The crypto market is up today and Bitcoin (BTC) price jumped up 3.1% on Nov. 15 reaching $17,171, as confidence briefly returns to the global macro outlook with a lower-than-expected producer price index (PPI) print and a cooling U.S. dollar.

Crypto and equities markets responded to PPI data which showed wholesale prices rose 0.2% for the month and 8% from a year ago. This is less than the expected 0.4% monthly estimate and the previous month’s 8.4% yearly increase. The news sent the Nasdaq up 2.5% and the S&P 500 up 1.4%.

FTX’s recent bankruptcy triggered an incredible amount of volatility, but Bitcoin price reacted positively by rallying over $17,000 while traders are warning of a final capitulation yet to come. Let’s examine three major factors influencing crypto market strength in the current environment.

The picture for the rest of Q4 remains muddy, as some analysts still expect 2022 to copy the 2018 bear market. At the same time, there is hope that this bearish trend will be gone for good by the start of 2023.

The Federal Reserve makes some progress on inflation

High inflation has been a year-long problem and back-to-back negative CPI reports have given the Fed multiple reasons to continue raising rates. After the CPI data boosted Bitcoin upwards $1,000 in minutes on Nov. 10, the positive PPI is showing the market that inflation may have peaked.

As inflation seems to level off, rumors are gathering over the outlook for rate hikes. After the positive PPI numbers and the November 75-basis-point hike, suspicions are that policy will begin to U-turn, making smaller hikes in subsequent months before reversing altogether in 2023.

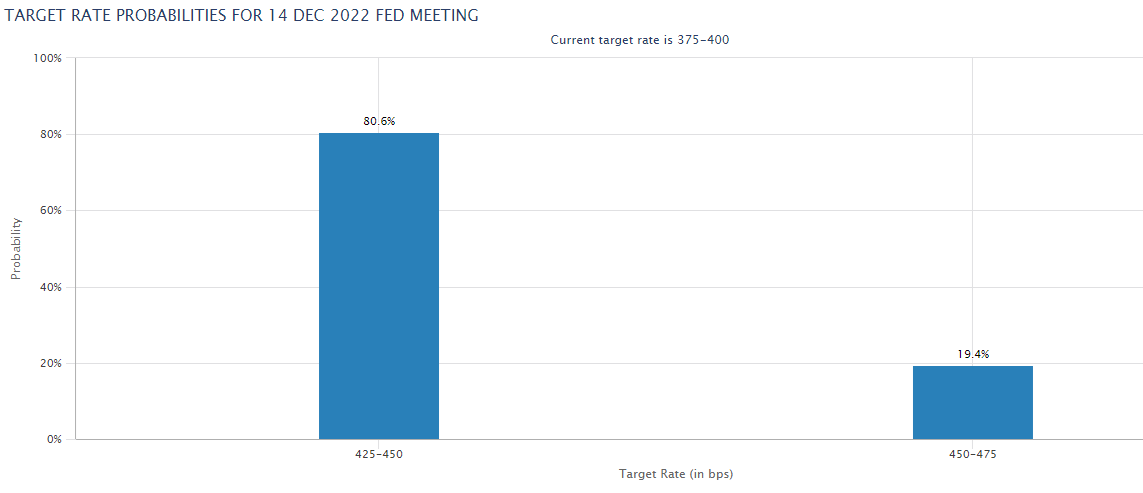

December’s Federal Open Market Committee (FOMC) is currently expected to yield a hike of 25 to 50 basis points, not the usual 75 bps, according to CME Group’s FedWatch Tool.

Bitcoin open interest drops after a FTX-induced volatility spike

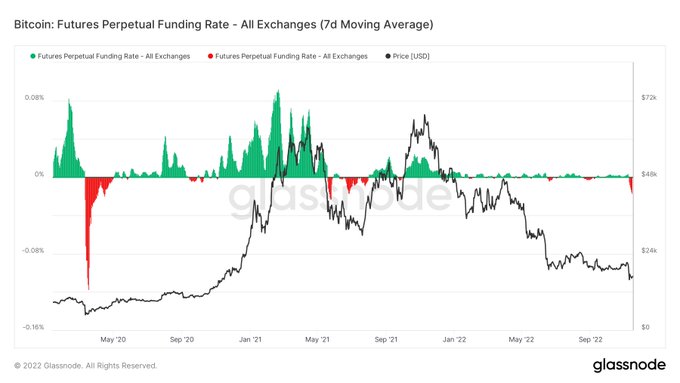

Data shows that BTC/USD volatility was at yearly lows under $16,000 but the FTX bank run translated the spike investors had been expecting.

Bitcoin open interest also saw a steep drop off after the volatile week following FTX’s collapse. On Nov. 5, BTC open interest was at $32.8 billion and dropped substantially to $18.5 billion on Nov. 14.

A look at the Bitcoin historical volatility index (BVOL), recently at multi-year lows seen only a handful of times, has since sharply increased to over 25.05.

The dollar eyes a new chapter

After a parabolic uptrend throughout 2022, the U.S. dollar index is now beginning to show signs of cooling off.

The U.S. dollar index (DXY) recently hit its highest levels since 2002, and momentum may have cooled after the recent CPI and PPI print showed the Fed making some progress with run-away inflation. In a perfect world, investors would ideally view a retracting DXY as a reason to increase sentiment for risk assets like cryptocurrencies.

In the meantime, DXY is under pressure and its descent came in lockstep with a return to form for Bitcoin and altcoins. Historically, a cooling DXY is followed by Bitcoin price moving in the opposite direction.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk, and you should conduct your own research when making a decision.

Leave A Comment