The United States equities markets plunged on Aug. 26 following Federal Reserve Chair Jerome Powell’s speech where he reiterated the central bank’s hawkish stance. Continuing its correlation with the equities market, Bitcoin (BTC) and the cryptocurrency markets also witnessed a sharp selloff on Aug. 26.

Bitcoin has declined about 14% this month, making it the worst performance for August since 2015 when the price had dropped 18.67%. That may be bad news for investors because September has a dubious record of a 6% average loss since 2013, according to data from CoinGlass.

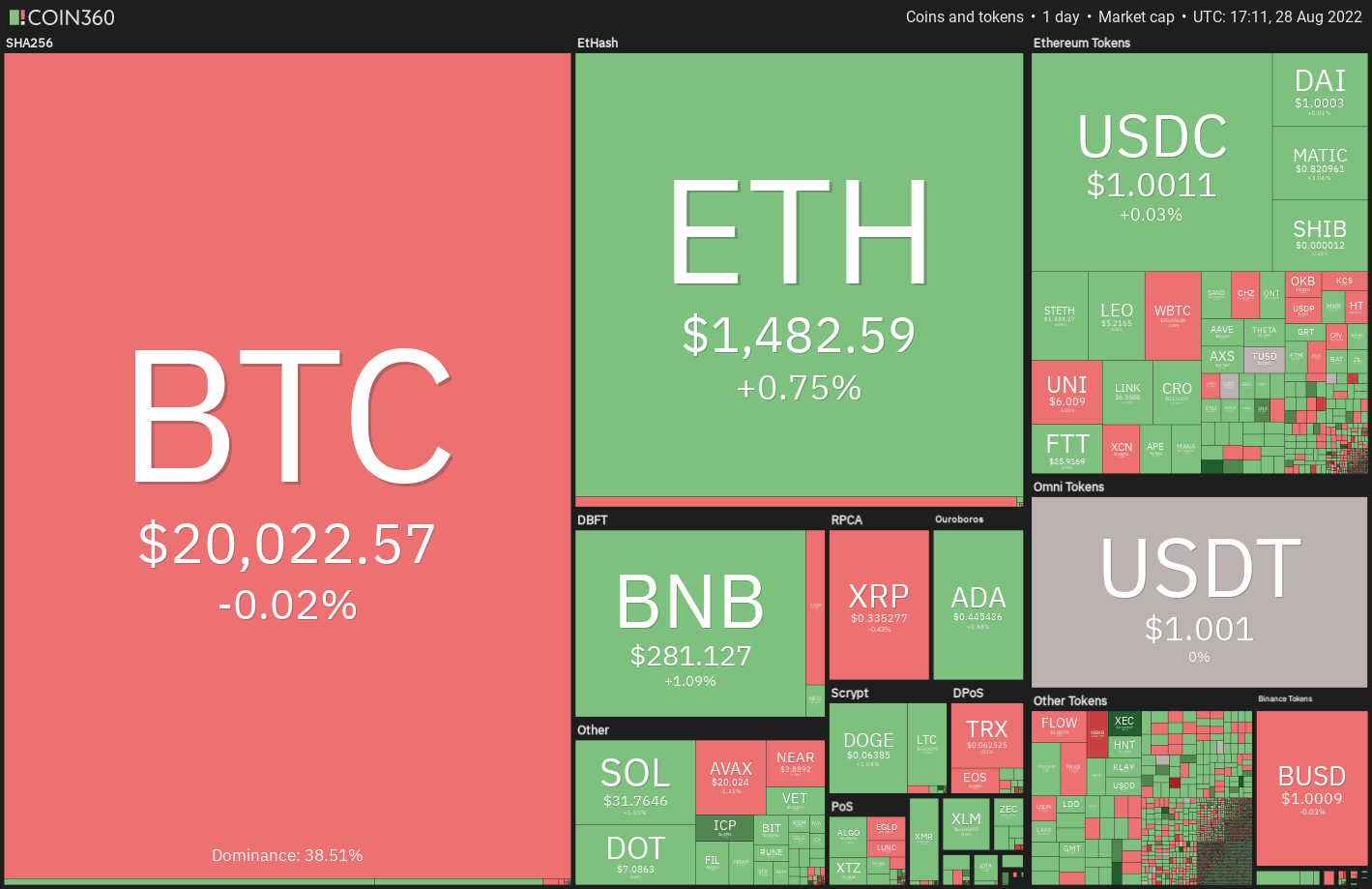

What are the critical levels to watch on Bitcoin? If it stages a turnaround, what are the cryptocurrencies that may outperform in the short term? Let’s study 5 cryptocurrencies that are looking strong on the charts.

BTC/USDT

A weak rebound off a strong support indicates that bulls are hesitant to aggressively buy at the level. The bulls successfully defended the support line for several days but could not push the price above the 20-day exponential moving average ($21,806). This shows a lack of demand at higher levels.

The BTC/USDT pair could drop to the strong support zone between $18,910 and $18,626. If the price rebounds off this zone, the bulls will try to push the price above the 50-day simple moving average ($22,340). If they manage to do that, the pair could rise to $25,211.

Conversely, if the price breaks below $18,626, the pair could retest the June 18 intraday low at $17,622. The bears will have to sink the price below this level to signal the resumption of the downtrend.

The first sign of strength will be a rise above the 20-EMA. If that happens, the pair could rise to the 50-SMA. A break above this level could signal that the correction may be over.

On the contrary, if the price breaks below $19,800, the selling could pick up momentum and the pair may plummet to the $18,910 to $18,626 zone.

MATIC/USDT

Polygon (MATIC) has rebounded off its strong support, which shows that bulls are defending the level aggressively. This increases the likelihood of the range-bound action continuing for a few more days. That is one of the reasons for focusing on this altcoin.

Alternatively, if the price turns down from the moving averages, it will suggest that bears are selling on rallies. The bears will then attempt to sink the price below the crucial support at $0.75. If they succeed, the pair could decline to $0.63.

The buyers will try to push the price above the overhead resistance at $0.84. If they succeed, the pair could rally to $0.91 which may again act as a strong resistance. To invalidate this positive view, the bears will have to sink the price below $0.75.

ATOM/USDT

Cosmos (ATOM) has been selected because it is trading above the 50-day SMA ($10.58) and is near the psychological support at $10.

The ATOM/USDT pair could then rise to the overhead resistance at $12.50 and later to $13.45. A break above this level could suggest that the downtrend may be over.

Contrary to this assumption, if the price turns down and slips below the support zone, it could start a deeper correction. The pair could then decline to $8.50.

Conversely, if the price rebounds off the uptrend line, it will suggest that bulls are buying the dips to this level as they have done on previous occasions. The buyers will have to push the price above the moving averages to open the doors for a possible rally to $12.50.

Related: Bitcoin threatens 20-month low monthly close with BTC price under $20K

XMR/USDT

Monero (XMR) has made it to the list because it is holding above its immediate support at $142. This suggests that lower levels are attracting buyers.

This positive view could invalidate in the near term if the price turns down and breaks below the strong support at $142. If that happens, the pair could slide to $132 and later to $117. The downsloping 20-day EMA and the RSI in the negative territory indicate that bears have a slight edge.

Conversely, if the price turns down from the 20-EMA, it will suggest that bears are selling on minor rallies. The pair could then decline to the strong support at $142. If this support cracks, it will suggest the start of a deeper correction.

CHZ/USDT

Chiliz (CHZ) has found a place in this list for the third consecutive week. That is because, even after the recent correction, it remains in an uptrend.

The bulls purchased this drop and are attempting to resume the up-move toward the overhead resistance at $0.26. The bulls will have to clear this hurdle to open the doors for a possible rally to $0.33.

The rising moving averages suggest advantage to buyers but the negative divergence on the RSI indicates that the bullish momentum may be weakening. If the price turns down and breaks below the 20-day EMA, the advantage will turn in favor of the bears. The pair could then decline to the 50-day SMA ($0.15).

The next trending move could start if bulls push and sustain the price above $0.26 or below $0.20. Until then, the bulls are likely to buy the dips to the support at $0.20 and sell near the overhead resistance at $0.26. Trading inside the range is likely to remain volatile and random.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Leave A Comment