“Cause baby, now we’ve got bad loans

You know it used to be mad loans

So take a look what you’ve done

Cause baby, now we’ve got bad loans, hey!”

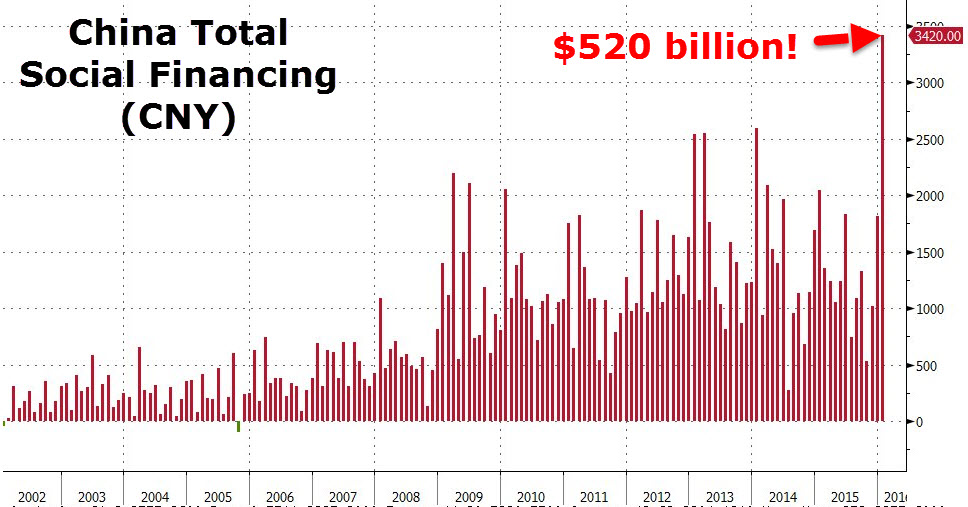

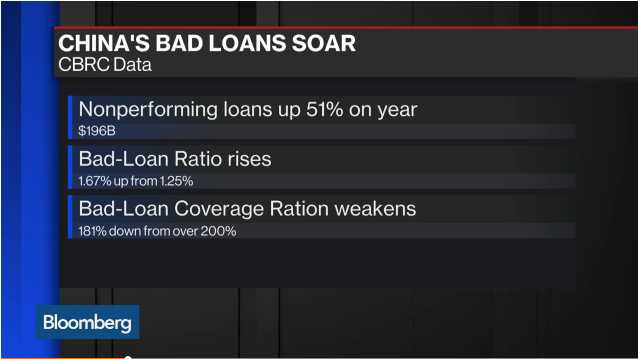

Bad loans at Chinese banks jumped 7% in the fourth quarter and are now topping 1.27Tn Yuan which is, fortunately, “only” $196Bn but still – that’s a LOT of bad loans! And, of course, this being China, those are just the ones they are admitting to. If you include “special-mention” loans, where future repayment is at risk but yet to become nonperforming, the industry’s total troubled loans swelled to 4.2Tn Yuan ($648Bn), representing 5.46% percent of total advances made by banks.

“The slower quarterly increase in NPLs are likely to be results of stepped-up efforts by banks to recollect loans, more aggressive write-offs, and some relaxation in their bad-loan recognition standards,” said Chen Shujin, a Hong Kong-based analyst at DBS Vickers Hong Kong Ltd. “We don’t expect to see any turnaround of asset quality until the end of this year.”

This is why, here at Philstockworld, we turned bearish on 2016 back in the fall and now, finally, other Wall Street analysts are catching up, with BAC, JPM, CS et al now dropping their 2016 forecasts by 10% to roughly our 2,000 year-end target (if all goes well) on the S&P. Some of the others are still on drugs, with 2,200 targets but, in the case of Deutsche Bank (DB), I think it’s just wishful thinking that maybe that will be enough for them to survive the year intact.

Like the Sinatra song, DB has been up up and down and over and out and, lately, flat on their faces and the problems facing the European Banks aren’t so different from those facing the Chinese banks – as they are in any economic downturn as more and more of their business loans become troubled.

Leave A Comment