Buying an asset in a downtrend can be a risky maneuver because most investors struggle to spot reversals and as the trend deepens traders take on deep losses. In instances like these, being able to spot descending channel patterns can help traders avoid buying in a bearish trend.

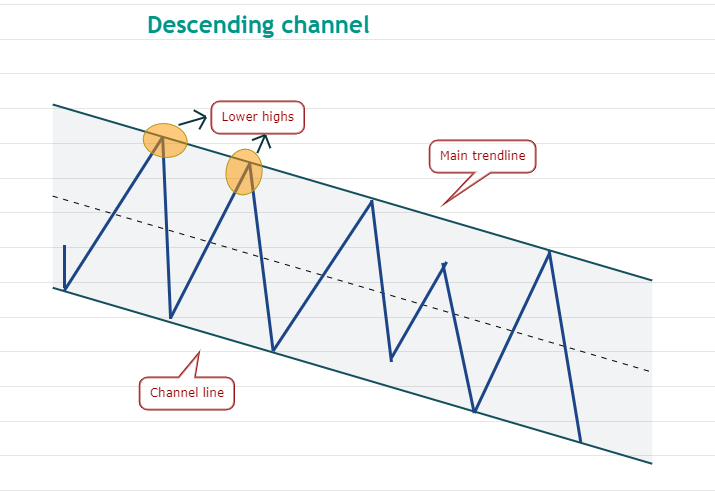

A “descending channel,” also known as a “bearish price channel” is formed by drawing two downward trendlines, parallel to each other, which confine the price action of the asset.

Descending channel basics

In a downtrend, the price action forms a series of lower highs and lower lows. A descending channel is drawn by joining the lower highs and the lower lows using parallel trendlines. The main trendline is drawn first where two or more lower highs are connected. Then a parallel line, also called the channel line, is drawn connecting the lower lows.

The price action inside a descending channel continues to move south as bears sell on any relief rallies to the main trendline.

When the price reaches the channel line, bulls believe that the price has become attractive and they buy, but the bears are in no mood to allow the bulls to have their way. They sell when the price reaches the main trendline and the trend remains down.

The trading inside the channel is usually random but bound between the two parallel lines. A break below the channel indicates that the bearish momentum has picked up and that could result in a spike down.

Conversely, a breakout of the descending channel suggests a possible change in trend. Sometimes these breakouts result in a new uptrend, but on other occasions the price action forms a range before resuming the downtrend.

Descending channel breakouts

As seen above, the price action is largely caged between these two lines. The bulls pushed the price above the channel on June 17 but could not sustain the higher levels. The bears again quickly pulled the price back into the channel, trapping the aggressive bulls.

There were a few spikes below the channel line but the long tails on the candlesticks show that bulls used these dips to buy. This shows how the lines act as strong support and resistance.

Finally, the price broke above the channel on July 24 and after a minor consolidation, the recovery continued. This confirmed a legitimate breakout, indicating a possible trend change.

The bulls pushed and closed the price above the channel on Jan. 5, 2020. This signaled a possible change in trend. The target objective can be arrived at by adding the height of the channel to the breakout level.

In the above case, the depth of the channel was $31.50. Adding this to the breakout level at $51.80, gave a target objective of $83.30. The pair easily exceeded the pattern target and turned down from $96.90 on Feb. 15, 2020.

This suggests that traders should use the target as a guide but decide on closing the position after analyzing other supportive indicators and patterns.

Descending channel breakdowns

The sellers again broke below the channel line on May 19. Attempts by the bulls to push the price back into the channel failed on May 20 and May 21, confirming a valid breakdown. The pattern target of the breakdown was $5.10 and the LUNA/USDT pair bottomed out at $3.91.

Take care to not mix up bull flags and descending channels

Thomas Bulkowski, author of the book Encyclopedia of Chart Patterns, says when a pattern is less than three weeks long, it is a flag, but longer than that can be considered as a channel.

In the above example, the correction lasted for just over three weeks and the price resumed its up-move after breaking out of the flag.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Leave A Comment