A cross-chain operating system says it allows anyone to launch and manage tokenized fund, strategy, or financial product.  aims to democratize asset management by enabling on-chain DeFi portfolios, with a number of high-profile protocols already on board.

aims to democratize asset management by enabling on-chain DeFi portfolios, with a number of high-profile protocols already on board.

Crypto is a thrilling, innovative industry that’s shaping up to have a profound impact in the decades to come — but of course, it’s had quite a few knocks in recent years.

With high-profile collapses of FTX and Celsius badly bruising confidence in the sector over the past year, with some consumers losing their life savings as contagion spread.

As damaging as these bankruptcies have been, passionate entrepreneurs who care about the ecosystem are now taking it upon themselves to learn lessons from the downfall of people like Bankman-Fried and Mashinsky, making the space safer for everyone.

A key tenet in this campaign is reducing counterparty risk and putting power back into the hands of everyday crypto enthusiasts, who shouldn’t have to worry about withdrawals suddenly being suspended.

Inevitably, there are a few hurdles that need to be overcome before this becomes a reality. One of them surrounds delivering a seamless and frictionless experience — eliminating the pain points that DeFi investors are confronted with every day: complexity, security concerns, high gas fees, user interface difficulties. The other involves catering to a broad range of crypto believers — and ensuring that newcomers are served just as well as seasoned traders who have been in the industry for years.

Now, a dedicated cross-chain operating system says it’s opening its arms to everyone and demystifying DeFi by ensuring all of its users can cultivate their own portfolios with a few clicks.

‘Ready to use or create your own’

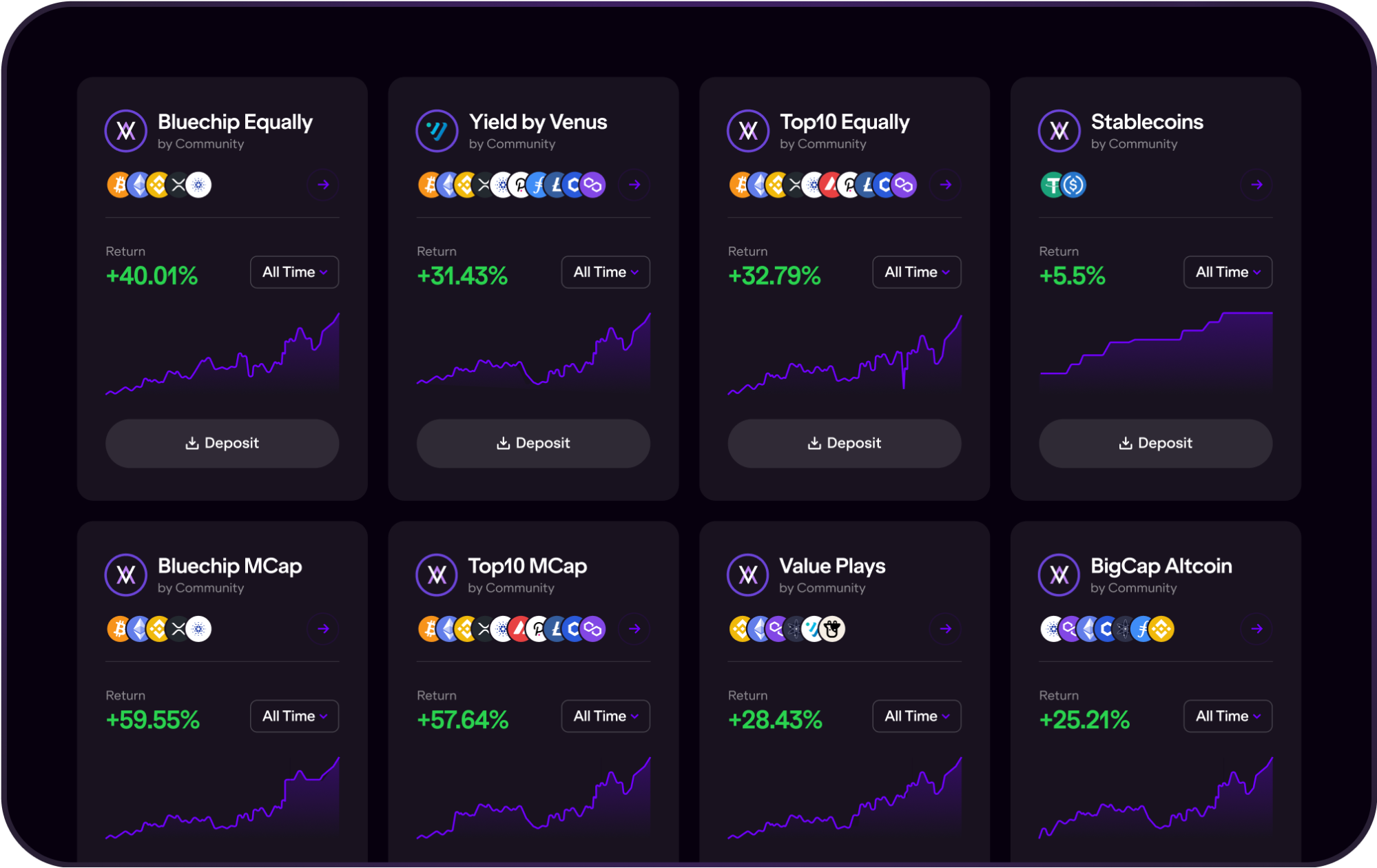

This new, democratized approach is being pioneered by  , which is driven by a desire to offer diversification to the masses. With Velvet, users are given an easy to use interface and the choice to either access ready-to-use DeFi portfolios created by Asset Managers and Crypto Natives, or create their own.

, which is driven by a desire to offer diversification to the masses. With Velvet, users are given an easy to use interface and the choice to either access ready-to-use DeFi portfolios created by Asset Managers and Crypto Natives, or create their own.

Given the catastrophic implosions during the bear market, Velvet Capital stresses that portfolio’s created on the platform are noncustodial — meaning it doesn’t hold any user assets. To beef up security further, audits are also completed on a regular basis.

Source:

Choice is an important thing. Some investors prefer to let the best fund managers and algorithms do all the hard work on their behalf, others prefer to take a hands-on investing approach. In the past, establishing a portfolio that spans a plethora of DeFi protocols would involve endless wallet integrations that add painful delays when multiple transactions need to be executed quickly. Velvet Capital is integrated with PancakeSwap, 1inch, Ox, Paraswap, Alpaca Finance, and others to optimize investors’ capital efficiency and yield in one place.

Michael Hage, vice president of business development, said:

“Building Velvet Capital is exciting because it’s the first professional grade DeFi asset management OS that’s open to all investors and will allow anyone to create and manage on-chain portfolios in a non-custodial way.”

Version 1 of Velvet Capital launched in November 2022 and allowed users to invest in ready made crypto indexes and yield farming portfolios— the next gen version 2 is set to go live soon and will deliver a professional-grade experience that’ll make it simple and easy to trade on-chain.

At the core of this platform is an ambition of unlocking access to a diverse range of crypto assets — without the limitations of a single chain. User experience is another priority, with performance across multiple timeframes broken down in an easy-to-understand interface.

Funds can be distributed directly via a native Web3 app and can use the Velvet Capital API to execute logic on-chain through Velvets infrastructure.

In the crypto space, choice and quality have never mattered more. Velvet Capital is now rising to the occasion — all while enabling the institutional adoption of DeFi.

Learn more about

Disclaimer. Cointelegraph does not endorse any content or product on this page. While we aim at providing you with all important information that we could obtain in this sponsored article, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor can this article be considered as investment advice.

Leave A Comment