The upcoming Ethereum merge is one of the most widely discussed topics in the crypto sector and analysts have a wide range of perspectives on how the transition to proof of stake could impact Ether’s price.

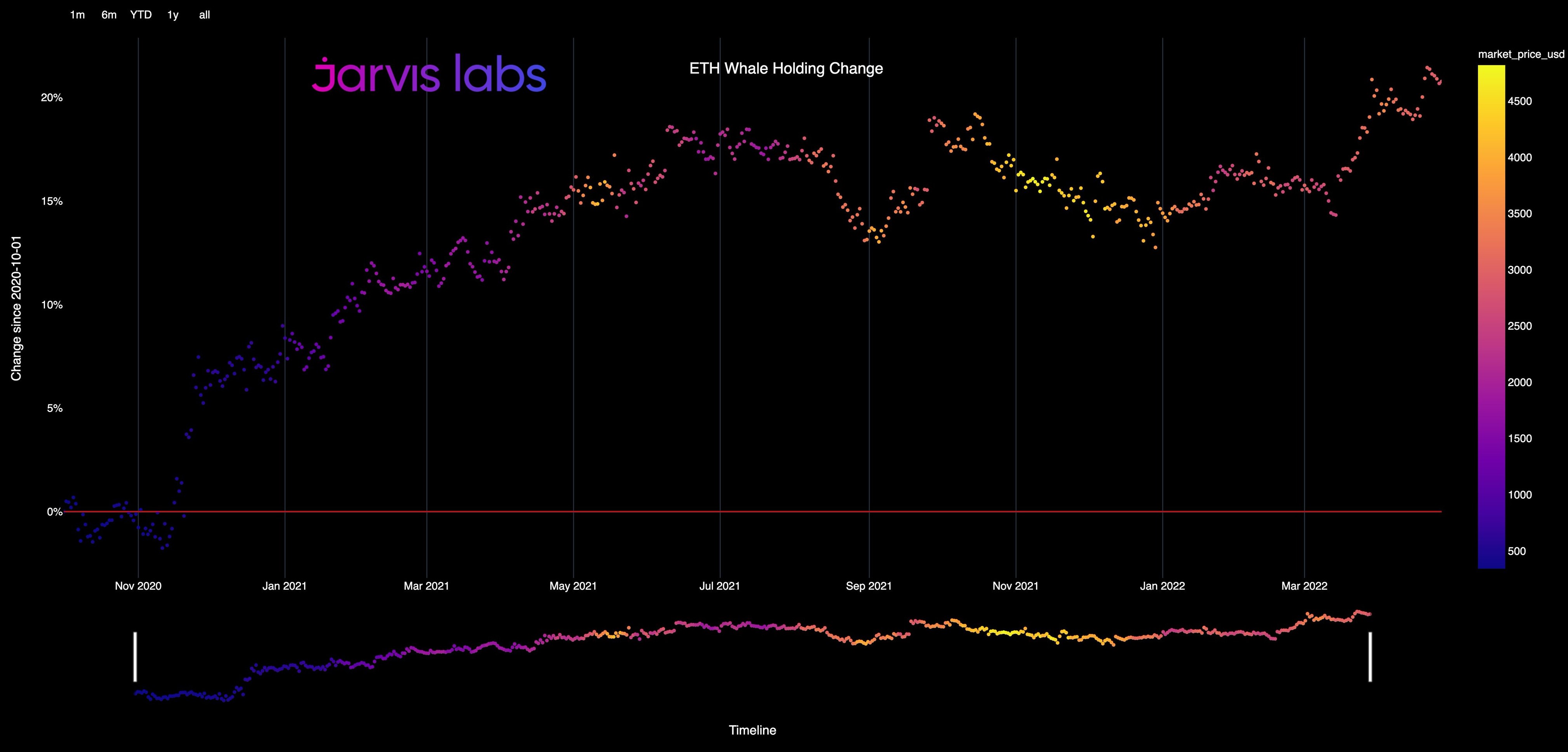

A deeper dive into the ongoing accumulation of Ether by whale wallets was provided by cryptocurrency intelligence firm Jarvis Labs, which posted the following chart looking at the percentage change in whale wallet holdings versus ET price.

Jarvis Labs said,

“Whales are continuing to accumulate Ether, their accumulation remains in sideways-to-uptrend.”

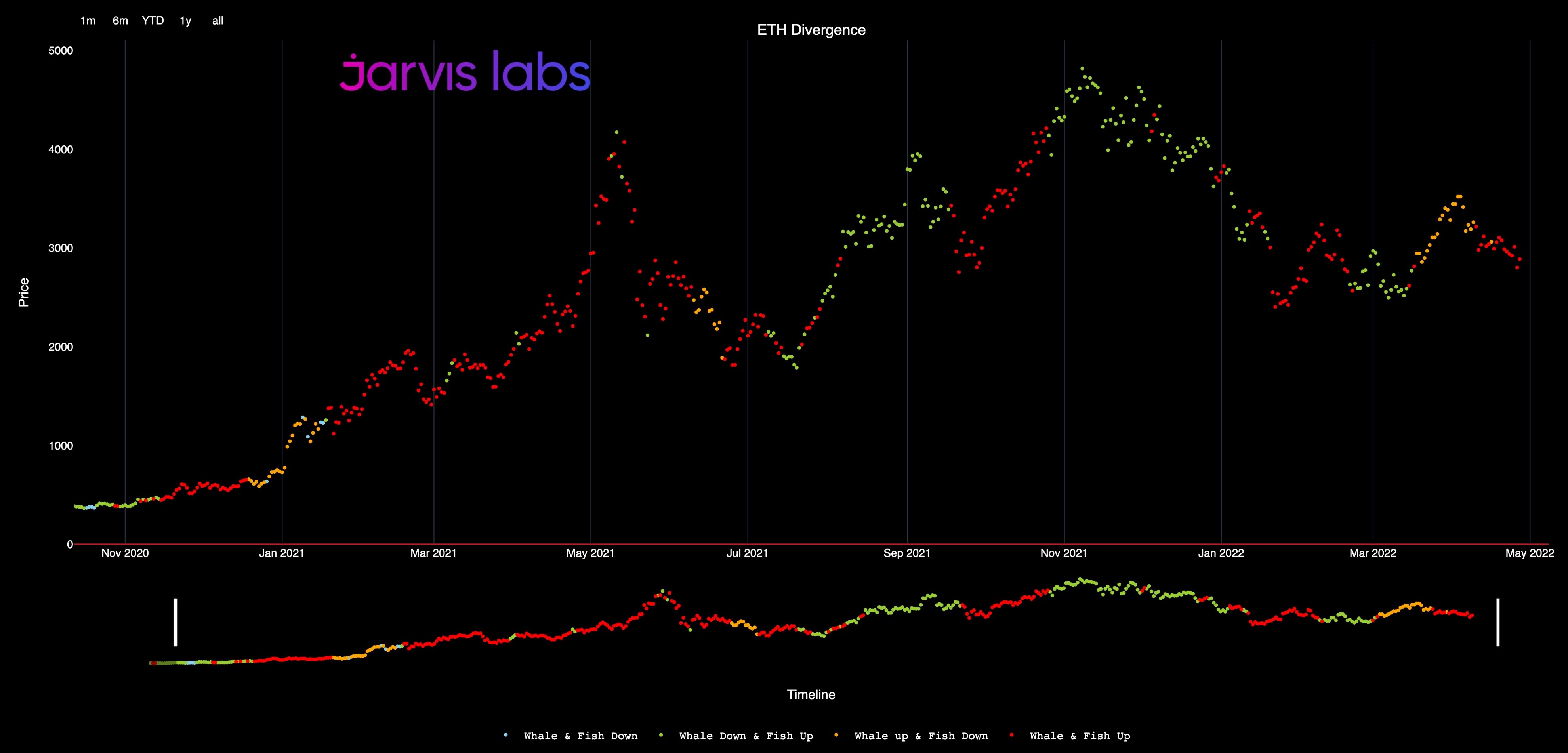

And it’s not just the whales who are looking to scoop up Ether on the dip as shown in the following chart where red dots indicate that both whale wallets and smaller wallets have seen an increase in accumulation.

“Looking at just the Ether wallets distributions, it can be inferred that Whales UP + Fishes UP (Both whales and Fishes seem to be accumulating). Merge narrative?”

Is an Ethereum decoupling on the horizon?

Analysts at Delphi Digital contemplated whether Ethereum price could decouple from BTC leading into or after the merge. The analysts also predict that the altcoin is “likely to see more consolidation for ETH/BTC in the short run.”

According to Delphi Digital, the current bullish “ultrasound money” and “Merge” narratives surrounding Ether might be just the thing to help Ether break free from its correlation to Bitcoin price action.

Delphi Digital said,

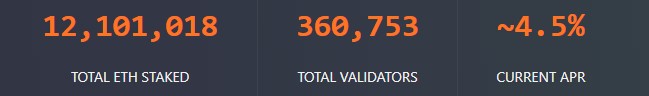

“The interest in “post-Merge” Ether is only going to get stronger from here, especially as more people recognize the opportunity to earn higher real yields denominated in a deflationary asset.”

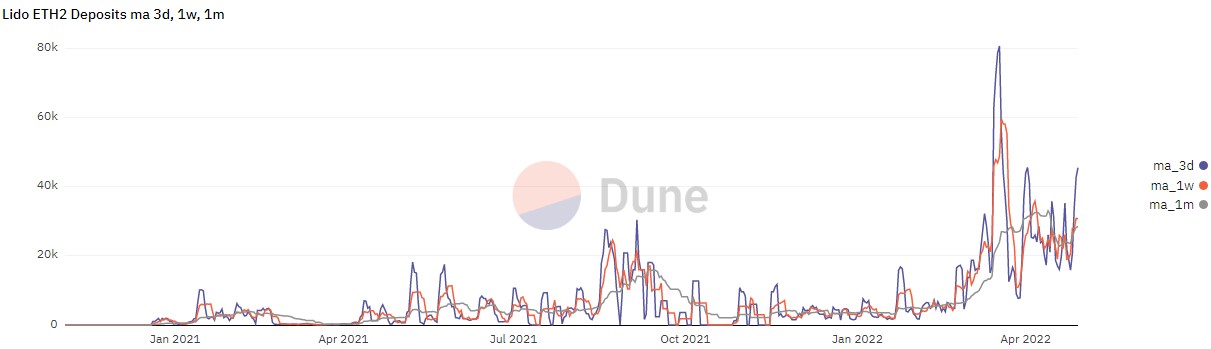

Ether staking gains momentum

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Leave A Comment