Back in September, we pointed out that assets managed by Norway’s sovereign wealth fund had surged to over $1 trillion after they made the controversial decision to increase their exposure to global equity bubbles. The move has worked out perfectly in the short term, though we still have our doubts as to whether the “greater fool” theory works over the long term…certainly, it never has before but maybe this time is different.

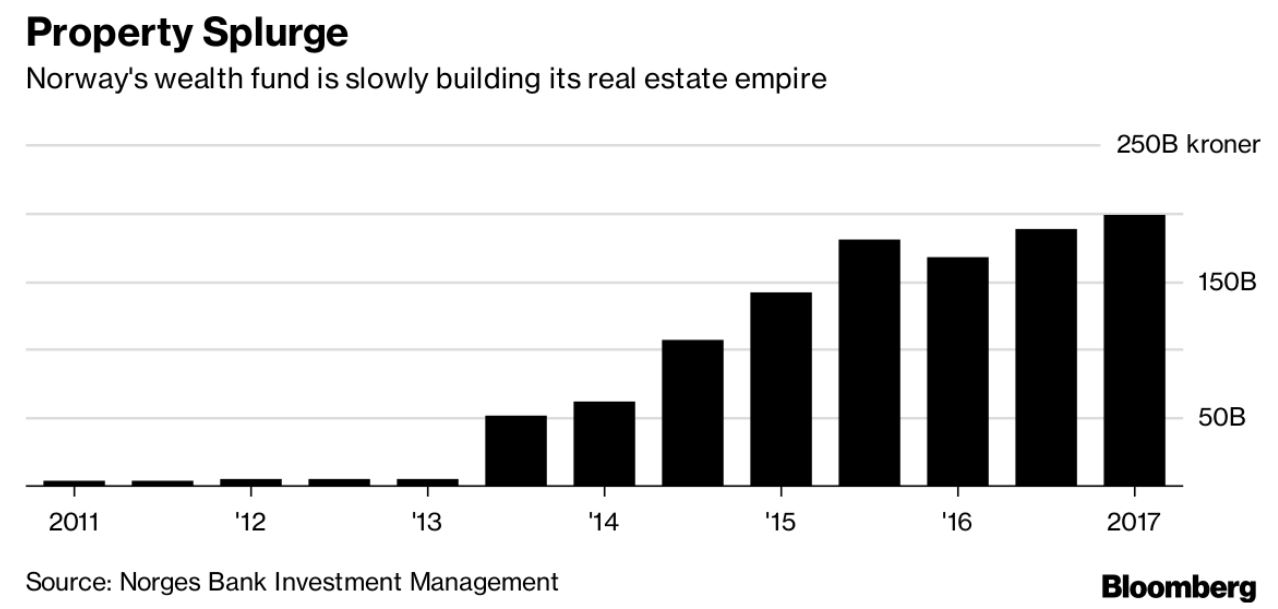

Alas, as Bloomberg points out today, bubbles in equity markets aren’t the only ones to have attracted the attention of Norway’s wealth management team which is scooping up commercial real estate projects all over the world, despite their own acknowledgment of “red flags.”

There may be worrying developments in some property markets, but the world’s biggest sovereign wealth fund says it has no intention of pulling back from real estate.

A gap is opening between what stock-pickers think real estate is worth and what assets could be worth in the physical market, a potential sign that a correction could be looming. For example, the largest real estate investment trust in the U.K., Land Securities, now trades at a 36 percent discount to net asset value.

“It’s clearly a red flag in pricing if anything is too far off in any direction,” Karsten Kallevig chief executive officer of Norges Bank Real Estate Management, said in an interview at his Oslo office on Wednesday.

So where are the Norwegians looking to lease you some office space?Well, only in “prime spots” like New York’s Times Square…

Kallevig, 43, now oversees $24 billion in key real estate, including much of London’s Regent Street, as well as properties on Times Square and the Champs Elysees, among other prime spots. Overall, the fund holds about $1 trillion in stocks, bonds and real estate, and is in the process of building its property holdings to about 7 percent of its total portfolio.

So far, the fund still has an appetite for new acquisitions. “I haven’t pulled back mandates, that’s for sure,”Kallevig said.

After splitting off from the rest of the fund’s benchmark portfolio and increasing its scope to buy real estate last year, Kallevig is expanding his internal top management team. In September, he appointed two new chief investment officers to oversee the U.S. and European markets.

The fund’s strategy is to focus on about 10 global cities. The new CIOs see similarities in Europe and the U.S., and are competing with largely the same bidders on both sides of the Atlantic for the most prestigious properties. “It’s the same type of names we’re seeing across all our markets, the deals that we target are relatively large,” Per Loken, who’s in charge of the U.S. markets, said in an interview.

Leave A Comment