Technical analysis is a controversial topic, but higher lows are commonly interpreted as a sign of strength. Today, Ether (ETH) might be 30% below its May 12 high at $4,380, but the current $3,050 price is 78% higher than the 6-month low at $1,700. To understand whether this is a “glass half full” situation, one must analyze how retail and pro traders are positioned according to derivatives markets.

Binance also announced that it would halt fiat deposits and spot crypto trading for Singapore-based users in accordance with local regulatory requests. Huobi, another leading derivatives and spot exchange in Asia, also announced that it would retire existing Mainland China-based user accounts by year-end.

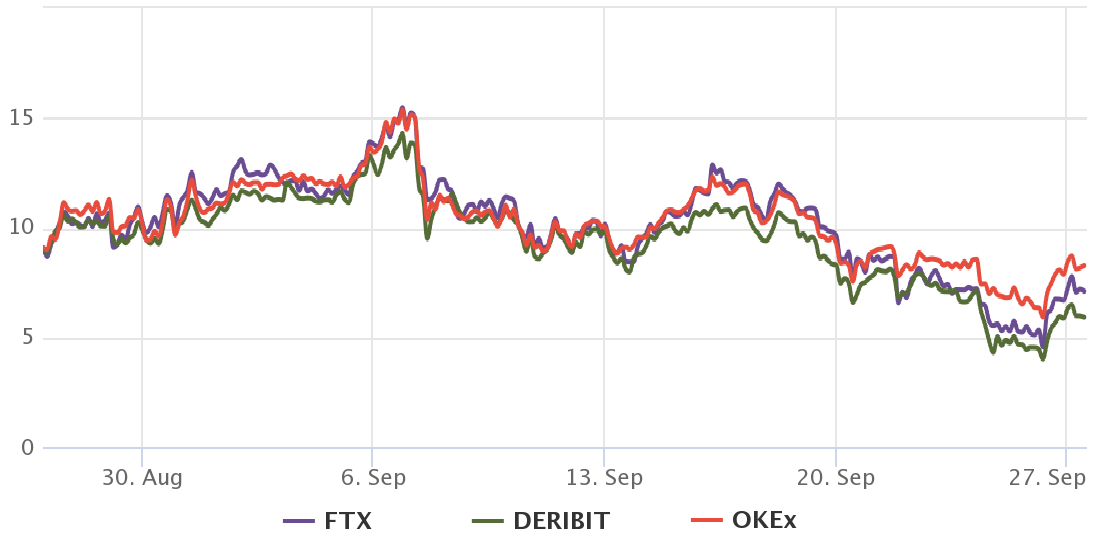

Pro traders are neutral, but fear is starting to settle in

To assess whether professional traders are leaning bullish, one should start by analyzing the futures premium — also known as the basis rate. This indicator measures the price gap between futures contract prices and the regular spot market.

Ether quarterly futures are the preferred instruments of whales and arbitrage desks. Although it might seem complicated for retail traders due to their settlement date and price difference from spot markets, their most significant advantage is the lack of a fluctuating funding rate.

As depicted above, Ether’s dip below $2,800 on Sept. 26 caused the basis rate to test the 5% threshold. Albeit re again on Monday.

Retail traders usually opt for perpetual contracts (inverse swaps), where a fee is charged every 8-hours depending on which side demands more leverage. Thus, to understand if longs are panicking due to the recent newsflow, one must analyze the futures markets’ funding rate.

Between Sept. 1 and Sept. 7, a moderate spike in the funding rate took place, but it dissipated as a sudden crypto crash caused $3.54 billion worth of future contracts liquidations. Apart from some short-lived, slightly negative periods, the indicator has held flat ever since.

Both professional traders and retail investors seem unaffected by the recent $2,800 support being tested. However, the situation could quickly revert, and ‘fear’ could emerge if Ether falls below such a price level, which has been holding strong for 52 days.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Leave A Comment