In trading, selling a position is as important as buying it at the right time. Therefore, the big question that could be troubling traders is whether or not Bitcoin (BTC) price will enter a bearish phase or will the bull run continue after this week’s pullback.

PlanB, the creator of the popular Bitcoin stock-to-flow model, recently tweeted that the crypto bull run has only startedtweeted that the crypto bull run has only started and is “nowhere near the end of it.”

PlanB is not the only voice that is hugely bullish on Bitcoin. Mike McGlone, the senior commodity strategist at Bloomberg Intelligence, believes that if previous behavior is considered, Bitcoin’s 2021 peak could be nearer to $400,000.

The fund recently participated in the $200 million funding round held by NYDIG and also invested in crypto accounting firm Lukka. This shows that institutional investors are broadening their perspective and are looking at investing opportunities other than Bitcoin.

Let’s study the charts of top-5 cryptocurrencies that may resume their uptrend in the short term.

BTC/USDT

Bitcoin is currently in a corrective phase and trading inside a descending channel. The strong rebound off the 50-day simple moving average ($52,000) on March 26 shows the bulls continue to accumulate at lower levels.

A breakout of this zone could signal the start of the next leg of the uptrend that has a target objective at $71,112.06. The 20-day exponential moving average ($54,820) has started to turn up and the relative strength index (RSI) is sustaining in the positive zone, suggesting that the bulls are trying to assert their supremacy.

Contrary to this assumption, if the price turns down from the resistance line of the channel, the bears will try to sink the pair below the 50-day SMA. If they succeed, the pair may drop to the support line and a break below it could start a deeper correction to $43,006.77.

A strong bounce off this support could eventually form an inverse head and shoulders pattern that will complete on a breakout and close above $56,618. This setup has a target objective at $63,339.98.

On the contrary, a break below $54,000 will suggest weakness and a lack of buyers at higher levels.

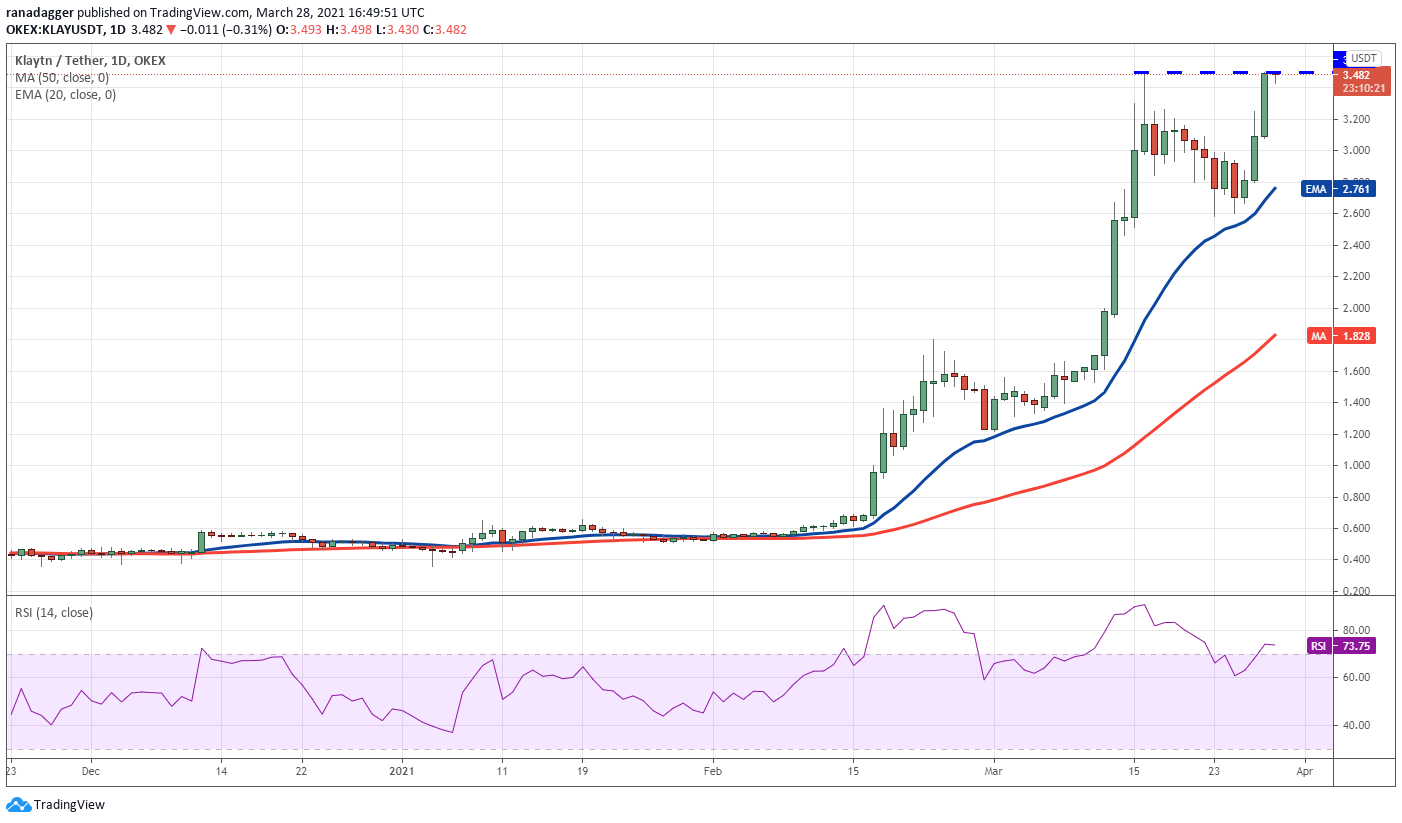

KLAY/USDT

Klaytn (KLAY) has been in a strong uptrend since mid-February. The altcoin recently completed a minor correction as the bulls purchased the dip to the 20-day EMA ($2.76) on March 26, suggesting the sentiment remains positive.

This view will invalidate if the price turns down and breaks below the 20-day EMA. Such a move will suggest a possible change in sentiment. The first support is at $2.58 and a break below this level could start a deeper correction.

Even if the price turns down from $3.50 but finds support at the 20-EMA, it will suggest that the sentiment remains bullish. A strong rebound off this support will increase the possibility of the resumption of the uptrend.

Conversely, a break below the moving averages could pull the price down to the critical support at $2.60.

VET/USDT

VeChain (VET) is in a strong uptrend. The altcoin bounced off the 20-day EMA ($0.078) on March 25, indicating the sentiment is positive and the bulls view the dips as a buying opportunity.

However, the bulls have not allowed the bears to establish their supremacy. If the buyers can drive the price above $0.098, the VET/USDT pair could resume the uptrend. The next target level on the upside is $0.136.

This bullish view will invalidate if the price turns down from the current levels or the overhead resistance and breaks the 20-day EMA. Such a move could pull the price down to the 50-day SMA ($0.059).

Conversely, if the bears sink and sustain the price below the moving averages, a drop to $0.076 is possible. A break below this support could signal the start of a deeper correction.

SOL/USDT

Solana (SOL) had formed a bearish descending triangle pattern, which would have completed on a break and close below $11.90. However, that did not happen. The bulls aggressively purchased the dip to the $11.90 support on 26 March and pushed the price above the downtrend line on March 27, invalidating the bearish setup.

Sustained buying from the bulls has propelled the price to a new all-time high today. If the bulls can sustain the price above $18.20, the SOL/USDT pair may rally to $24.84.

On the contrary, if the price turns down from the current level, a drop to the 20-day EMA ($14.60) is possible. A strong rebound off this support will suggest accumulation by the bulls at lower levels and may enhance the prospects of the resumption of the uptrend.

If the bulls can sustain the price above $18.20, it will suggest the resistance has flipped into support and the uptrend may resume.

This bullish view will invalidate if the bears sink the price below the 20-EMA. Such a move could keep the pair range-bound for a few days.

KSM/USD

Kusama (KSM) is in a strong uptrend. The recent dip to the 20-day EMA ($381) on March 25 was purchased aggressively, as seen from the long tail on the day’s candlestick. This shows strong demand on every minor dip as traders expect the rally to extend further.

If the bulls can push and sustain the price above $505.33, the pair could extend its up-move to $583.

The pair has not broken and stayed below the 20-day EMA since Jan. 14. Therefore, traders can watch this level carefully because a break and close below it will suggest that the bullish momentum has weakened.

Conversely, if the bears sink the price below the moving averages, it will suggest profit-booking by traders. That could pull the price down to $370 where buyers may again step in.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Leave A Comment