Bitcoin (BTC) is facing a stiff challenge from the bears near the $48,000 mark. As Cointelegraph reported earlier, the buy and sell levels show that sellers on Binance have held their ground at $48,000.

PlanB, the creator of the stock-to-flow Bitcoin price model, said if Bitcoin manages to close August above $47,000, the year-end “worst-case scenario” target price of $135,000 may come into play.

Despite the slight downturn, the institutional adoption of Bitcoin continues to increase. Filings with the United States Securities and Exchange Commission show that four wealth management firms have bought shares in Grayscale’s Bitcoin Investment Trust.

Compared to their Asian counterparts, the respondents in the United Kingdom and the United States reported a low 8% and 9% adoption rate. However, the report warned that “due to the varying Google infrastructure in each territory, not all surveys were nationally representative.”

Will Bitcoin’s hesitation near the $48,000 mark result in profit-booking? Could altcoins attract funds that exit Bitcoin? Let’s study the charts of the top-5 cryptocurrencies that may extend their up-move in the next few days.

BTC/USDT

Bitcoin turned down from the resistance line of the rising wedge pattern on Aug. 14. This suggests that the bears have not given up and are defending the resistance line aggressively.

The upsloping moving averages and the relative strength index (RSI) in the positive zone suggest that bulls are in control.

Contrary to this assumption, if bears sink the price below the wedge, the pair could drop to the 20-day exponential moving average ($42,682). If the price rebounds off this level, the bulls will make one more attempt to resume the up-move.

But if the price slips below the 20-day EMA, the pair may drop to the 50-day simple moving average ($37,176).

The flattening 20-EMA and the RSI near the midpoint suggest that the bullish momentum may be weakening.

If the price rebounds off the current level and rises above the overhead resistance zone, it will indicate that bulls are buying on every minor dip. That will suggest the resumption of the up-move.

ETC/USDT

Ethereum Classic (ETC) broke and closed above the overhead resistance at $63.56 on Aug. 13, completing an ascending triangle pattern. This bullish setup has a pattern target at $94.91.

The rising 20-day EMA ($57) and the RSI in the overbought zone suggest that bulls have the upper hand. If the price breaks below $63.56, the pair could drop to the 20-day EMA.

A strong rebound off the 20-day EMA will suggest that the bullish sentiment remains intact. The buyers will then make one more attempt to resume the up-move. This positive view will be negated if bears pull the price below the 20-day EMA. That could result in a decline to the 50-day SMA ($51).

If bulls propel the price above $76.16, the next stop could be $84.16. On the contrary, if bears sink the price below $70, the pair could decline to the 20-EMA. A strong bounce off this level will suggest that the sentiment remains positive but a break below it may pull the price down to $63.56.

LUNA/USDT

Terra protocol’s LUNA token has been trading inside an ascending channel for the past few days. The breakout and close above the downtrend line suggest the start of a new uptrend.

Alternatively, if the price breaks below the channel and the 20-day EMA ($14), it will suggest that the bullish momentum has weakened. The pair could then retest the breakout level at the downtrend line.

If the price rebounds off the 50-SMA, the pair could trade between $15.81 and $18 for some time. A breakout and close above $18 could start the next leg of the uptrend that could reach $20.81. Conversely, a break below $15 may signal the start of a deeper correction to $13.

KLAY/USDT

Klaytn (KLAY) rose above the $1.81 resistance on Aug. 14 but the bulls could not sustain the higher levels. The long wick on the candlestick of the past two days suggests that bears are aggressively defending the overhead resistance.

If the price rebounds off either support, the bulls will make one more attempt to rise above $1.81. A breakout and close above this level will complete a rounding bottom pattern, which has a target objective at $2.90.

This positive view will invalidate if the price turns down and breaks below the 20-day EMA ($1.32). That could result in a decline to the 50-day SMA ($1.07).

Conversely, if the price rebounds off the 20-EMA, the bulls will make one more attempt to clear the hurdle at $1.81. If they succeed, the KLAY/USDT pair could rally to $2.18. The rising moving averages and the RSI is in the positive zone, indicate advantage to the bulls.

Related: Bullish Ethereum traders can place risk-averse bets with this options strategy

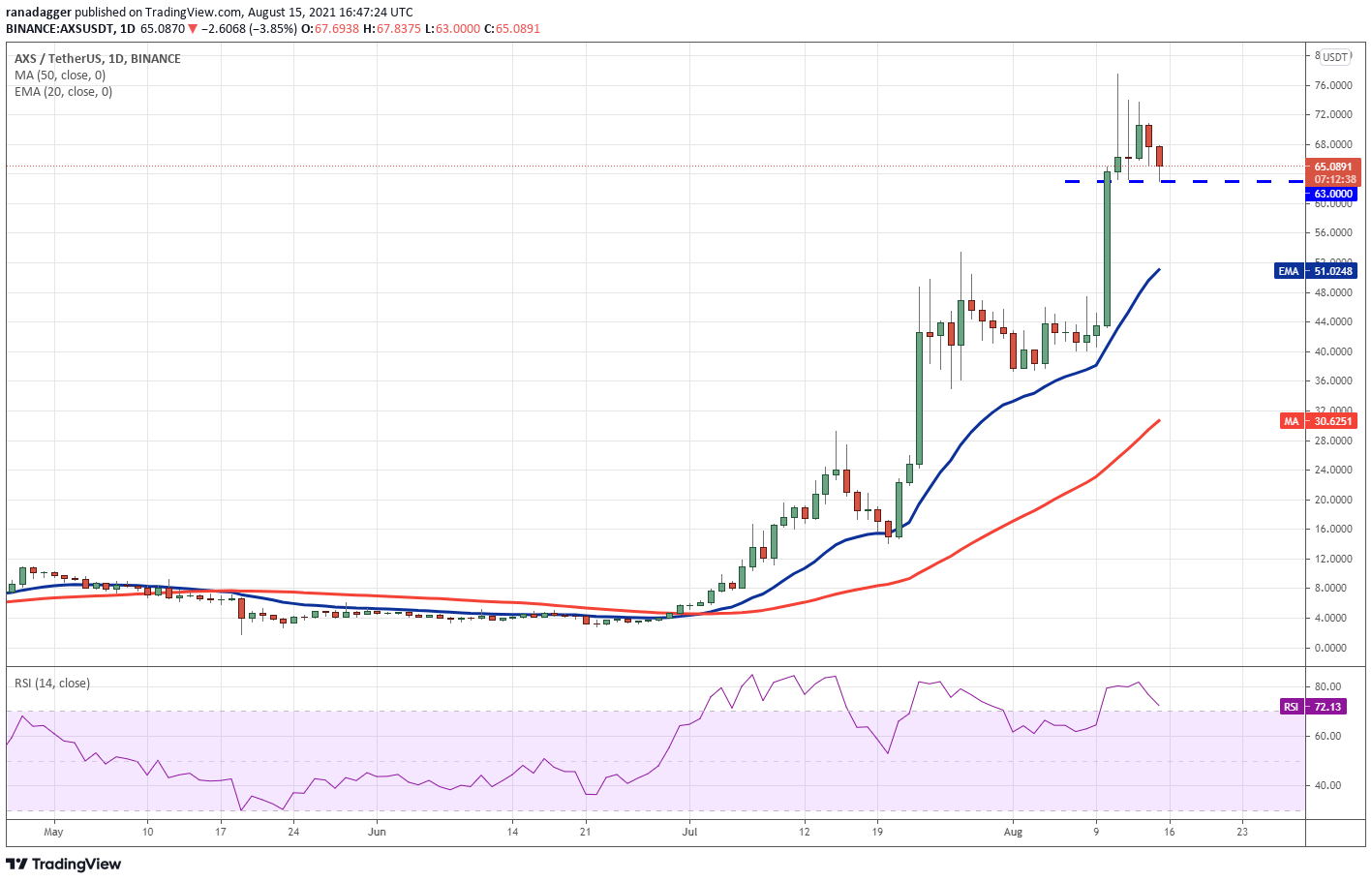

AXS/USD

Axie Infinity’s native token AXS has been in a strong bull run in the past few weeks, hitting a new all-time high at $77.48 on Aug. 11. The long wick on the day’s candlestick showed that traders booked profits at higher levels.

Therefore, the bulls are again likely to buy the dip to the 20-day EMA. A strong rebound off this level will suggest that the sentiment remains positive and traders are buying the dips. The bulls will then again try to resume the uptrend.

A breakout and close above $77.48 could clear the path for a possible run to $91 and then to psychological resistance at $100. Alternatively, a breakdown and close below the 20-day EMA may signal the start of a deeper correction.

Contrary to this assumption, if the price rises from the current level and breaks above the downtrend line, it will invalidate the bearish setup. That could increase the possibility of a retest of the all-time high at $77.48.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Leave A Comment