One of the main narratives of hope for cryptocurrency investors is that there will be a major shift in public perception that sparks a new wave of capital from retail and institutional traders.

Unfortunately for these hopeful bulls, data indicates that they opposite has occurred for nearly a year, a fact evidenced by the declining rate of searches for the term Bitcoin (BTC) on Google.

Further evidence for the declining interest in cryptocurrencies can be found when looking at the total exchange trade volumes on major exchanges. According to data from Blockchain.com, this metric was at $165.8 billion on April 19, its lowest level since October 2020.

Related: Coinbase announces beta of NFT marketplace with social engagement

NFTs heat up

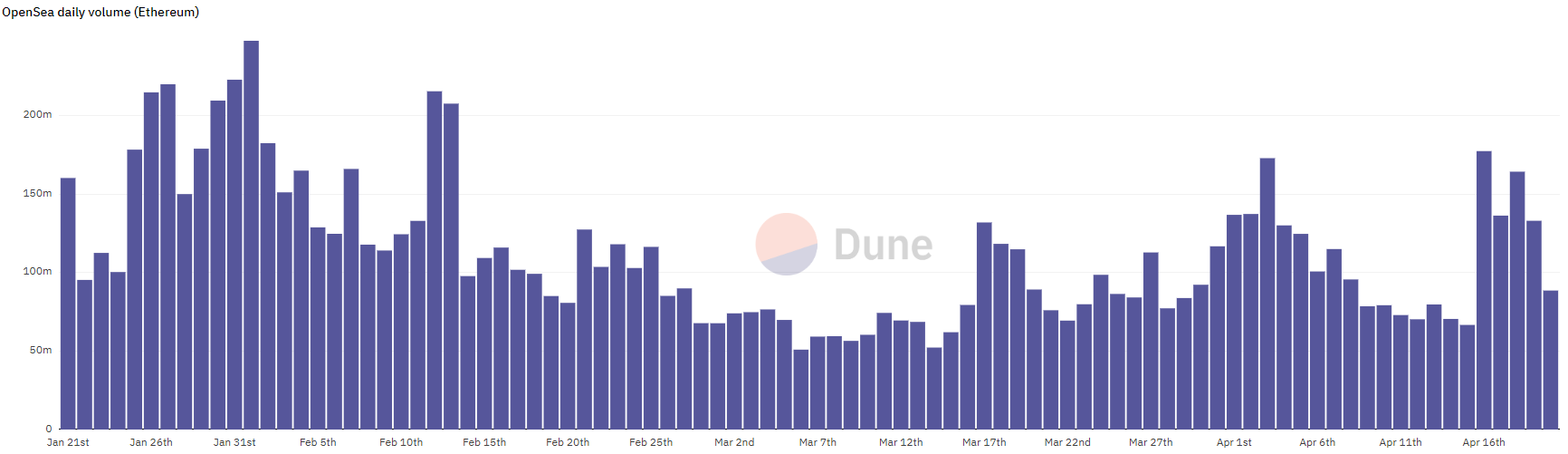

The one source of hope across the cryptocurrency ecosystem can be seen in the nonfungible token sector, which has begun to see an increase in the daily trading volumes at OpenSea, the largest NFT marketplace, after bottoming out in early March according to data from Dune Analytics.

It remains to be seen if the hype and speculation being generated in the NFT market can broaden into increased inflows to the cryptocurrency ecosystem as a whole or if the nascent sector is destined to flame out like the ICO boom / bust cycle in 2017-2018.

On the mainstream adoption front, it appears as though crypto investors are still looking for that killer DApp or use case that will kick off the next round of widespread inflow to the market.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Leave A Comment