Despite lingering concerns over the Ripple vs SEC lawsuit, XRP has demonstrated significant growth in multiple areas of its protocol during the second quarter (Q2) of this year, as revealed by a recent report from crypto analytics platform Messari.

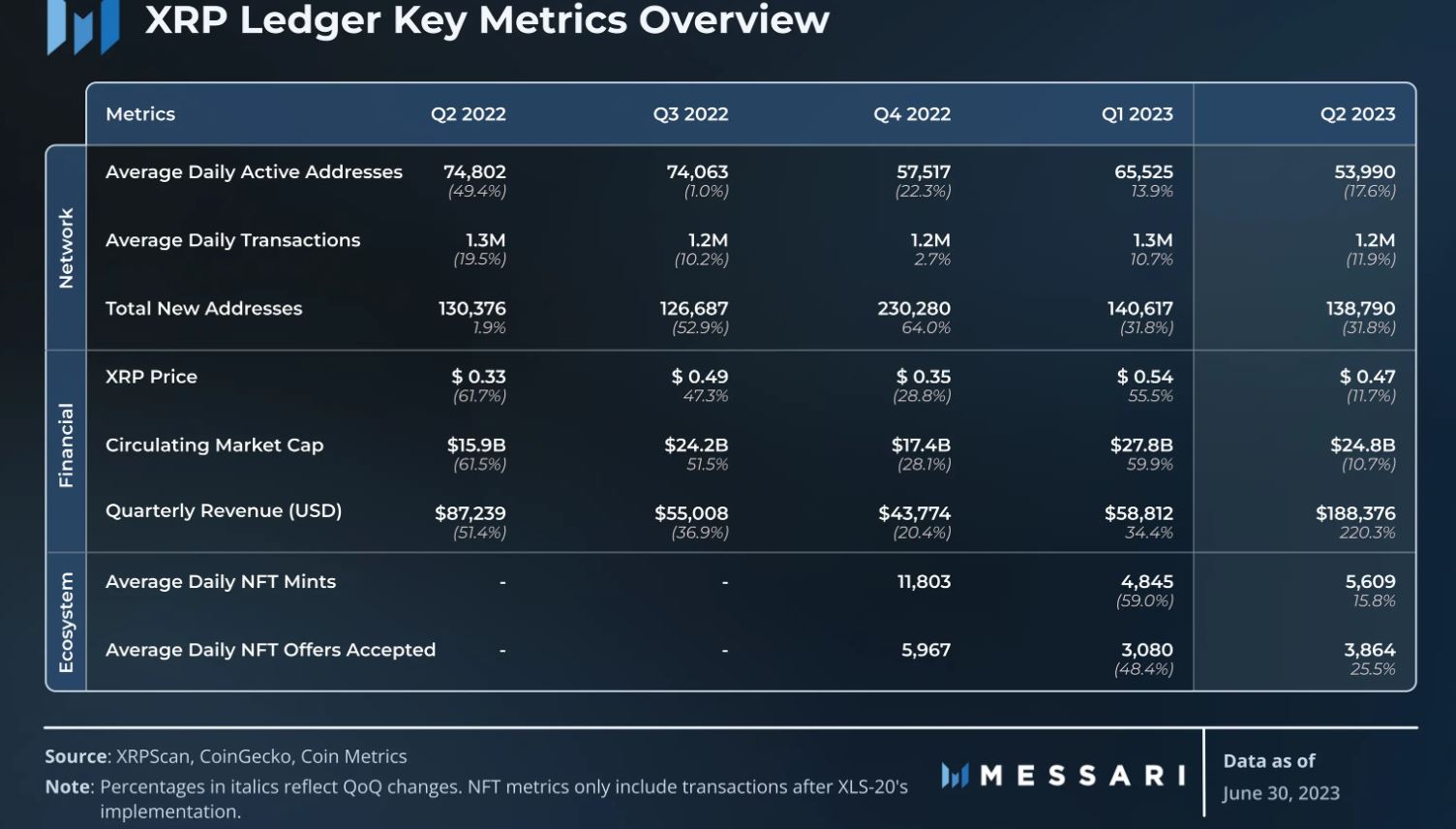

Based on data from Messari, XRP’s circulating market cap has experienced a Year-to-Date (YTD) increase of 42.5%. This growth was driven by the asset’s price surge in the first quarter. However, in the second quarter (Q2), the market cap declined by 10.7% Quarter on Quarter (QoQ), from $27.8 billion to $24.8 billion.

Although the XRP network experienced a decline in transaction volume QoQ, there was a notable 12.7% QoQ increase in average daily non-fungible token (NFT) transactions, rising from 13,800 to 15,500. While XRP’s XRPL has a strong presence in decentralized finance (DeFi) and NFT ecosystems, its influence has often been overshadowed by top competitors like Ethereum (ETH) and Solana (SOL). However, there are signs of this trend starting to shift.

The XRPL achieved several notable milestones, including a significant increase in the total new address count, which reached 138,790, representing a growth of 31.8% compared to the same period last year. Additionally, the quarterly revenue surged by 220.3% to reach $188,376.

Related: Ripple Labs to revolutionize real estate industry through tokenization

Despite facing challenges due to the SEC lawsuit, XRP has seen efforts from developers within its ecosystem to drive utility adoption. The growth witnessed in essential operational aspects of the XRPL reflects the progress of XRP towards its goal of providing sustainable value and utility.

With its Ripple Labs to revolutionize real estate industry through tokenization and dedicated research in blockchain technology, XRP possesses distinctive fundamentals that have the potential to drive substantial long-term growth and innovation.

Magazine: Ripple, Visa join HK CBDC pilot

Leave A Comment