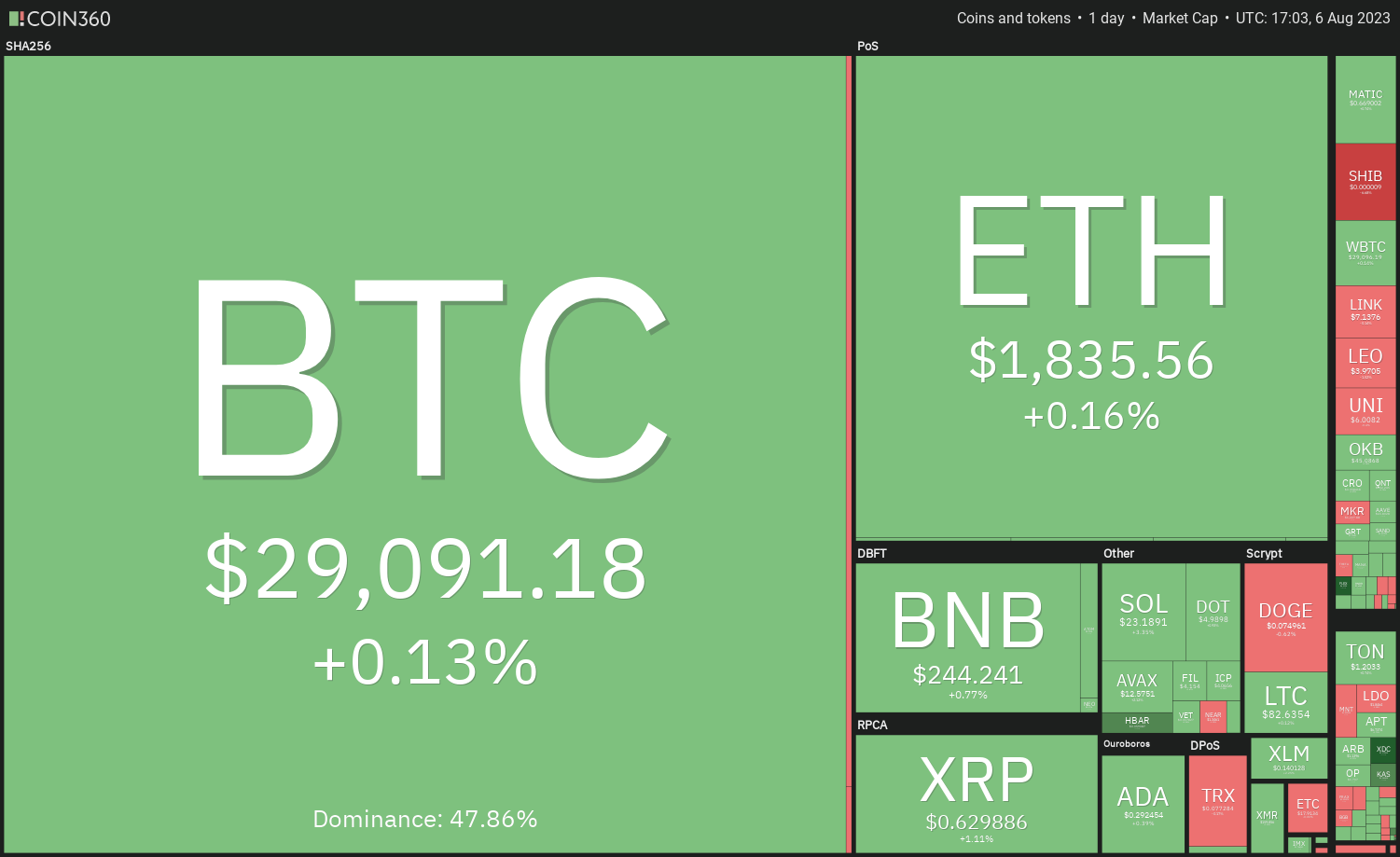

Bitcoin (BTC) continued its boring price action over the weekend, indicating that the bulls and the bears are not waging large bets as they are uncertain about the next directional move. Nevertheless, traders should continue to keep a close watch because a period of consolidation is usually followed by an increase in volatility.

Although it is difficult to predict the direction of the breakout with certainty, some analysts point to the Bitcoin whales increasing their exposure as a positive sign. On-chain analyst Cole Garner believes the bull move could continue till September when the summer seasonality kicks in and the shakeout happens.

What are the top-5 cryptocurrencies that are looking positive in the near term? Let’s study their charts to determine the resistance levels to keep an eye on.

Bitcoin price analysis

Bitcoin formed an inside-day candlestick pattern on Aug. 5, indicating indecision among the bulls and the bears. The price is getting squeezed between the 20-day exponential moving average ($29,430) and the horizontal support at $28,861.

Conversely, if the price rebounds off the current level and breaks above the 50-day simple moving average ($29,840), it will suggest the start of a recovery to the overhead resistance zone between $31,804 and $32,400.

The 20-EMA is turning down gradually and the RSI is just below the midpoint, suggesting that the bears have a minor advantage. The sellers will have to sink and sustain the price below $28,861 to resume the short-term down move.

If bulls want to start a recovery, they will have to drive and sustain the price above the moving averages. If they do that, the pair could climb to the stiff overhead resistance at $30,000. A break and close above this level could open the doors for a further rally to $31,000.

Shiba Inu price analysis

Shiba Inu (SHIB) broke and closed above the overhead resistance of $0.0000085 on Aug. 4, indicating that the bulls are trying to start a new uptrend.

If the bulls do not give up much ground from the current levels, it will signal that traders are holding on to their positions as they anticipate another leg higher. If the price breaks above $0.000010, the pair may surge to $0.000012 and then to $0.000014.

Instead, if the price continues lower and breaks below the 20-EMA, it will suggest that traders are aggressively booking profits. A break below the 61.8% Fibonacci retracement level of $0.000009 could open the doors for a potential fall to $0.0000085.

Uniswap price analysis

Uniswap (UNI) has been in a correction for the past few days but a positive sign is that the bulls are trying to arrest the decline near the 20-day EMA ($6.04).

Another possibility is that the price sustains below the 20-day EMA. If that happens, it will suggest that the up-move has ended. The pair could then descend to the 50-day SMA ($5.58) where buying may emerge.

The flattish 20-day EMA and the RSI near the midpoint do not give a clear advantage either to the bulls or the bears.

Contrarily, if bulls propel the price above the 20-EMA, it will suggest that the bears are losing their grip. The pair may first rise to the 50-SMA and if this level is taken out, the up-move may reach $6.70.

Related: XRP price disappoints after court ruling, Deaton remains optimistic

OKB price analysis

OKB (OKB) has been gradually falling inside a large range between $38 and $59 for the past several weeks. The bulls pushed the price above the downtrend line on Aug. 4, indicating that the short-term downtrend may be ending.

Contrary to this assumption, a slide below the downtrend line will indicate that the attempt to start an up-move fizzled out. The bears will gain further strength if they sink the OKB/USDT pair below the moving averages. The pair could then slump to $41.

The 20-EMA is an important support to watch out for. If the price plunges below the 20-EMA and the downtrend line, it will suggest that bears are back in command. The pair may then tumble to $42.

Hedera price analysis

Hedera (HBAR) broke above the overhead resistance of $0.055 on Aug. 6, indicating that bulls are attempting a comeback.

The important level to watch on the downside is $0.055. If bulls flip this level into support, it will indicate a change in sentiment from selling on rallies to buying on dips.

This positive view will invalidate in the near term if the price turns down and plummets below the 50-day SMA ($0.05). That could sink the pair to $0.045.

The sharp rally has pushed the RSI into deeply overbought territory, indicating that a minor correction or consolidation is possible. On the downside, $0.055 is the critical level to keep an eye on.

If bears want to prevent this up-move, they will have to yank the price below the breakout level of $0.05. The pair could then plunge to $0.045.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Leave A Comment