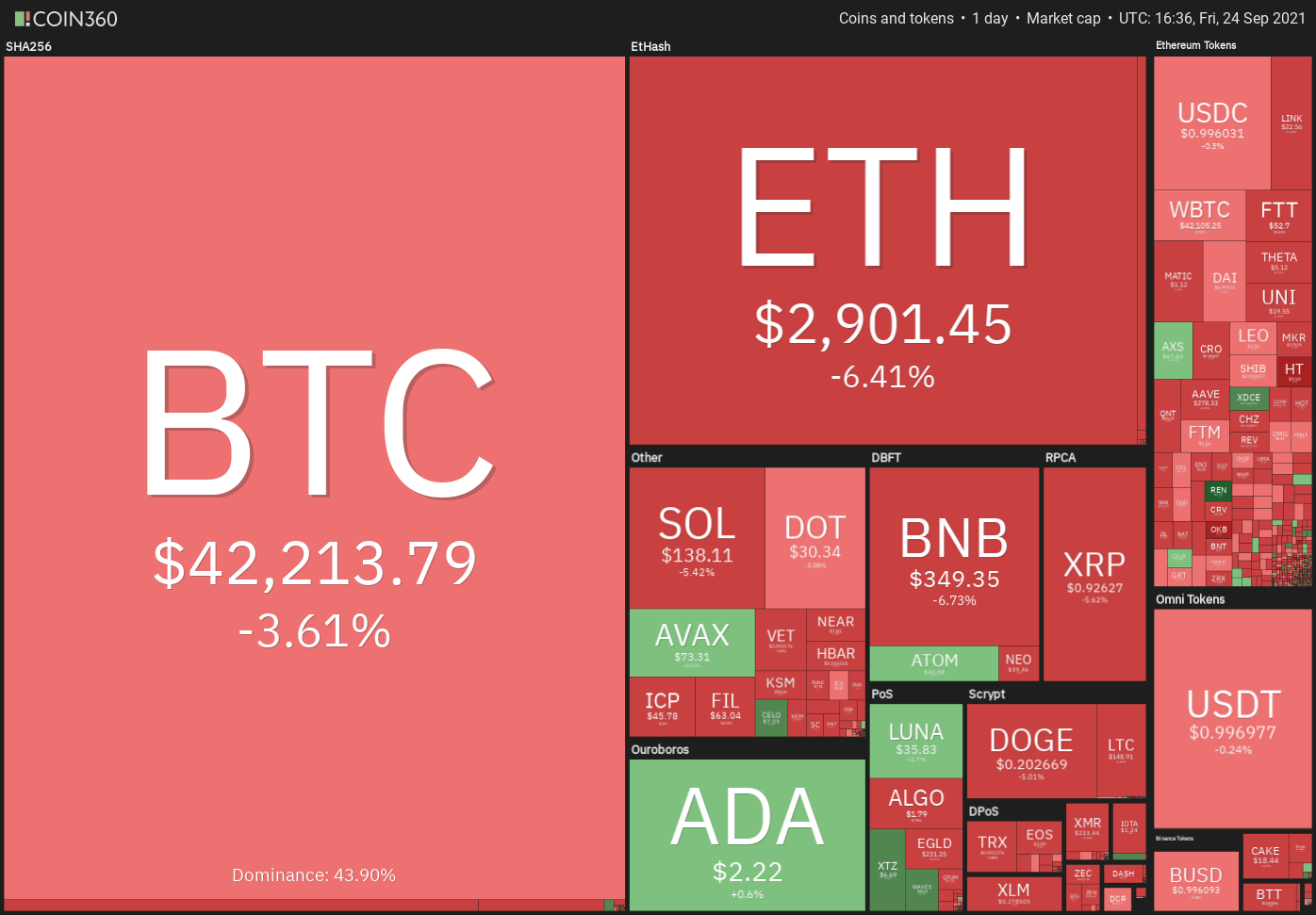

The crypto market’s recovery was rocked on Sept. 24 after news that China’s government is adopting a new set of measures that includes stronger inter-departmental coordination to “cut off payment channels, dispose of relevant websites and mobile applications” to crack down on illegal cryptocurrency transactions efficiently.

Although the news has caused a selloff, long-term investors are unlikely to be perturbed because, apart from announcing additional measures to enforce the existing ban effectively, there is nothing else that has changed.

Is the current correction in Bitcoin and most major altcoins a good buying opportunity or could the crypto markets tumble further? Let’s analyze the charts of the top-10 cryptocurrencies to find out.

BTC/USDT

Bitcoin bounced off the 100-day simple moving average ($40,874) and rose above the neckline of the head and shoulders pattern on Sept. 22. That showed strong demand at lower levels but the recovery could not clear the hurdle at the 20-day exponential moving average ($45,596).

This level may act as a strong support but if it cracks, the next stop could be at the pattern target at $32,423.05.

Contrary to this assumption, if the price turns up from the current level or the 100-day SMA, the bulls will again try to drive the pair above the moving averages. A close above the 50-day SMA ($46,816) will suggest that the correction may be over.

ETH/USDT

Ether (ETH) rebounded off the 100-day SMA ($2,734) on Sept. 22 and rose above the breakdown level at $3,000. This shows that bulls bought the dip and tried to trap the aggressive bears.

If the index breaks and closes below the 100-day SMA, the ETH/USDT pair could witness aggressive selling. The pair could then drop towards the pattern target at $1,972.12. This negative view will invalidate if bulls drive and sustain the price above the moving averages.

ADA/USDT

Cardano’s (ADA) strong rebound off the $1.94 level hit a roadblock at the 20-day EMA ($2.36). This suggests that sentiment remains negative and traders are selling on rallies to the 20-day EMA.

Alternatively, if the price rises from the current level or rebounds off $1.94, the bulls will again attempt to clear the overhead hurdle. A break and close above the 20-day EMA will be the first sign that the correction may be over. The pair could then rally to $2.60 and then $2.80.

BNB/USDT

Binance Coin’s (BNB) rebound off the strong support at $340 turned down from $385.30 today, indicating strong selling by traders at higher levels.

Contrary to this assumption, if the price rebounds off the current level, the bulls will make one more attempt to push the price above the moving averages. A break and close above $433 will signal that the correction may have ended.

XRP/USDT

XRP bounced off the 100-day SMA ($0.87) on Sept. 22 but the bulls could not extend the recovery. The altcoin formed a Doji candlestick pattern on Sept. 23, indicating indecision among the bulls and the bears.

This level may act as a strong support but if bears sink the price below it, the next stop could be $0.50. This negative view will be negated if the price rebounds off the 100-day SMA and rises above the $1.07 to $1.13 resistance zone.

SOL/USDT

Solana (SOL) bounced and rose above the 20-day EMA ($145) on Sept. 22 but the bulls could not push the price above the downtrend line. This suggests that bears are selling on rallies.

If the price rebounds off it, the bulls will again try to thrust and sustain the price above the downtrend line. If they can pull it off, the pair could rise to $170 and then to $200.

Conversely, if the 50-day SMA cracks, the pair could witness panic selling and the price could then drop to the 78.6% Fibonacci retracement level at $98.26.

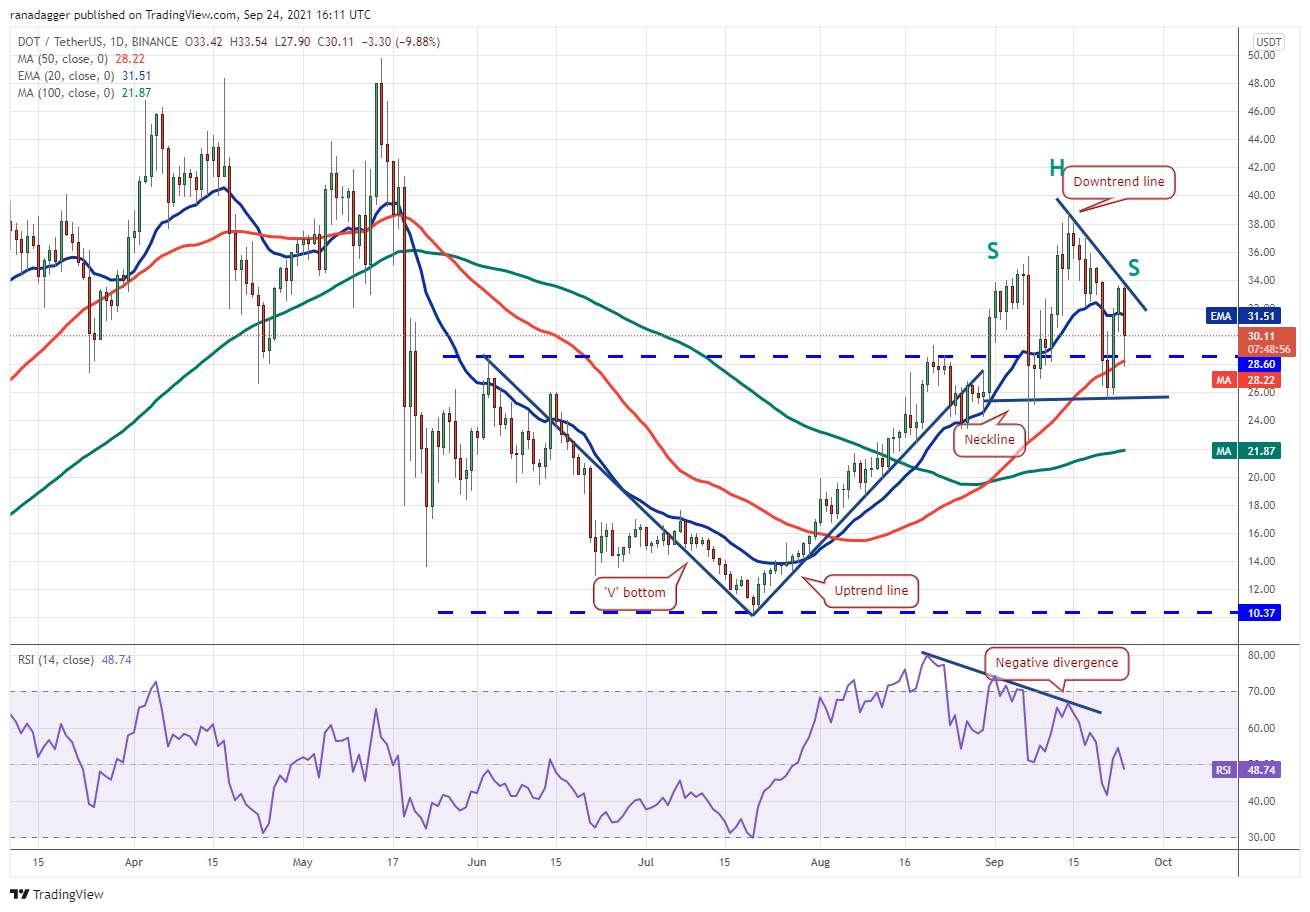

DOT/USDT

Polkadot’s (DOT) rebound off $25.50 stalled at $33.60. This suggests that bears are selling at higher levels. The bears are attempting to pull the price below the breakout level at $28.60. If they manage to do that, a retest of $25.50 is likely.

Contrary to this assumption, if the price rebounds off the current level or the neckline, the bulls will make one more attempt to resume the up-move. A break and close above $33.60 could open the doors for a retest at $38.77.

Related: Bitcoin hits $45K, TWTR stock price rises 3.8% after BTC tipping comes to Twitter

DOGE/USDT

The bulls pushed Dogecoin (DOGE) above $0.21 on Sept. 22 but the recovery failed to attract buyers at higher levels. After forming an inside-day candlestick pattern on Sept. 23, the price has dropped below $0.21 today.

This level has held on three previous occasions, hence the bulls will again try to defend it. On the other hand, if bears sink the price below $0.15, the selling may intensify and the pair could plummet to $0.10.

AVAX/USDT

Avalanche (AVAX) rebounded off the 20-day EMA ($60.15) on Sept. 21 and rose to a new all-time high on Sept. 23. However, the bulls could not thrust the price above the resistance line of the ascending channel, which may have resulted in profit-booking by short-term traders.

On the other hand, a break and close below the channel will be the first sign that the bulls may be losing their grip. If bears pull the price below the 20-day EMA, the pair could plummet to $48 and then to the 50-day SMA ($43.06).

LUNA/USDT

The bulls successfully defended the retest of the breakout level in Terra protocol’s LUNA token on Sept. 21. This suggested that sentiment remained positive and traders viewed the dips as a buying opportunity.

If bears pull and sustain the price below the 20-day EMA, the LUNA/USDT pair could again drop to the critical support at $22.40. This is an important level to watch out for because if it cracks, the selling could intensify and the pair may drop to $18.

On the upside, if bulls drive the price above $40, the pair could retest the all-time high at $45.01. A breakout and close above this level could signal the resumption of the uptrend.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.

Leave A Comment