It’s been another great week for altcoins as the total market capitalization of all cryptocurrencies moves within spitting distance of the $2 trillion mark.

And it’s been equally positive for the Cointelegraph Markets Pro platform, which tracks crypto market conditions and real-time headline news in the blockchain industry to deliver market intelligence for every investor.

Markets Pro offers two unique features: The VORTECS™ Score, an algorithmically-derived weighted score that compares current market conditions to historically-similar marketscapes, and NewsQuakes™ — the industry’s most rapid aggregator of market-moving news, analyzed and collated from over a thousand primary sources every minute.

In this weekly report we analyze the most important highlights from the week’s events on Markets Pro.

Top VORTECS™ Score gains this week

Top VORTECS™ Score gains this week

Between March 26 and April 1, the three best-performing assets identified by Cointelegraph Markets Pro were Storj (+121%), Filecoin (+115%), and Holochain (+111%). All three rode green waves powered by patterns of trading and social activity that the VORTECS™ model has seen before — as described in our description of how the algorithm works.

Analyzing STORJ

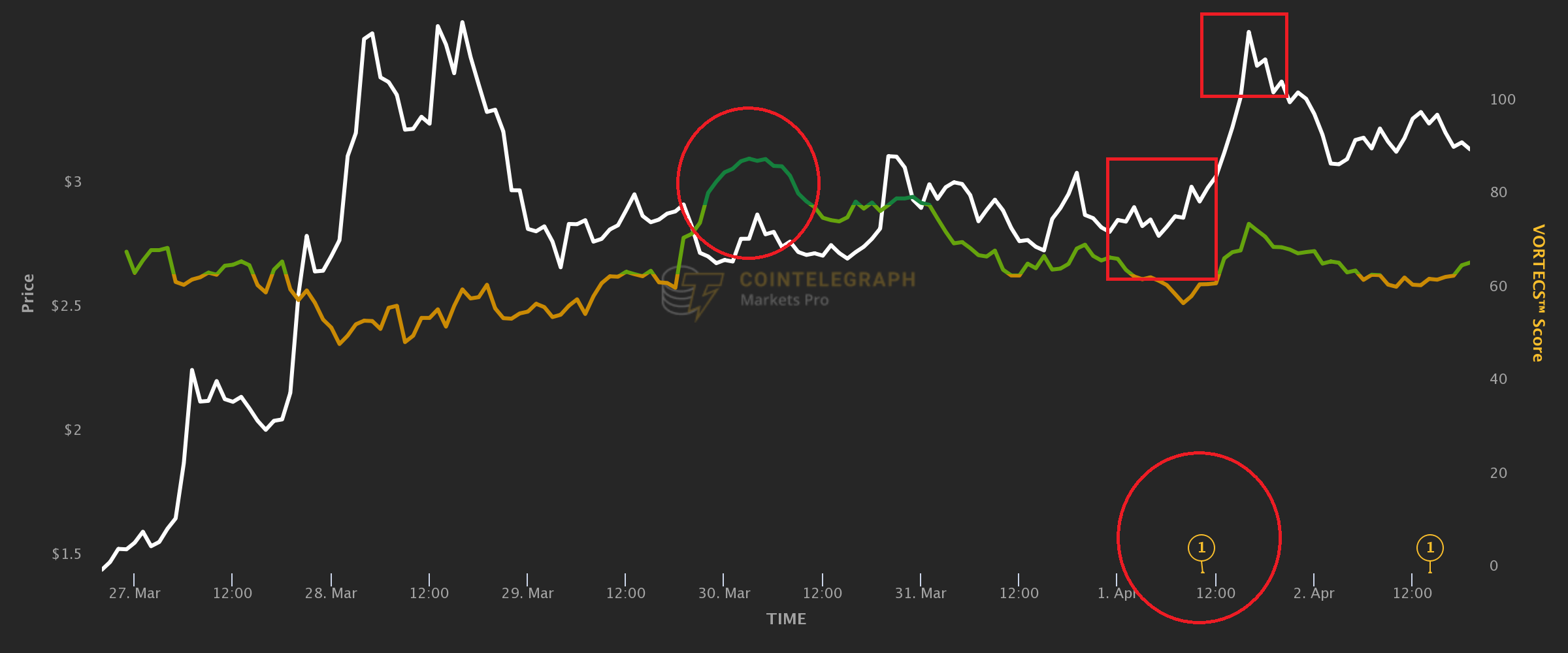

As the graph above demonstrates, the cloud storage token STORJ recorded a streak of high VORTECS™ scores, marked by the first red circle, roughly 60 hours before the price spike on April 1 (first and second red boxes).

As the graph above demonstrates, the cloud storage token STORJ recorded a streak of high VORTECS™ scores, marked by the first red circle, roughly 60 hours before the price spike on April 1 (first and second red boxes).

This price increase could also be explained by the effect of Storj-USDT margin swaps being listed on Huobi Futures the same day, an announcement captured in a NewsQuake™. Those using Markets Pro intelligence in their market research had the advantage of this powerful dual-validation pointing to both historically auspicious market conditions and favorable news around the asset following its recent listing on Coinbase.

Analyzing Filecoin (FIL) and Holochain (HOT)

Indeed, this has been a good week for storage coins. The second-best performer, Filecoin, pulled off a rally that saw it appreciate from around $125 to $233 in two days.

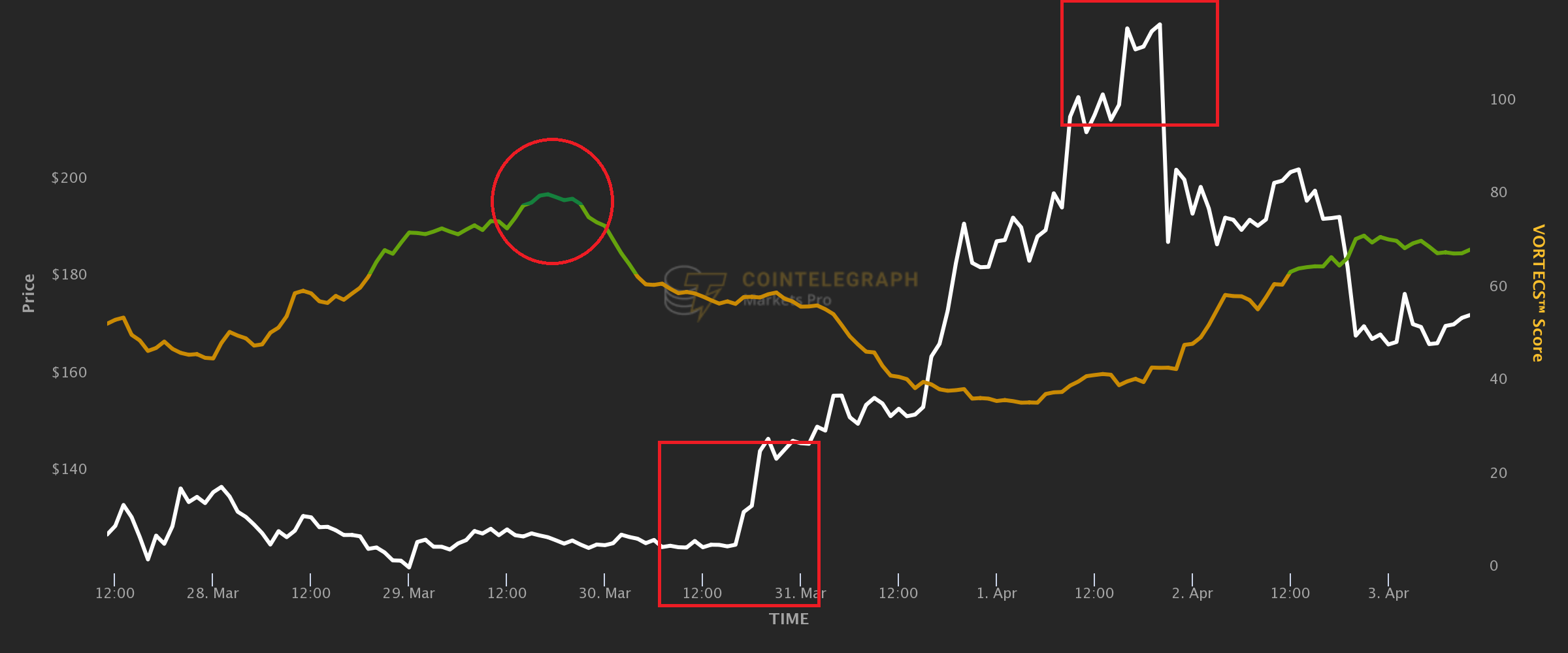

As seen in the graph above, some 24 hours before the price took off Filecoin’s VORTECS™ Score ventured into the 80+ territory for a few hours, marked by the red circle.

As seen in the graph above, some 24 hours before the price took off Filecoin’s VORTECS™ Score ventured into the 80+ territory for a few hours, marked by the red circle.

The rise of another big winner of the week, Holochain (seen below), also unfolded following a sequence of strong VORTECS™ scores, ranging from high 60s to high 70s, with a peak of 82 (red circle in the graph) coming around 50 hours before the asset began its ascent from $0.010 to $0.019.

Understanding VORTECS™: The relationship between the score and Newsquakes™

Understanding VORTECS™: The relationship between the score and Newsquakes™

Some users wondered whether NewsQuakes™ are a constituent part of the VORTECS™ score. The short answer is no. These are two completely different functionalities within Markets Pro that can complement each other but can also be used separately.

In fact, some of the NewsQuakes™ feature assets for which the score is not yet generated: One example is this week’s announcement of a partnership between DAFI and DIA saw the latter asset, not yet indexed by the VORTECS™ model, appreciate by almost 22%.

That said, oftentimes the two work in conjunction. The example of Filecoin already mentioned above showcases how a high VORTECS™ score and a subsequent NewsQuake™ can be used to boost users’ confidence that the conditions for a coin are favorable.

In other cases, a positive VORTECS™ score can follow the news: Once a favorable announcement is absorbed by market participants, trading and social conditions can align into a pattern that the model identifies as bullish. And sometimes, the two can be completely unrelated.

Analyzing 0x (ZRX)

The graph above shows the price of 0x starting to climb steadily after the news of the asset’s listing on OKEx went public — all while the VORTECS™ score remained neutral.

The graph above shows the price of 0x starting to climb steadily after the news of the asset’s listing on OKEx went public — all while the VORTECS™ score remained neutral.

Testing results: Week’s top strategies

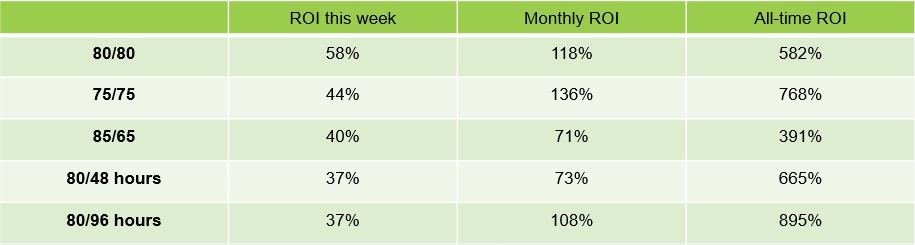

This week, 17 of the 42 VORTECS™ strategies currently tested outperformed both Bitcoin and an evenly weighted portfolio of all the top 100 altcoins. Of those strategies, 8 were score-based (Buy at VORTECS™ X / Sell at VORTECS™ Y) and 9 were time-based (Buy at VORTECS™ X / Sell after Y hours).

The table below contains information on ROI that the top-5 strategies of the week have generated up to April 1st 2021. For more context, you can also see these strategies’ monthly and all-time returns (tracked since January 5th 2021).

These strategies are designed to represent benchmarks for the VORTECS™ model’s aggregate performance. To discover how these tests are performed, consult the methodology help file.

These strategies are designed to represent benchmarks for the VORTECS™ model’s aggregate performance. To discover how these tests are performed, consult the methodology help file.

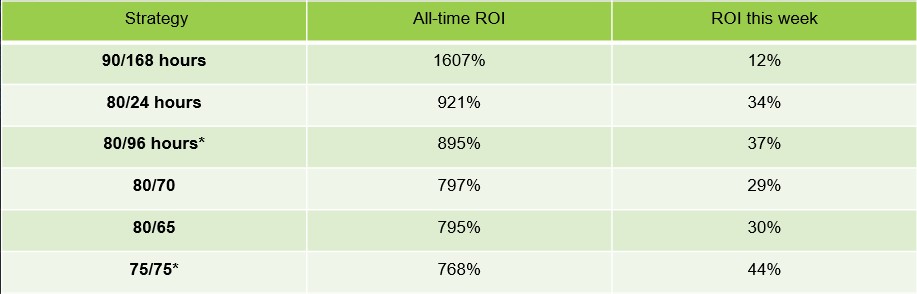

Testing results: All-time leaders

The table below presents three best all-time strategies in each category (score-based and time-based) and their performance this week. As the table demonstrates, strategies that do well in the long run can have a downward blip in any given week: Buy at 90 / Sell after 168 hours is a particularly conspicuous example this time. At the same time, two of the all-time best have also had a solid showing this week.

New alerts system

New alerts system

A total of 107 VORTECS™ hit Markets Pro users this week, featuring 27 different coins.

One of the most frequent requests we’ve been getting from the community is to enable notifications at different levels of the VORTECS™ score. There are now 12 dedicated Discord channels designed to alert subscribers when an asset goes above or below a specific threshold.

Powerful NewsQuakes™

A total of 86 NewsQuake™ notifications went out to the Cointelegraph Markets Pro community this week, including 44 exchange listings, 25 partnerships, and 17 staking announcements.

Markets Pro also tracks the most consequential news identified by NewsQuakes™ and the price action of various crypto assets following the headline. This week the most consequential news items were followed by significant price gains over the course of the week:

· Storj listing on Coinbase: +161% peak return

· Ankr Network listing on Coinbase: +109% peak return

· Filecoin’s partnership with Chainlink: +48% peak return

Cointelegraph Markets Pro is available exclusively to subscribers on a monthly basis at $99 per month, or annually with two free months included. It carries a 14-day money-back policy to ensure that it fits the crypto trading and investing research needs of subscribers, and members can cancel anytime.

Important disclaimer

Cointelegraph is a publisher of financial information, not an investment adviser. We do not provide personalized or individualized investment advice. Cryptocurrencies are volatile investments and carry significant risk including the risk of permanent and total loss. Past performance is not indicative of future results. Figures and charts are correct at the time of writing. Consult your financial advisor before making financial decisions. Full terms and conditions.

Leave A Comment