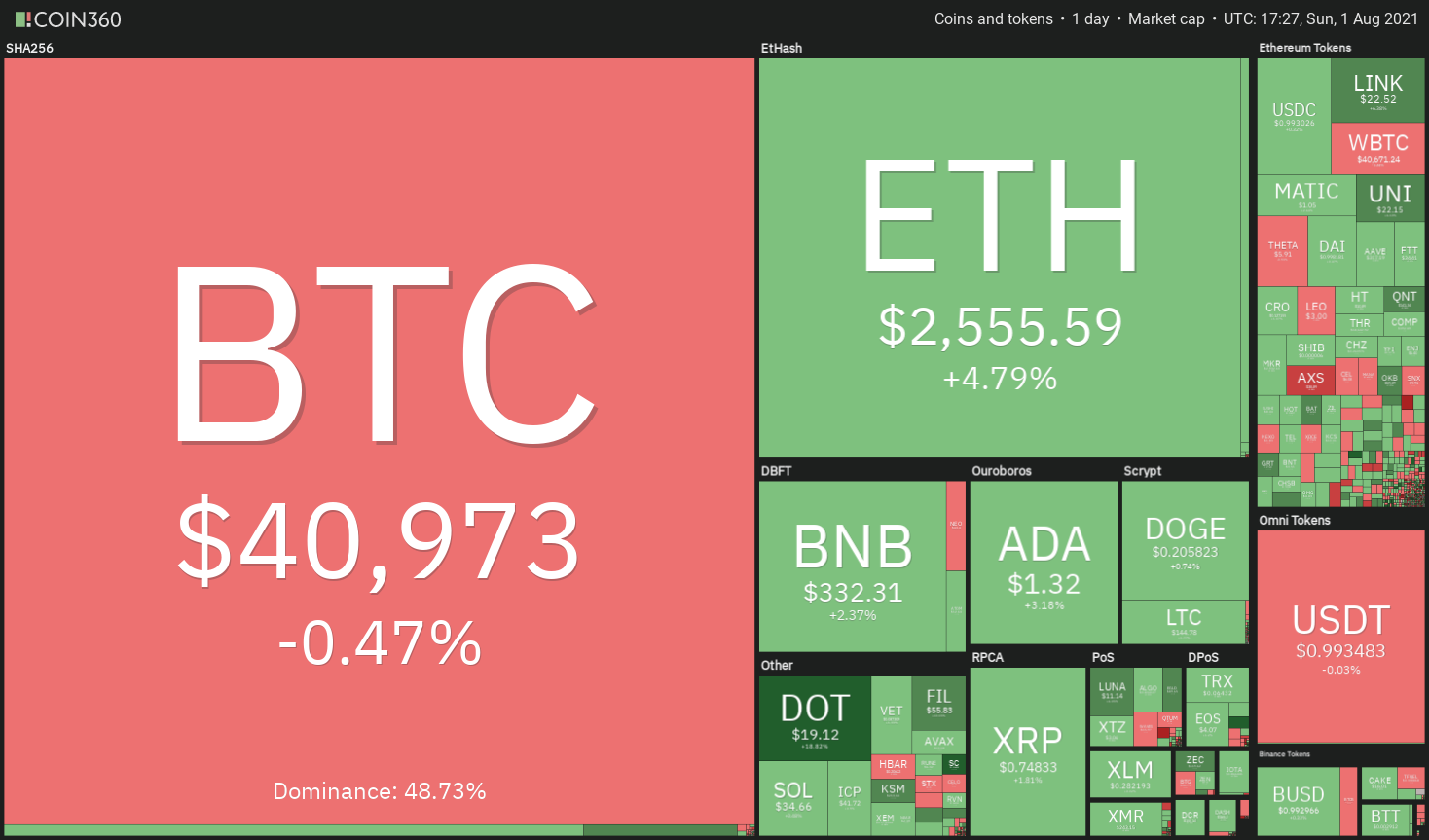

Bitcoin’s (BTC) 43% rally from $29,482.61 on July 21 to $42,316.71 on July 30 has invigorated the bulls who had been sitting on the sideli. After the sharp rise, some analysts are debating whether Bitcoin could repeat its sharp bull run seen in 2013 and 2017.

Vailshire Capital founder and CEO Jeff Ross highlighted that Bitcoin had rallied ten-fold in the second half of 2013 after facing three months of negative news. Ross said: “I still contend that 2021 will behave in similar fashion.”

Meanwhile, institutional investors continue to accumulate Bitcoin when the price is still depressed. Asset management firm GoldenTree, with about $45 billion in assets under management, has purchased an undisclosed amount of Bitcoin, according to The Street.

Bitcoin’s short-term sentiment has clearly turned bullish following the strong recovery of the past few days. Let’s study the charts of the top-5 cryptocurrencies that may participate in the up-move in the next few days.

BTC/USDT

Bitcoin’s sharp rally of the past few days is facing stiff resistance at $42,451.67 but the positive sign is that buyers have not given up much ground. This suggests that bulls are not dumping their positions as they anticipate the up-move to continue.

On the other hand, if the price turns down from the current level, the bulls will attempt to defend the support at $36,670. A strong rebound off this support could keep the pair range-bound between $36,670 and $42,451.67 for a few days.

The bears will have to pull the price below $36,670 to gain the upper hand. Such a move could unlock the possibility for a retest at $31,000.

Alternatively, if the bears pull the price below the 20-EMA, the pair could drop to the 50-simple moving average. A strong bounce off this support will suggest that sentiment remains positive and traders are buying on dips.

The bullish momentum may weaken if the price dips below the 50-SMA. Such a move could result in a decline to $36,670.

UNI/USDT

Uniswap (UNI) rose above the downtrend line on July 30, invalidating the descending triangle pattern. This could result in a short squeeze as aggressive bears rush to cover their positions.

However, the bears may have other plans as they are likely to try to defend the overhead zone. If the price turns down from the zone but rebounds off the 20-day EMA ($19.25), it will suggest that traders are buying the dips. That will increase the possibility of a break above $25 and a rally to $30.

Contrary to this assumption, if the price turns down and plummets below the moving averages, several aggressive bulls may get trapped. That may result in a drop to $17.24 and then to $13.

This positive view will be negated if the price turns down from the overhead resistance and breaks below the 20-EMA. Such a move will suggest that traders booked profits near $23.45 aggressively. That may result in a deeper pullback to the 50-SMA.

LINK/USDT

Chainlink (LINK) broke above the 50-day SMA ($18.73) on July 27, suggesting that bears were losing their grip. After a minor hesitation near the psychological level at $20, the bulls resumed the relief rally on July 30.

If the price turns down from the current level but rebounds off the 20-day EMA ($18.83), it will suggest that the sentiment has turned bullish. The buyers will then attempt to push the LINK/USDT pair toward the stiff overhead resistance zone at $32.50 to $35.

Conversely, if the pair breaks below the moving averages, it will suggest that bears have not yet given up. They may then pull the price down to the critical support zone at $13.38 to $15.

On the other hand, if bears pull the price below $21, several aggressive bulls may get trapped. The price could then drop to the 50-SMA. This is an important level for the bulls because if it cracks, the pair may extend its decline to $15.

SOL/USDT

The bulls pushed Solana (SOL) above the downtrend line on July 31, invalidating the descending triangle pattern. The bears are currently attempting to pull the price back below the downtrend line and trap the aggressive bulls.

If they succeed, the SOL/USDT pair could rally to $44 where the bears are likely to mount a stiff resistance. This positive view will invalidate if the bears pull the price below the moving averages. Such a move could open the doors for a further fall to $26.50.

If the pair rebounds off the 20-EMA, the buyers will again attempt to clear the overhead hurdle. If they manage to do that, the pair could start its journey toward $44.

A break below the 20-EMA will be the first sign of weakness. That may pull the price to the 50-SMA and delay the possible break above $38.10.

Related: 3 reasons why Ethereum price might not hit $5,000 anytime soon

XMR/USD

Monero (XMR) broke above the downtrend line on July 26, which invalidated the developing descending triangle pattern. The failure of a bearish setup is a positive sign.

If the price turns down from the current level but finds support at the 20-day EMA ($220), it will suggest that traders are buying on dips. The bulls will then make one more attempt to resume the up-move.

This positive view will invalidate if the bears sink the price below the moving averages. Such a move will suggest that the current rally was a bull trap.

The upsloping moving averages and the RSI in the positive territory suggest the path of least resistance is to the upside. If bulls thrust the price above $250, the upward march may pick up momentum.

On the downside, bears will have to sink and sustain the price below $227.50 to invalidate the bullish view.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Leave A Comment