Stablecoins like Tether (USDT) and USD Coin (USDC) have hit another milestone in terms of accumulation by exchanges.

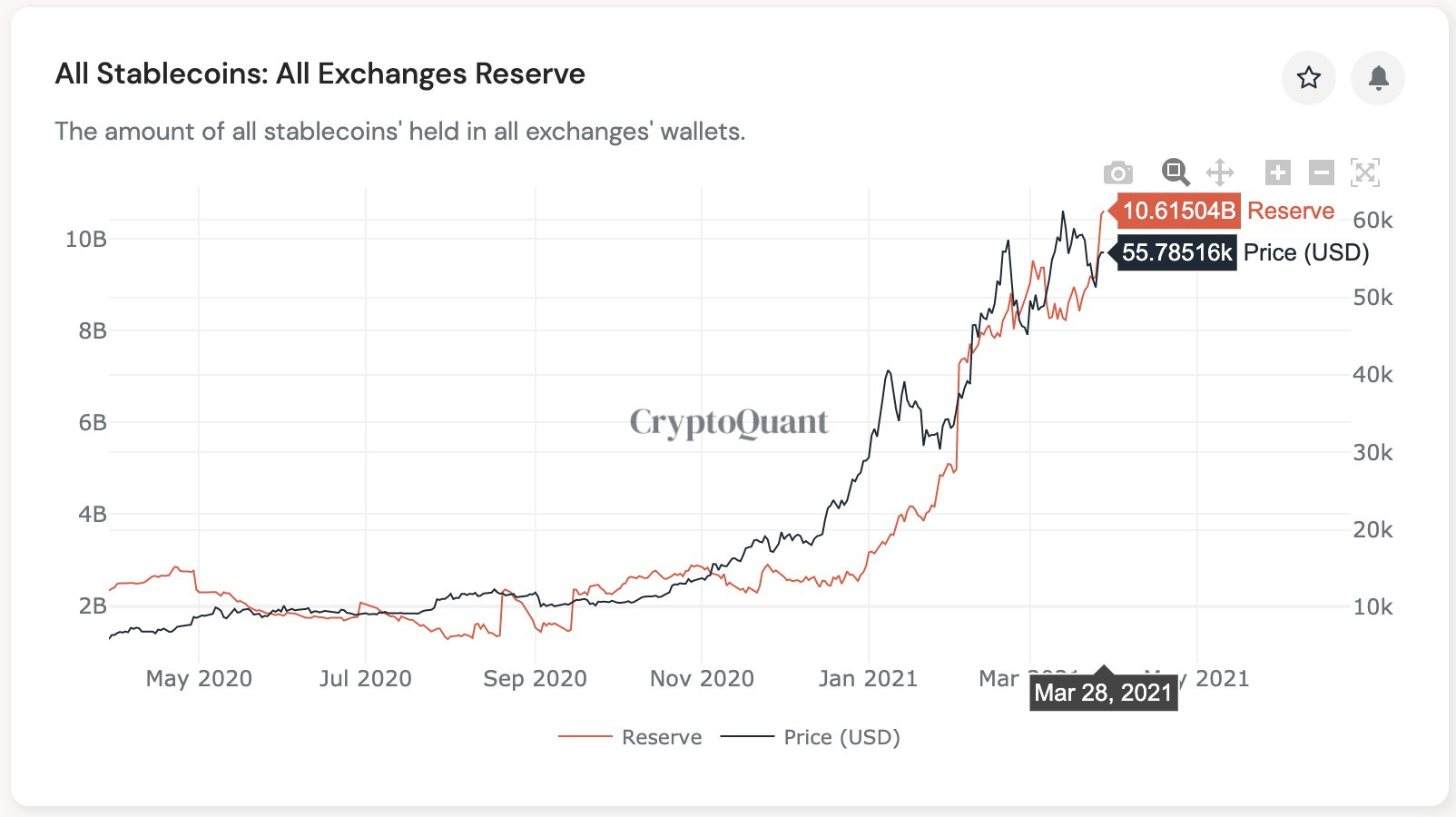

According to market data provider CryptoQuant, stablecoin holdings on global crypto exchanges soared to a new all-time high on March 28, exceeding $10 billion.

Cryptocurrency exchanges are now holding nearly 16% of the total market value of all stablecoins, as stablecoin market capitalization amounts to $63 billion at the time of writing, according to data from CoinGecko. The total trading volume of all stablecoins is estimated at about $88 billion.

Coupled with growing stablecoin accumulations, some other metrics like CryptoQuant’s “All Exchange Stablecoin Ratio” could potentially point at another upward move on crypto markets. Technical analyst Crypto Seer noted on March 27 that the metric had reached its lowest level since November 2020.

“Each time this ratio has gone so low is marked by periods of significant strength for $BTC. The significant reduction in on exchange supply for BTC can be noticed here,” he said. The metric indicates BTC reserves divided by all stablecoin reserves held on exchanges, pointing to potential selling pressure.

The latest stablecoin market milestone comes as payment giant Visa officially pilots its first settlement transaction in USD Coin on the Ethereum blockchain. USD Coin is the second-largest stablecoin pegged to the United States dollar following Tether.

“I smell crypto mass adoption here,” CryptoQuant CEO Ki Young said about Visa’s move into USDC.

According to CryptoQuant, USDC holdings on crypto exchanges now amount to over $2.2 billion, while its market cap is around $11 billion.

Leave A Comment