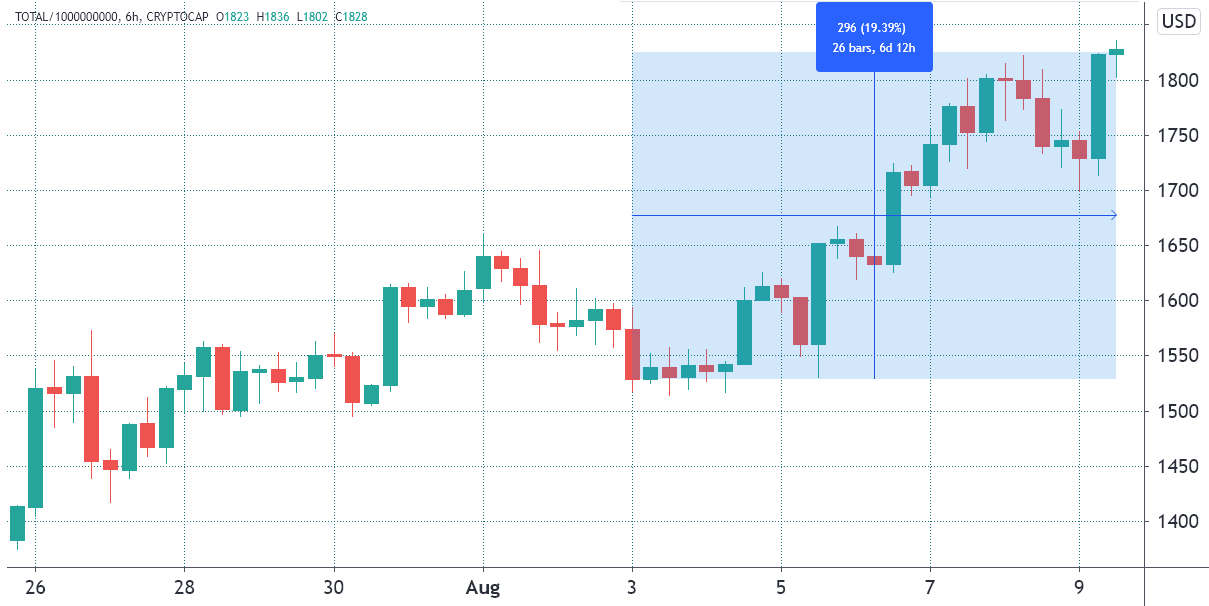

This week the total cryptocurrency market capitalization bounced back to $1.9 trillion, which was a 20% weekly increase and the highest level seen since May 20.

While the fresh bullish momentum attracted the attention of investors, Bitcoin’s (BTC) move from $33,400 to $45,900 was pretty much in line with the rest of the market.

Whether Bitcoin will finally break the $46,000 resistance remains an open question. However, the longer it takes, the higher the odds that altcoins will outperform the leading cryptocurrency.

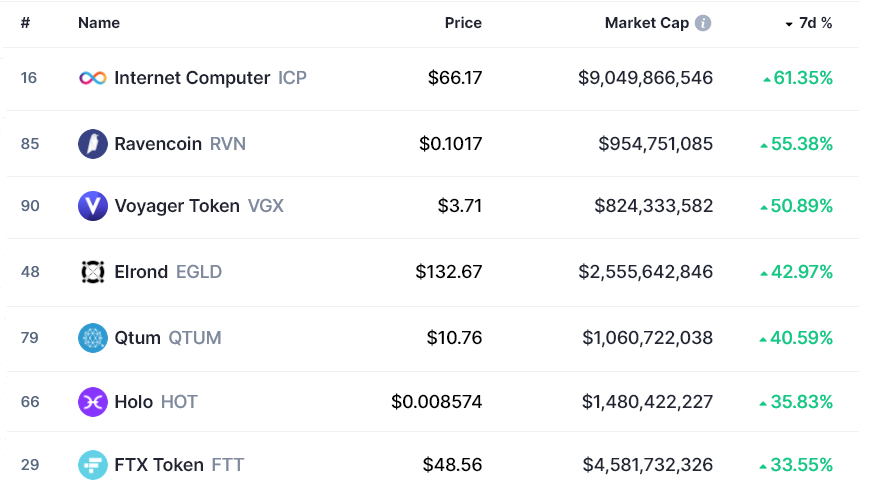

Internet Computer (ICP) announced on July 30 that within two weeks of its launch, the Fleek application reached 700 website deployments. Fleek allows one to build websites and front-end for decentralized applications on the Internet Computer blockchain with frictionless hosting.

According to the Dfinity Foundation blog, Fleek created an alternative open-source gateway to the blockchain so Internet Computer smart contracts data could be freely accessed using regular browsers.

Ravencoin (RVN) also became the most profitable coin to mine using graphic cards, according to data from whattomine.com and the network surpassed Ethereum (ETH).

#Ravencoin just flipped $ETH for profit for my farm. I will switch back to $RVN if this stays the case. pic.twitter.com/H6wcRQ55Yz

— CaptainCrypto (@CaptainCrypto33) August 3, 2021

Voyager’s breakout was caught by the VORTECS™ indicator

Voyager Digital, the company behind Voyager Token (VGX), acquired crypto trading and payments startup Coinify for $85 million. On August 1, Voyager also launched the VGX web swap 2.0 and staking portal.

VORTECS™ data from Cointelegraph Markets Pro began to detect a bullish outlook for VGX on July 31, before the recent price rise.

The VORTECS™ Score, exclusive to Cointelegraph, is an algorithmic comparison of historical and current market conditions derived from a combination of data points, including market sentiment, trading volume, recent price movements and Twitter activity.

Lastly, Elrond (EGLD) announced a $20 million funding from Moonlorian Blockchain Business Laboratory. According to Elrond’s blog, the blockchain firm is already incubating several projects in domains such as tokenization, NFT, traceability and loyalty platforms.

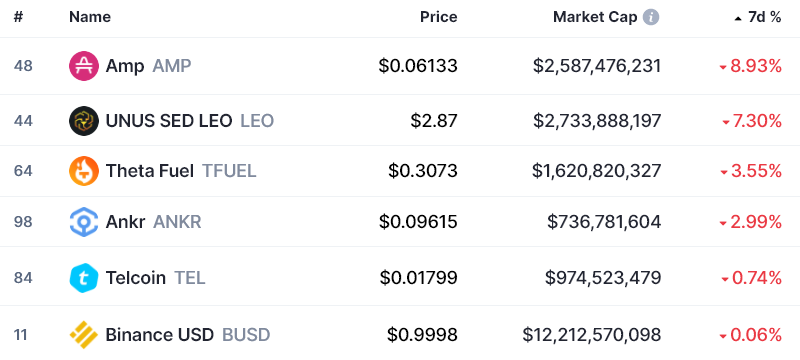

On the other hand, only six projects presented a negative performance over the last seven days.

Theta Fuel (TFUEL) faced a similar movement as it rallied 63% from July 20 to 25 during the launch of protocol 3.1.0 and reached a $0.368 top. The hard fork created a more efficient block proposal protocol, optimized the blockchain database and added support for Ethereum RPC API.

Altcoin holders certainly have reasons to celebrate, but investors should be mindful that an eventual Bitcoin price correction will likely cause traders to quickly capture profits from the most volatile altcoins.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Leave A Comment