Every week, subscribers of Cointelegraph’s data analytics platform receive a detailed breakdown of each algorithmic tool’s performance.

Over the weekend, Cointelegraph’s Markets Pro data intelligence service, which offers institutional-grade research tools for crypto traders, shared the latest VORTECS™ Report with its subscriber community.

The full report, available only to subscribers, zooms in on the past week’s biggest-gaining tokens as identified by the system’s artificial intelligence tools and offers interpretations of the data that it makes available to traders. Here are some of the highlights of the latest report:

It’s altcoin spring again

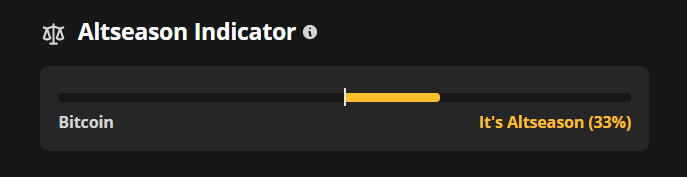

The Markets Pro Altseason Indicator metric is designed to help traders figure out whether it is a good time to be stocking on altcoins or to be prioritizing BTC investments over the next 14 days. The indicator takes into account the same variables as the VORTECS™ Score — price movement, tweet volume, trading volume and social sentiment — plus additional data sources such as altcoin listings and crypto projects’ press coverage.

When Bitcoin struggles and the market turns bearish, many traders tend to see BTC as a safer place to park value than more volatile alternative crypto assets. Conversely, when Bitcoin’s position is robust and investor optimism carries over to the altcoin market, money flows to the side of alts, where massive gains can be made.

When Bitcoin struggles and the market turns bearish, many traders tend to see BTC as a safer place to park value than more volatile alternative crypto assets. Conversely, when Bitcoin’s position is robust and investor optimism carries over to the altcoin market, money flows to the side of alts, where massive gains can be made.

In May, following months of a blooming altseason that started in early 2021, the Altseason Indicator flipped to the BTC side amid Bitcoin’s troubles and the corresponding bearish trend in the overall crypto market. However, the recent bullish turn meant that it was only a matter of time before a new altseason began.

Within separate seven-day periods over several weeks now, altcoins have on average been generating larger gains than Bitcoin. Yet, the way it usually works is that Bitcoin must first gain a very solid footing, and only after the original cryptocurrency is healthy enough can altcoins finally break out.

After BTC stabilized in the $45,000–$50,000 corridor, the path was clear for alts to storm to new highs. Now, the indicator is 33% on the altcoin side, meaning that historical conditions are favorable for trading alts. While this is still not a very strong Altseason Indicator score, the reversal is itself remarkable.

To get more data-powered insights like this, join hundreds of Cointelegraph Markets Pro subscribers who derive actionable insight from the platform’s data tools and its vibrant Discord community daily.

Cointelegraph Markets Pro is a simple, easy-to-use dashboard powered by the same technology and data used by the leading institutional investors — at a fraction of the cost. For the full report available exclusively to members, visit pro.cointelegraph.com.

Cointelegraph Markets Pro is a simple, easy-to-use dashboard powered by the same technology and data used by the leading institutional investors — at a fraction of the cost. For the full report available exclusively to members, visit pro.cointelegraph.com.

Leave A Comment